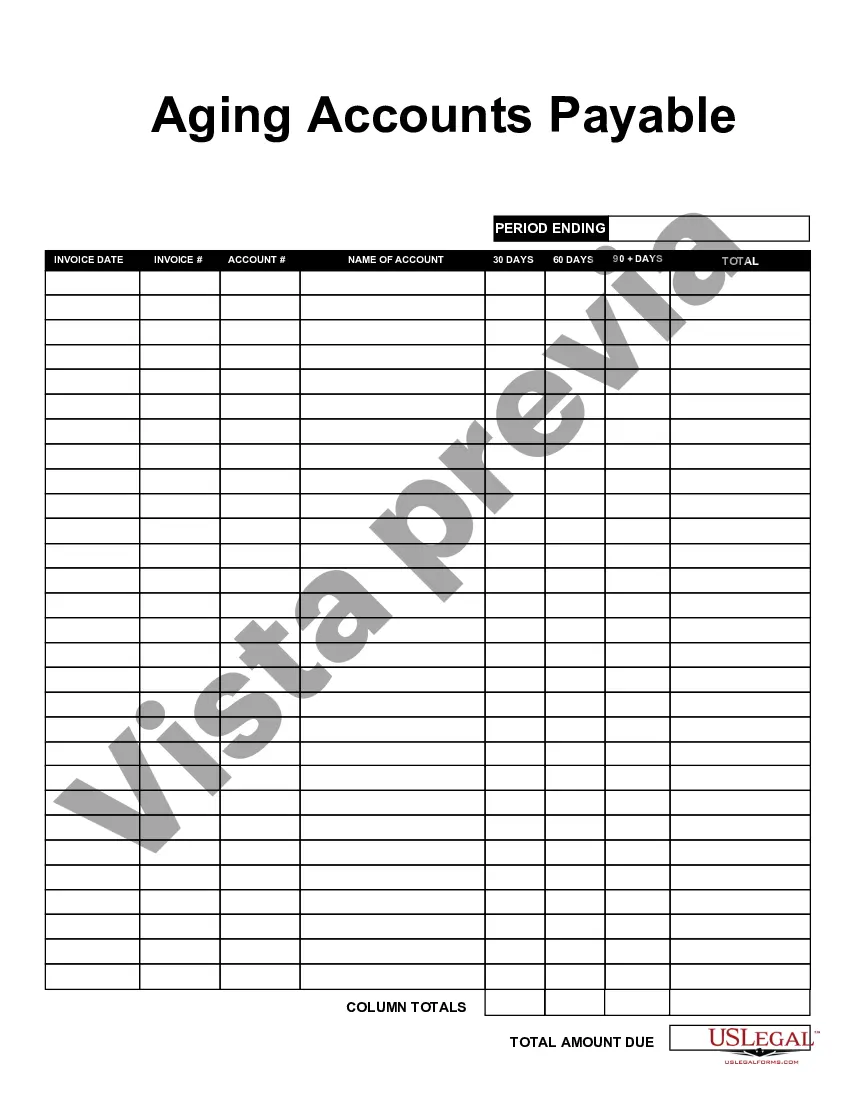

Broward Florida Aging Accounts Payable refers to the tracking and management of outstanding invoices and bills, specifically in the context of Broward County, Florida. This financial process helps organizations and businesses in Broward County monitor and control their cash flow by keeping a record of the amounts owed and the duration for which the payments have been outstanding. Keywords: Broward Florida, Aging Accounts Payable, invoices, bills, outstanding, cash flow, payments, organizations, businesses. There are no different types of Broward Florida Aging Accounts Payable specifically, as it is a general term that encompasses the overall management of outstanding payables. However, there can be different categories or aging periods within aging accounts payable, such as: 1. Current: This category includes invoices or bills that are unpaid but still within the payment terms agreed upon with the vendor or creditor. 2. 30-day aging: Refers to invoices or bills that have been overdue for 30 days or less. 3. 60-day aging: Encompasses invoices or bills overdue for 31 to 60 days. 4. 90-day aging: Consists of invoices or bills that have been outstanding for 61 to 90 days. 5. 90+ days aging: Represents invoices or bills that are overdue for more than 90 days. By categorizing accounts payable based on aging, businesses in Broward County can effectively identify and prioritize outstanding payments, allocate resources, and implement necessary actions to manage their financial obligations. This practice helps maintain positive relationships with vendors, avoid penalties or late fees, and ensure a healthy cash flow.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Broward Florida Antigüedad de cuentas por pagar - Aging Accounts Payable

Description

How to fill out Broward Florida Antigüedad De Cuentas Por Pagar?

If you need to get a trustworthy legal paperwork provider to obtain the Broward Aging Accounts Payable, consider US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can select from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, number of learning materials, and dedicated support make it easy to find and execute different documents.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply type to search or browse Broward Aging Accounts Payable, either by a keyword or by the state/county the document is created for. After finding the necessary form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Broward Aging Accounts Payable template and check the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be instantly available for download as soon as the payment is completed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes this experience less expensive and more affordable. Create your first company, organize your advance care planning, draft a real estate agreement, or complete the Broward Aging Accounts Payable - all from the convenience of your sofa.

Join US Legal Forms now!