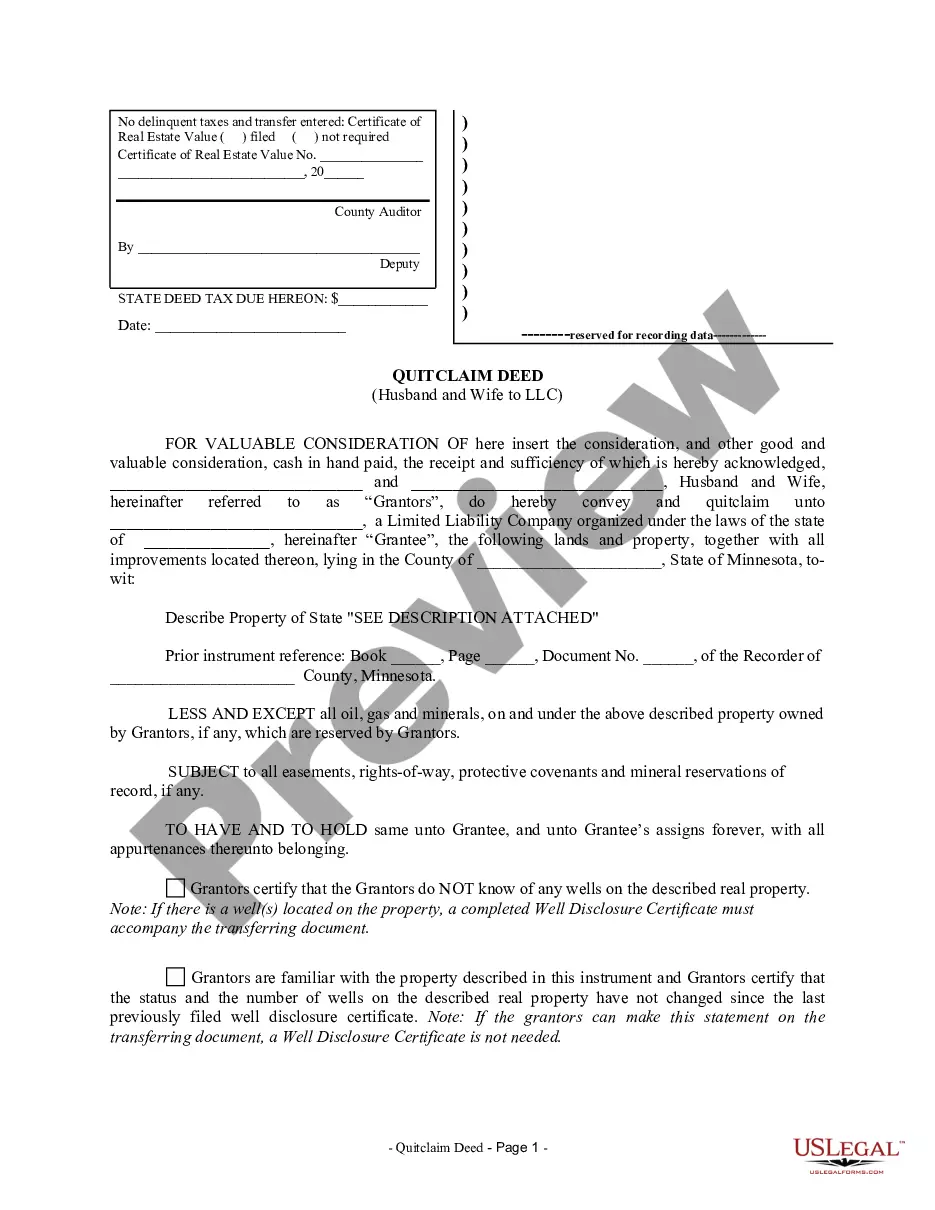

Maricopa, Arizona is a vibrant city located in Pinal County, known for its stunning desert landscapes, rich culture, and thriving community. In the financial realm, one common practice is the Assignment of Contract as Security for Loan, which plays a crucial role in providing lenders with added protection when extending loans to borrowers. An Assignment of Contract as Security for Loan refers to the process of using an existing contract as collateral to secure a loan. This arrangement involves the borrower assigning the rights and benefits of their contract to the lender, ensuring that if the borrower defaults on the loan, the lender can step in and enforce the terms outlined in the contract to recoup their investment. In Maricopa, like in many other locations, there are various types of Assignment of Contract as Security for Loan, each tailored to specific circumstances and purposes. Here are a few noteworthy types: 1. Real Estate Assignment: This type of Assignment of Contract involves using a real estate contract, such as a lease or purchase agreement, as security for a loan. By assigning the rights and obligations of the contract, the lender gains legal control over the property in case of default, allowing them to pursue foreclosure or other means to recover their loan amount. 2. Business Contract Assignment: In the realm of business finance, individuals or companies may use their business contracts, partnerships, or agreements as collateral for loans. By assigning these contracts to the lender, the borrower provides an additional layer of security, ensuring that the lender can claim the rights and benefits associated with the contracts if the borrower fails to repay the loan. 3. Accounts Receivable Assignment: This specific type of Assignment of Contract involves using outstanding accounts receivable (money owed by customers) as security. Borrowers assign their claims to these accounts to the lender, who can then collect the funds directly if the borrower defaults on the loan. It's important to note that an Assignment of Contract as Security for Loan is a legally binding agreement and must comply with state regulations. Both parties involved should seek proper legal counsel to ensure the assignment is valid and to protect their rights and interests. In summary, Maricopa, Arizona, like other areas, utilizes the Assignment of Contract as Security for Loan to provide lenders with an additional layer of protection. This practice allows borrowers to leverage existing contracts, such as real estate agreements, business contracts, or accounts receivable, as collateral for securing loans. By understanding the different types of assignments involved and seeking appropriate legal guidance, individuals and businesses can navigate this process effectively and ensure a mutually beneficial agreement.

