Hennepin Minnesota Joint-Venture Agreement — Speculation in Real Estate is an arrangement between two or more parties to collaborate on a real estate investment project in Hennepin County, Minnesota. This joint venture aims to leverage combined resources, expertise, and market knowledge to speculate and capitalize on potential opportunities in the local real estate market. The Hennepin Minnesota Joint-Venture Agreement — Speculation in Real Estate offers a framework for partners to outline their respective roles, responsibilities, and contributions to the venture. This comprehensive agreement covers key aspects such as capital investment, profit-sharing arrangements, decision-making authority, and exit strategies. There can be different types of Hennepin Minnesota Joint-Venture Agreement — Speculation in Real Estate, depending on the specific objectives, risk appetite, and investment strategies of the participating parties. Some common types of joint ventures in this context include: 1. Residential Development Joint Ventures: In this type, parties collaborate to speculate on residential property development projects in Hennepin County, aiming to capitalize on the growing demand for housing in the area. This could involve purchasing land, constructing residential units, and subsequently selling or renting them for profit. 2. Commercial Real Estate Joint Ventures: Here, the joint venture partners focus on speculating in commercial real estate opportunities in Hennepin County, such as office buildings, retail centers, or industrial properties. The goal is to identify undervalued or underutilized assets and optimize their value through renovation, repositioning, or lease negotiations. 3. Land Acquisition and Resale Joint Ventures: This type of joint venture concentrates on acquiring undeveloped or underdeveloped land in Hennepin County, speculating on its potential appreciation in value. Partners may seek to purchase land in strategic locations or areas with future growth potential and leverage their expertise to sell or develop the land profitably. 4. Mixed-Use Development Joint Ventures: These joint ventures encompass a combination of residential, commercial, and possibly other real estate sectors. Partners collaborate to speculate and create mixed-use projects, capitalizing on the synergies between different asset classes and catering to the evolving needs of Hennepin County's residents and businesses. These various types of joint ventures offer investors different avenues to capitalize on the real estate market in Hennepin County, whether by developing residential properties, focusing on commercial assets, acquiring and reselling land, or creating mixed-use developments. Through collaboration and strategic speculation, these joint ventures aim to generate substantial returns on investment while mitigating individual risks through shared responsibilities and resources.

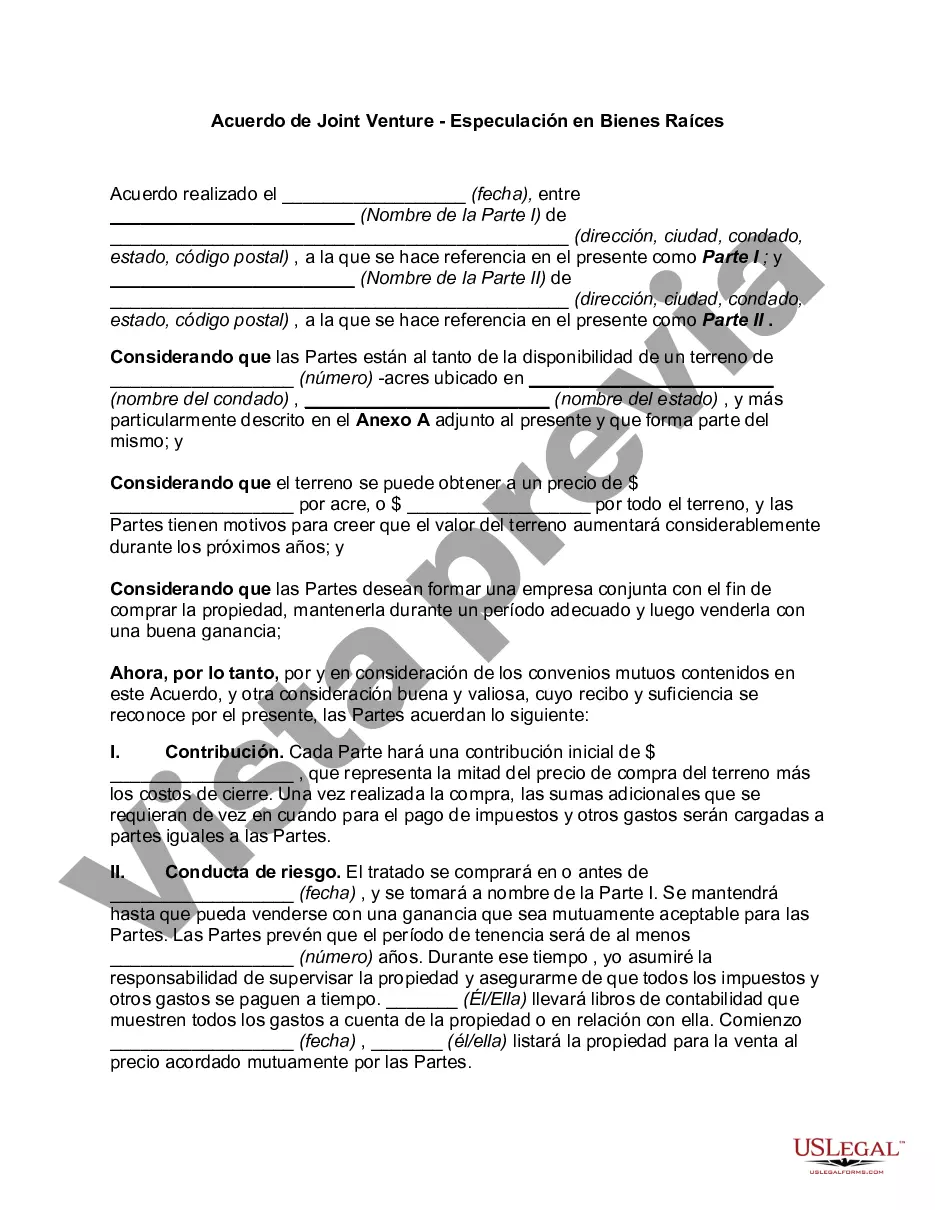

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Acuerdo de Joint Venture - Especulación en Bienes Raíces - Joint-Venture Agreement - Speculation in Real Estate

Description

How to fill out Hennepin Minnesota Acuerdo De Joint Venture - Especulación En Bienes Raíces?

If you need to find a reliable legal document supplier to obtain the Hennepin Joint-Venture Agreement - Speculation in Real Estate, consider US Legal Forms. Whether you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can select from over 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of supporting materials, and dedicated support make it easy to get and complete various papers.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

Simply type to look for or browse Hennepin Joint-Venture Agreement - Speculation in Real Estate, either by a keyword or by the state/county the form is created for. After locating required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to start! Simply find the Hennepin Joint-Venture Agreement - Speculation in Real Estate template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Register an account and choose a subscription option. The template will be immediately ready for download once the payment is completed. Now you can complete the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes these tasks less costly and more reasonably priced. Set up your first business, organize your advance care planning, create a real estate contract, or complete the Hennepin Joint-Venture Agreement - Speculation in Real Estate - all from the convenience of your home.

Join US Legal Forms now!