A Harris Texas Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property is a legal document designed to govern the division and ownership of assets acquired during a marriage, specifically focusing on a business operated by one spouse. This type of agreement is essential in protecting the rights and interests of both spouses, outlining the terms and conditions regarding the distribution of the business and its profits in the event of divorce or separation. There are different variations or types of Harris Texas Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property, namely: 1. Business Operations and Control: This type of agreement explicitly outlines the role and control of the spouse managing the business during the marriage. It may specify whether the non-operating spouse has any involvement or decision-making authority concerning the business's activities. 2. Asset Division: This aspect of the agreement determines how the community property, including the business and its assets, will be divided between the spouses in case of divorce or separation. It may establish a predetermined percentage or formula for asset allocation to protect the interests of both parties. 3. Income and Profit Distribution: This type of agreement addresses the distribution of income, profits, and dividends generated by the business during the marriage. It clarifies whether the income will be treated as community property or separate property and how it will be distributed between the spouses. 4. Valuation and Appraisal: It is essential to have a clear understanding of how the business's value will be determined in the event of divorce or separation. This type of agreement may require periodic appraisals or specify the method and criteria for valuing the business to ensure fairness and transparency. 5. Termination or Dissolution of the Business: In case the business needs to be dissolved or terminated during the marriage, this provision outlines the procedure, responsibilities, and the distribution of assets or liabilities associated with winding down the business operations. 6. Improvements and Expansion: This aspect of the agreement deals with any improvements or expansions made to the business during the marriage. It determines whether these enhancements will be considered community property or separate property and outlines the ownership rights and distribution of resulting profits or losses. Creating a Harris Texas Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property offers both spouses the opportunity to secure their financial well-being while ensuring a fair and amicable resolution in case of divorce or separation. By addressing the important elements mentioned above, couples can protect their individual interests and set clear guidelines for the management and division of marital property involving a business.

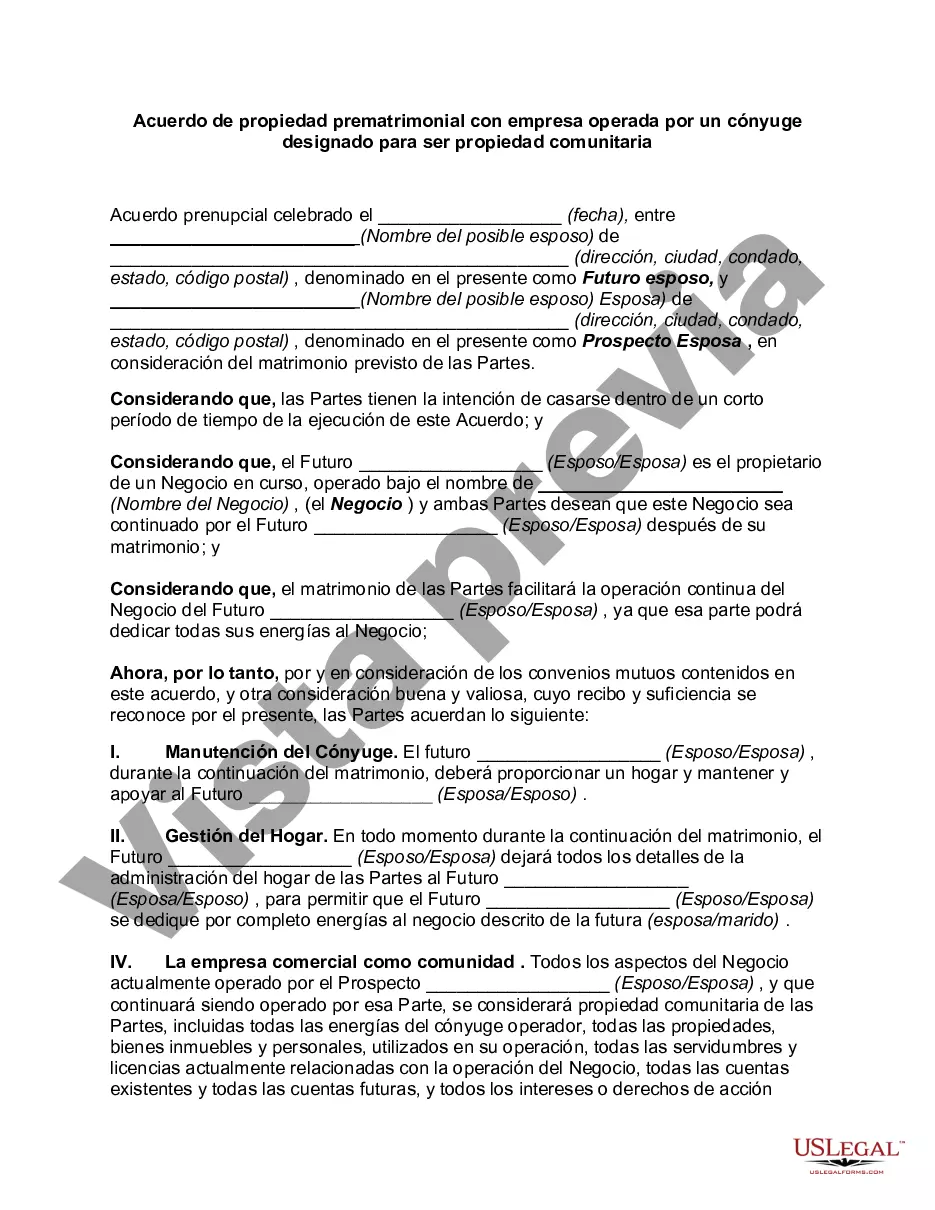

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Acuerdo de propiedad prematrimonial con empresa operada por un cónyuge designado para ser propiedad comunitaria - Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property

Description

How to fill out Harris Texas Acuerdo De Propiedad Prematrimonial Con Empresa Operada Por Un Cónyuge Designado Para Ser Propiedad Comunitaria?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare formal documentation that varies throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any personal or business objective utilized in your region, including the Harris Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Harris Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to get the Harris Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property:

- Make sure you have opened the right page with your localised form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Harris Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!