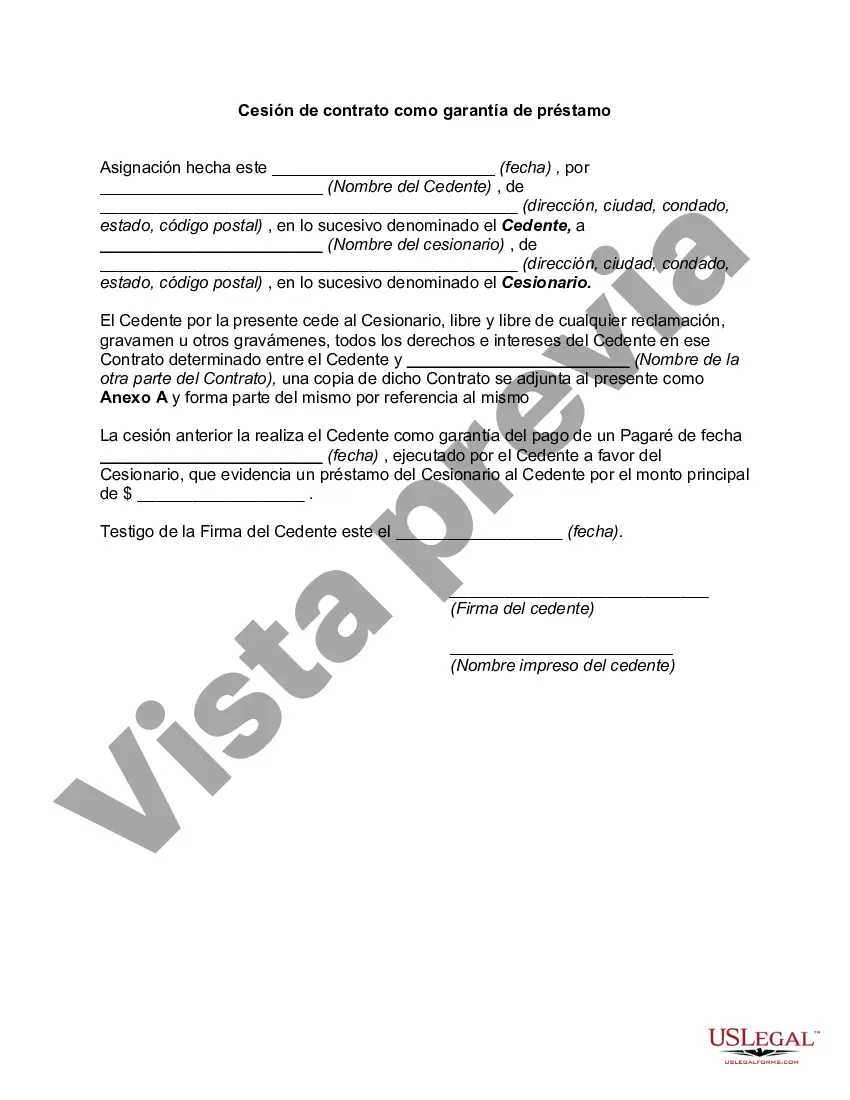

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Cesión de contrato como garantía de préstamo - Assignment of Contract as Security for Loan

