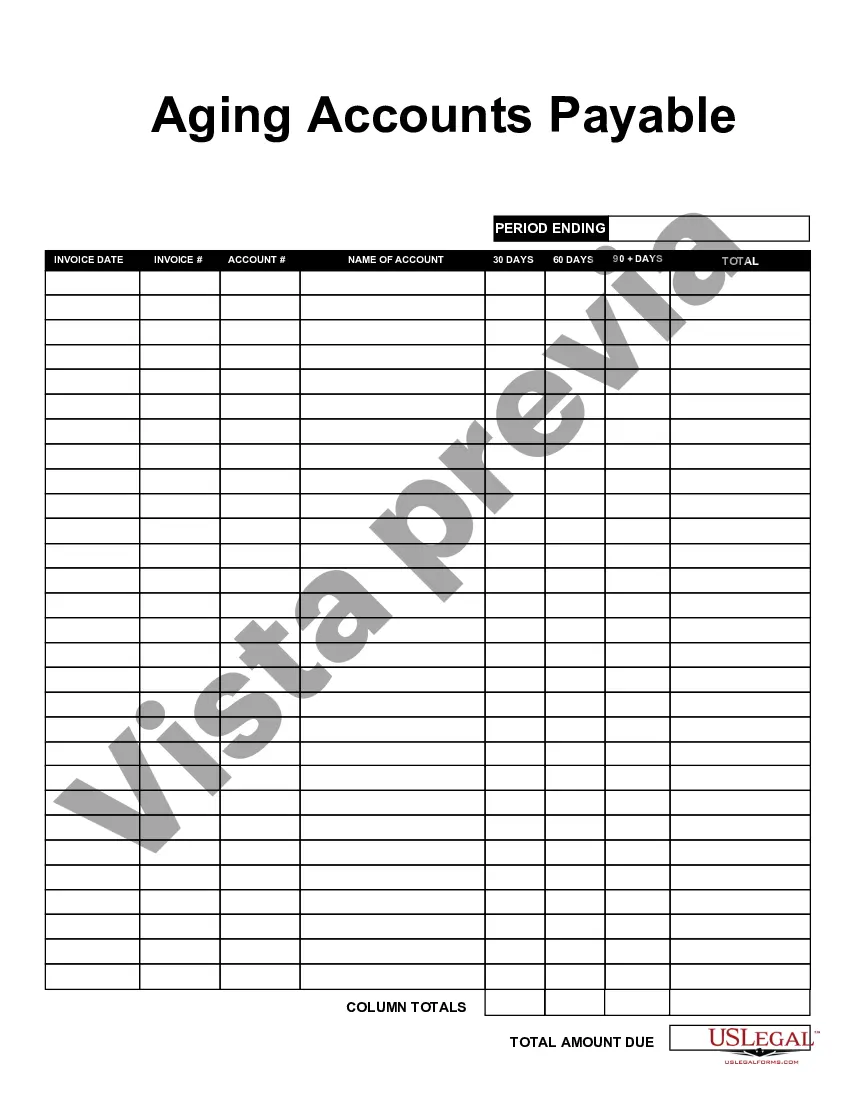

Chicago, Illinois Aging Accounts Payable refers to the process of tracking and managing outstanding payments owed by customers or clients to businesses or organizations based in Chicago, Illinois. It specifically focuses on monitoring the age of these accounts, in terms of how long they have been outstanding. Keywords: Chicago, Illinois, Aging Accounts Payable, accounts receivable, invoice, payment, outstanding, due date, collection, delinquency, aging schedule, aging report, past due, customer, client. Chicago, Illinois Aging Accounts Payable involves keeping an organized record of the invoiced payments that are pending from customers or clients in the Chicago area. This process ensures that businesses can effectively manage their cash flow and work towards timely collection of funds owed to them. Complying with accounting principles and practices, it helps companies maintain stability and financial health. The various types of Chicago, Illinois Aging Accounts Payable are categorized based on the age of the outstanding payments. Typically, these categories include: 1. Current: Accounts payable that are within the agreed-upon payment terms and have not exceeded the due date. 2. 30 days past due: Payments that are overdue by 30 days from the agreed-upon payment terms. 3. 60 days past due: Accounts payable that have reached 60 days past the due date. 4. 90 days past due: Payments that have passed the 90-day mark since the agreed-upon payment terms. 5. 90+ days past due: Accounts payable that have gone beyond the 90-day mark and are considered significantly delinquent. Special attention is given to the aging schedule or aging report, which provides a comprehensive overview of the different types of accounts payable and their respective ages. This report helps businesses identify problem areas, implement proactive measures for collection, and make informed decisions regarding the allocation of resources. For efficient management of Chicago, Illinois Aging Accounts Payable, businesses employ strategies for collections, including sending reminders, making phone calls to debtors, offering discounts or incentives for prompt payment, and collaborating with collection agencies if necessary. By closely monitoring and managing the aging accounts payable, companies in Chicago, Illinois can strengthen their financial stability, maintain healthy cash flow, meet financial obligations, and foster strong relationships with their customers or clients.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Antigüedad de cuentas por pagar - Aging Accounts Payable

Description

How to fill out Chicago Illinois Antigüedad De Cuentas Por Pagar?

Preparing legal documentation can be burdensome. In addition, if you decide to ask an attorney to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Chicago Aging Accounts Payable, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario accumulated all in one place. Therefore, if you need the recent version of the Chicago Aging Accounts Payable, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Chicago Aging Accounts Payable:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Chicago Aging Accounts Payable and save it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!