Maricopa Arizona Jury Instruction — Failure To File Tax Return A Maricopa Arizona jury instruction on failure to file tax return provides guidance to jurors regarding the legal implications and elements of a failure to file tax return charge. This instruction is applicable in cases where an individual has willfully and knowingly neglected their duty to file federal or state tax returns. The failure to file tax return jury instruction essentially outlines the necessary components and burden of proof required for the prosecution to establish the defendant's guilt. The instruction ensures that jurors understand the specific elements required to convict for this offense and clarifies any legal concepts they may encounter during the trial. A comprehensive Maricopa Arizona jury instruction for failure to file tax return may cover the following key points: 1. Definition and Explanation: The instruction starts by explaining the offense of failure to file tax return. It clarifies that this charge relates to willfully and knowingly not filing the required tax returns, specifically addressing federal or state tax obligations. 2. Elements of the Offense: The instruction identifies the essential elements that must be proven by the prosecution beyond a reasonable doubt. These elements typically include demonstrating that: — The defendant had a legal duty to file a tax return; — The defendant willfully and intentionally failed to file the required tax return; — The tax return was due within a specified time period; — The defendant's actions were deliberate and not due to mistake, accident, or incapacity. 3. Explanation of Willfulness: This section helps jurors understand the concept of willfulness. It may define willfulness as an intentional act or omission, pointing out that it does not require an evil motive or bad purpose. The instruction may further explain that a willful act refers to one undertaken voluntarily, with the knowledge that the action is unlawful. 4. Jury's Role: The instruction emphasizes the jury's role in determining the defendant's guilt or innocence based on the evidence presented during the trial. It advises jurors to carefully evaluate the credibility of witnesses, examine exhibits, and apply the law as instructed by the court. Different Types of Maricopa Arizona Jury Instruction — Failure To File Tax Return: Depending on the nature of the case and its specific circumstances, there may not be different types of Maricopa Arizona jury instruction specifically tailored to various situations. However, the instruction could be adapted to address any relevant nuances or legal aspects unique to a given case, ensuring a fair and comprehensive jury understanding. In conclusion, a Maricopa Arizona jury instruction on failure to file tax return provides essential guidance to jurors in cases where individuals have willfully and knowingly failed to fulfill their obligation of filing tax returns. It outlines the elements of the offense, clarifies the concept of willfulness, and empowers jurors to make a well-informed decision based on the evidence presented during the trial.

Maricopa Arizona Jury Instruction - Failure To File Tax Return

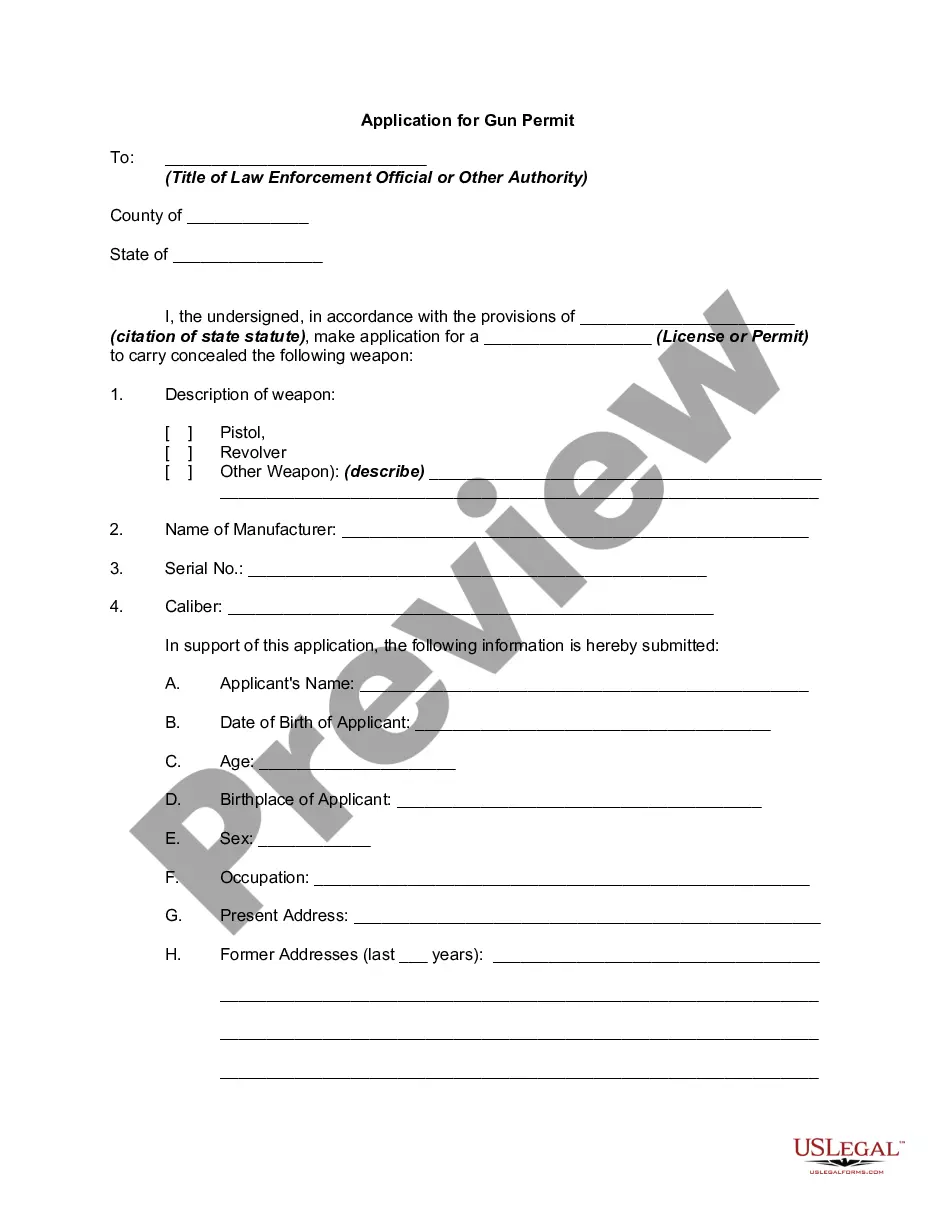

Description

How to fill out Maricopa Arizona Jury Instruction - Failure To File Tax Return?

How much time does it normally take you to draw up a legal document? Since every state has its laws and regulations for every life sphere, locating a Maricopa Jury Instruction - Failure To File Tax Return suiting all local requirements can be stressful, and ordering it from a professional lawyer is often pricey. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, collected by states and areas of use. In addition to the Maricopa Jury Instruction - Failure To File Tax Return, here you can find any specific document to run your business or individual affairs, complying with your county requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can get the file in your profile anytime later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Maricopa Jury Instruction - Failure To File Tax Return:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Maricopa Jury Instruction - Failure To File Tax Return.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!