Description

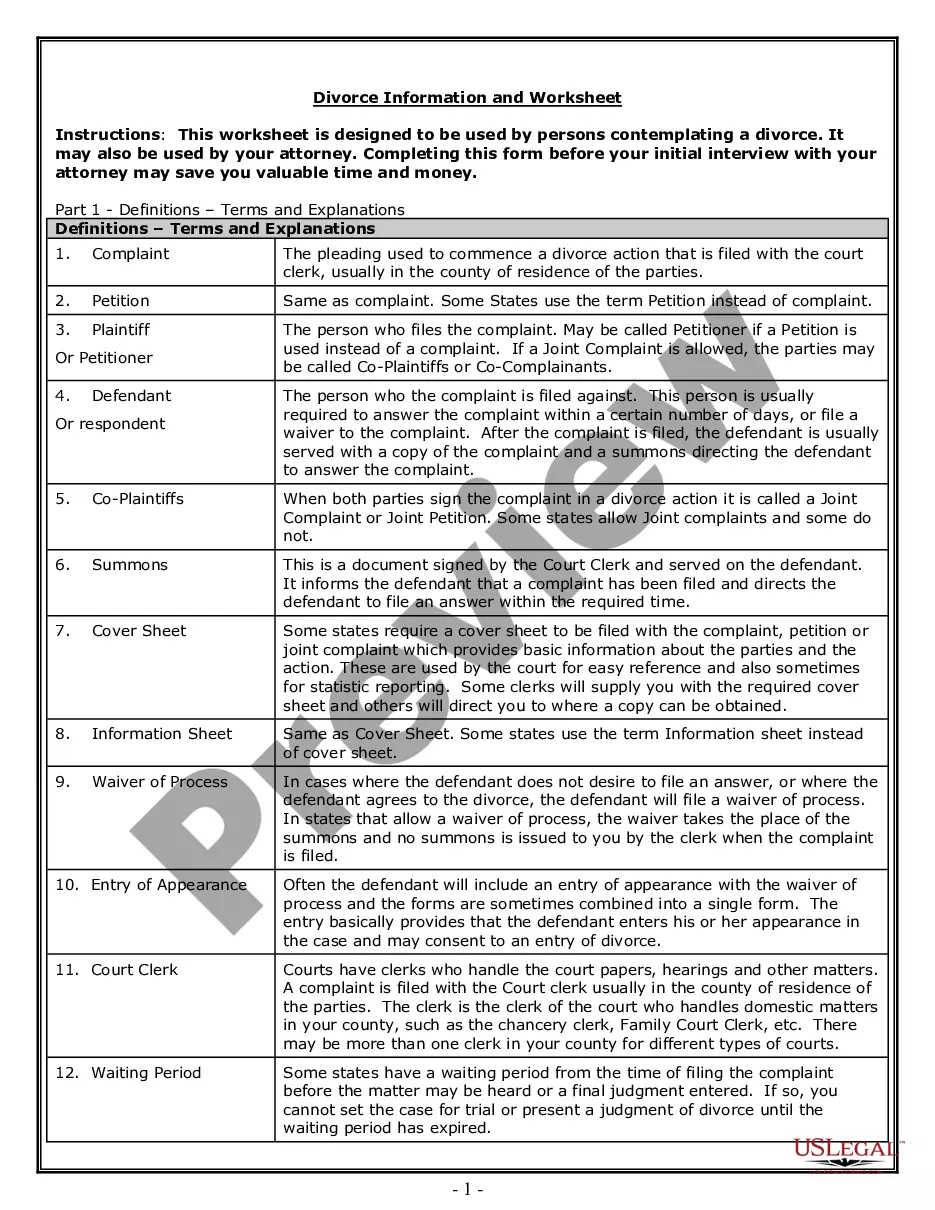

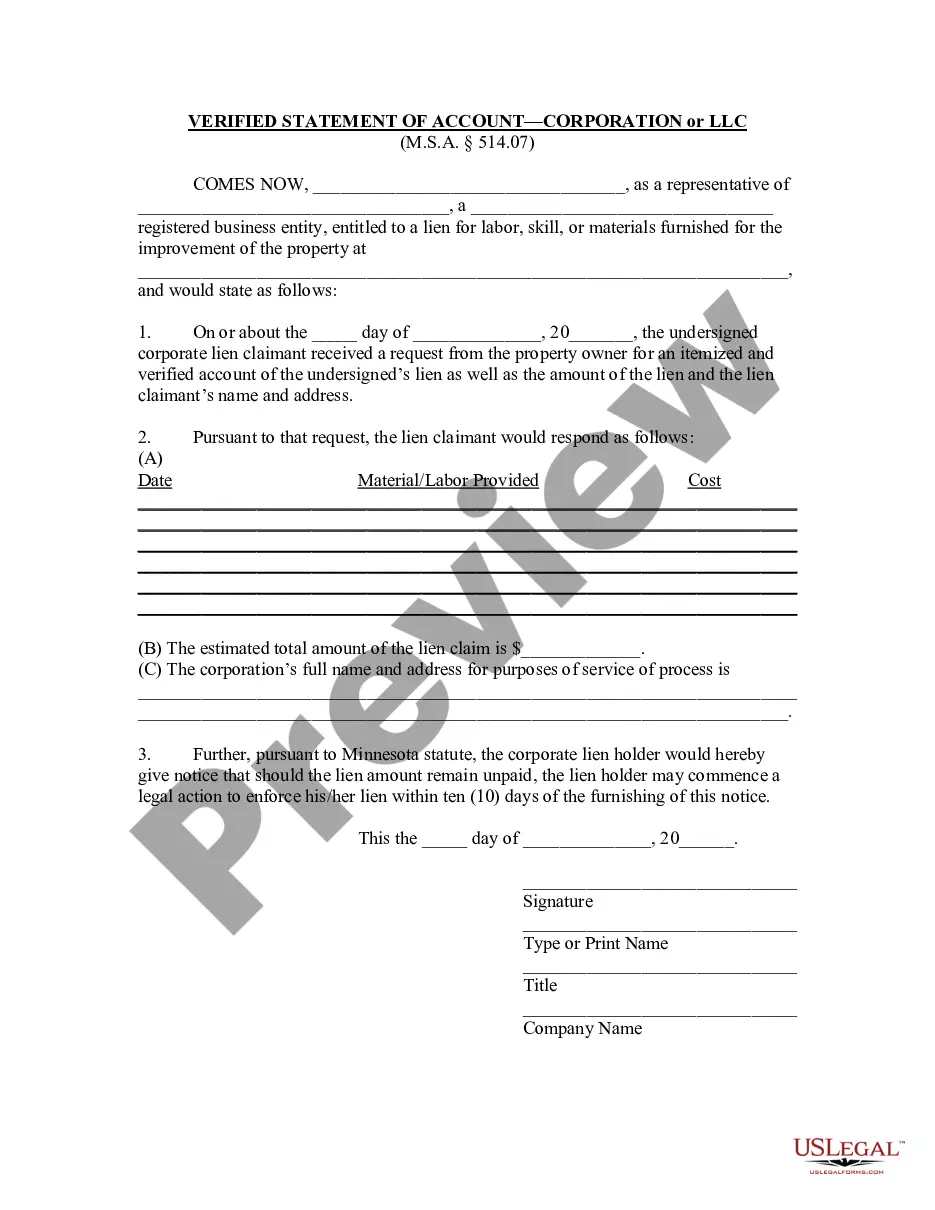

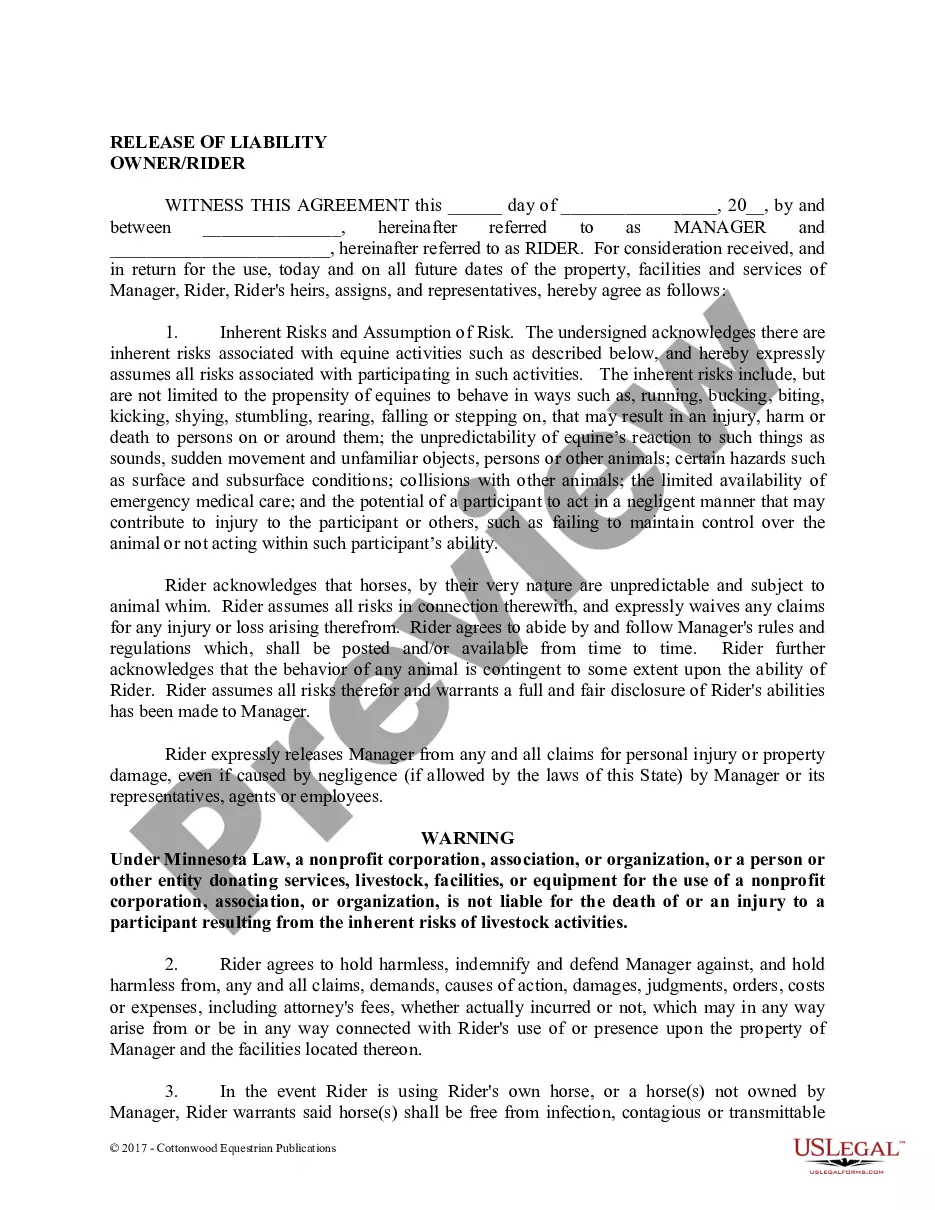

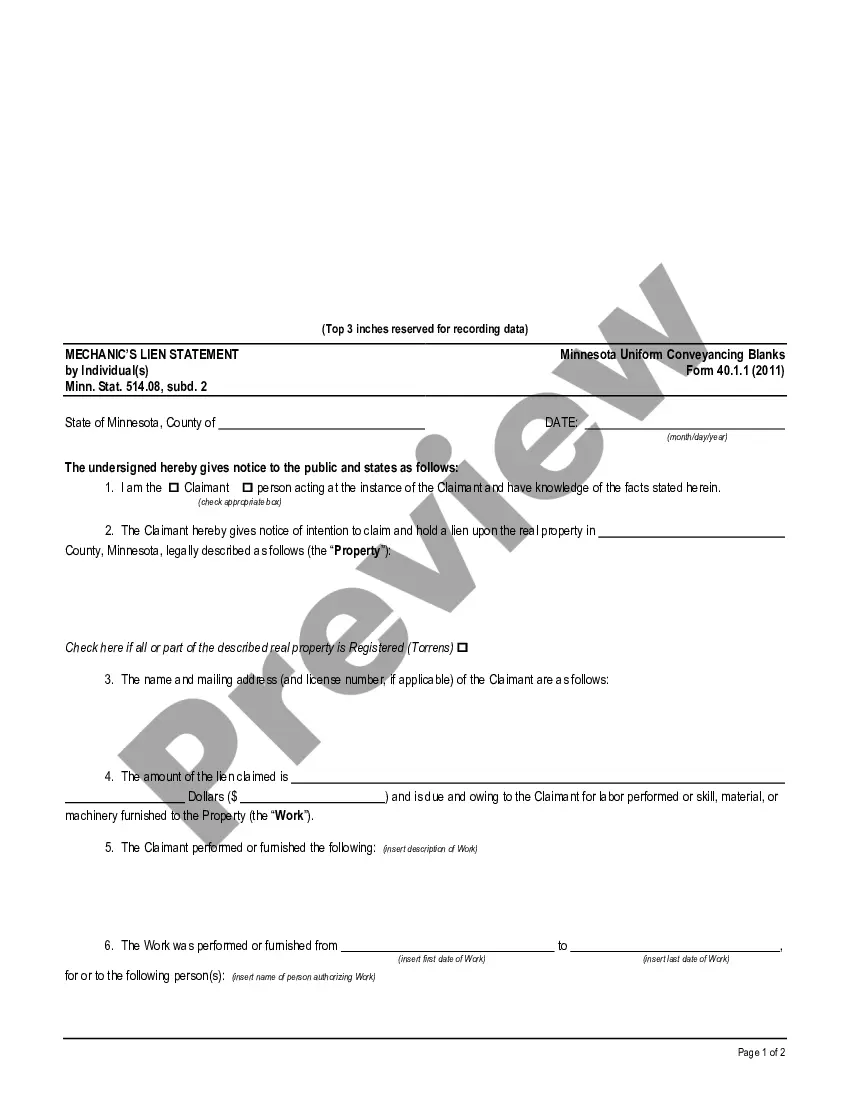

How to fill out Maricopa Arizona Cesión De Contrato Como Garantía De Préstamo?

Creating documents, like Maricopa Assignment of Contract as Security for Loan, to take care of your legal affairs is a challenging and time-consumming process. Many circumstances require an attorney’s participation, which also makes this task expensive. However, you can get your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents created for a variety of scenarios and life circumstances. We ensure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Maricopa Assignment of Contract as Security for Loan template. Simply log in to your account, download the template, and personalize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before getting Maricopa Assignment of Contract as Security for Loan:

- Make sure that your template is compliant with your state/county since the regulations for creating legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or reading a quick intro. If the Maricopa Assignment of Contract as Security for Loan isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to begin utilizing our website and get the form.

- Everything looks great on your side? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and enter your payment information.

- Your template is good to go. You can go ahead and download it.

It’s easy to locate and buy the needed template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!