Palm Beach, Florida is a popular destination for those looking to tie the knot surrounded by stunning beaches, palm trees, and luxurious accommodations. However, before saying "I do," couples should consider a Palm Beach Florida Prenuptial Property Agreement Designating Status of Separate and Community Property to protect their assets and establish property rights. This legal document outlines the division of assets and debts in the event of a divorce, ensuring that both parties are aware of their rights and obligations. When creating a Prenuptial Property Agreement, it is crucial to specify the status of separate and community property to avoid any confusion or disputes in the future. Different types of Palm Beach Florida Prenuptial Property Agreements include: 1. Traditional Prenuptial Property Agreement: This type of agreement clearly defines the separate and community property of each spouse before the marriage. It allows each party to retain ownership of their premarital assets and establishes guidelines for the division of joint assets acquired during the marriage. 2. Business Prenuptial Property Agreement: For couples with significant business interests, a Business Prenuptial Property Agreement is essential to protect their respective business assets. This type of agreement safeguards the ownership and control of businesses, partnerships, or professional practices, enabling a smooth transition in the event of a divorce. 3. Real Estate Prenuptial Property Agreement: In cases where one or both individuals own real estate properties, a Real Estate Prenuptial Property Agreement is necessary to determine the division and ownership of these assets. It can address issues like rental income, mortgages, and property appreciation, ensuring a fair distribution in case of a divorce. 4. Retirement Accounts Prenuptial Property Agreement: A Retirement Accounts Prenuptial Property Agreement helps couples outline the distribution of retirement savings, such as Individual Retirement Accounts (IRAs), pensions, and 401(k) plans. This agreement establishes the ownership and distribution of these funds, avoiding potential conflicts down the road. 5. Debt Allocation Prenuptial Property Agreement: In situations where one or both parties have significant debts before marriage, a Debt Allocation Prenuptial Property Agreement can be crucial. It outlines how existing debts will be allocated and who will be responsible for them, safeguarding each spouse from being burdened with their partner's financial liabilities. By carefully crafting a Palm Beach Florida Prenuptial Property Agreement Designating Status of Separate and Community Property, couples can protect their financial interests and maintain peace of mind throughout their marriage. Consulting with an experienced family law attorney is highly recommended ensuring the agreement complies with Florida law and meets the unique needs and circumstances of the couple.

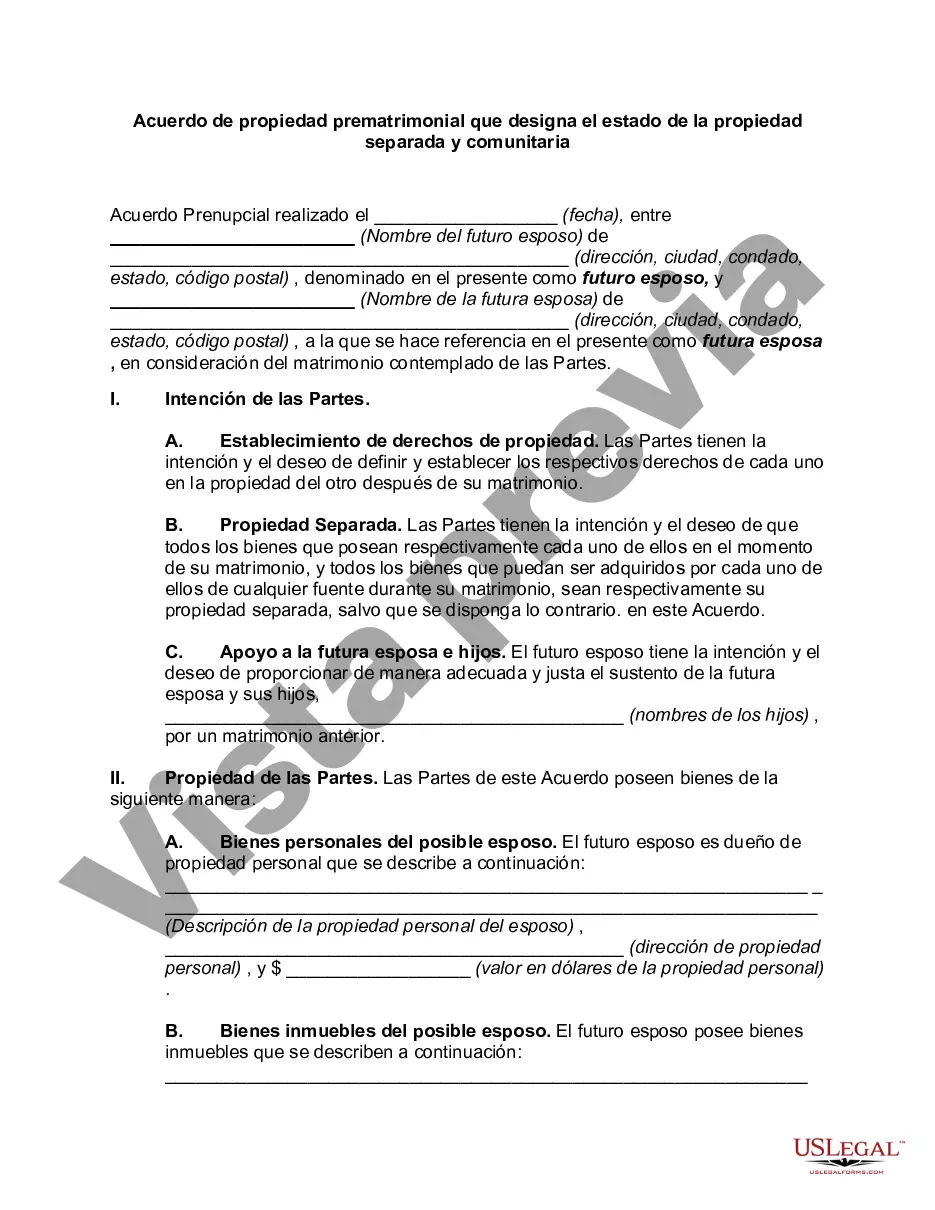

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Beach Florida Acuerdo de propiedad prematrimonial que designa el estado de la propiedad separada y comunitaria - Prenuptial Property Agreement Designating Status of Separate and Community Property

Description

How to fill out Palm Beach Florida Acuerdo De Propiedad Prematrimonial Que Designa El Estado De La Propiedad Separada Y Comunitaria?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare formal paperwork that differs from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. Here, you can easily locate and download a document for any personal or business purpose utilized in your region, including the Palm Beach Prenuptial Property Agreement Designating Status of Separate and Community Property.

Locating forms on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Palm Beach Prenuptial Property Agreement Designating Status of Separate and Community Property will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to obtain the Palm Beach Prenuptial Property Agreement Designating Status of Separate and Community Property:

- Make sure you have opened the correct page with your localised form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template satisfies your needs.

- Look for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Palm Beach Prenuptial Property Agreement Designating Status of Separate and Community Property on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!