A Wake North Carolina Assignment of Contract as Security for Loan refers to a legal agreement where an individual or entity assigns their contractual rights and obligations to a lender as collateral for a loan in Wake County, North Carolina. This contract functions as a means of securing the loan and providing assurance to the lender that their investment is protected. Keywords: Wake North Carolina, Assignment of Contract, Security for Loan, contractual rights and obligations, lender, collateral, loan, Wake County, legal agreement, investment protection. Different Types of Wake North Carolina Assignment of Contract as Security for Loan: 1. Real Estate Assignment of Contract as Security for Loan: In this type of assignment, the borrower assigns their rights and obligations under a real estate contract to the lender as collateral for a loan. The lender may exercise these rights if the borrower defaults on the loan. 2. Business Assignment of Contract as Security for Loan: This type of assignment involves the borrower assigning their rights and obligations under a business contract, such as a supply agreement or service contract, to the lender as security for a loan. This ensures that the lender has recourse if the borrower fails to repay the loan. 3. Accounts Receivable Assignment of Contract as Security for Loan: In this scenario, the borrower assigns their rights to receive payment from customers or clients (accounts receivable) to the lender as collateral for a loan. The lender can collect these payments directly from the assigned accounts receivable if the borrower defaults on the loan. 4. Intellectual Property Assignment of Contract as Security for Loan: This type of assignment is applicable when the borrower owns valuable intellectual property rights, such as patents, trademarks, or copyrights. By assigning these rights to the lender as security for a loan, the lender gains leverage to recover their funds if the borrower defaults. 5. Equipment Assignment of Contract as Security for Loan: Here, the borrower assigns their rights and obligations under a contract relating to the purchase or lease of equipment to the lender as collateral for a loan. In case of loan default, the lender can claim ownership or possess the equipment to recoup the outstanding balance. 6. Future Receivables Assignment of Contract as Security for Loan: This assignment involves the borrower granting the lender rights to future stream of income, ensuring repayment from future receivables. This type of assignment is commonly used in merchant cash advances or funding agreements where the lender recoups the loan amount from a percentage of the borrower's future income. 7. General Assignment of Contract: In some cases, a borrower may assign multiple contracts, rights, and obligations to the lender as security for a loan. This comprehensive assignment includes all contractual rights with respect to certain transactions or business operations, providing the lender with broad collateral coverage. In conclusion, Wake North Carolina Assignment of Contract as Security for Loan is a significant legal agreement wherein the borrower transfers their contractual rights and obligations to the lender as collateral for a loan. Various types of assignment exist, including those related to real estate, business contracts, accounts receivable, intellectual property, equipment, future receivables, and general assignments. These assignments help protect the lender's investment and provide alternatives for loan recovery in case of default.

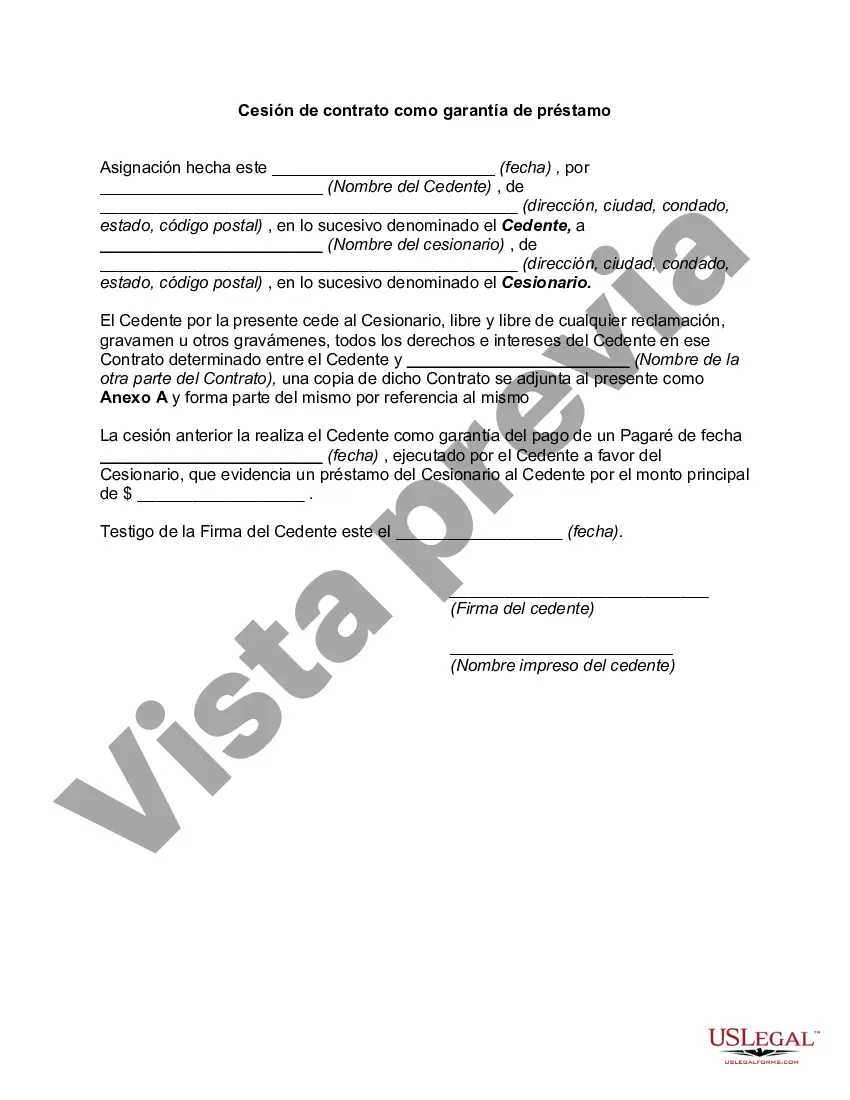

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Cesión de contrato como garantía de préstamo - Assignment of Contract as Security for Loan

Description

How to fill out Wake North Carolina Cesión De Contrato Como Garantía De Préstamo?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare official paperwork that differs from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any personal or business objective utilized in your region, including the Wake Assignment of Contract as Security for Loan.

Locating samples on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the Wake Assignment of Contract as Security for Loan will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to get the Wake Assignment of Contract as Security for Loan:

- Make sure you have opened the right page with your local form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template satisfies your requirements.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the appropriate subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Wake Assignment of Contract as Security for Loan on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!