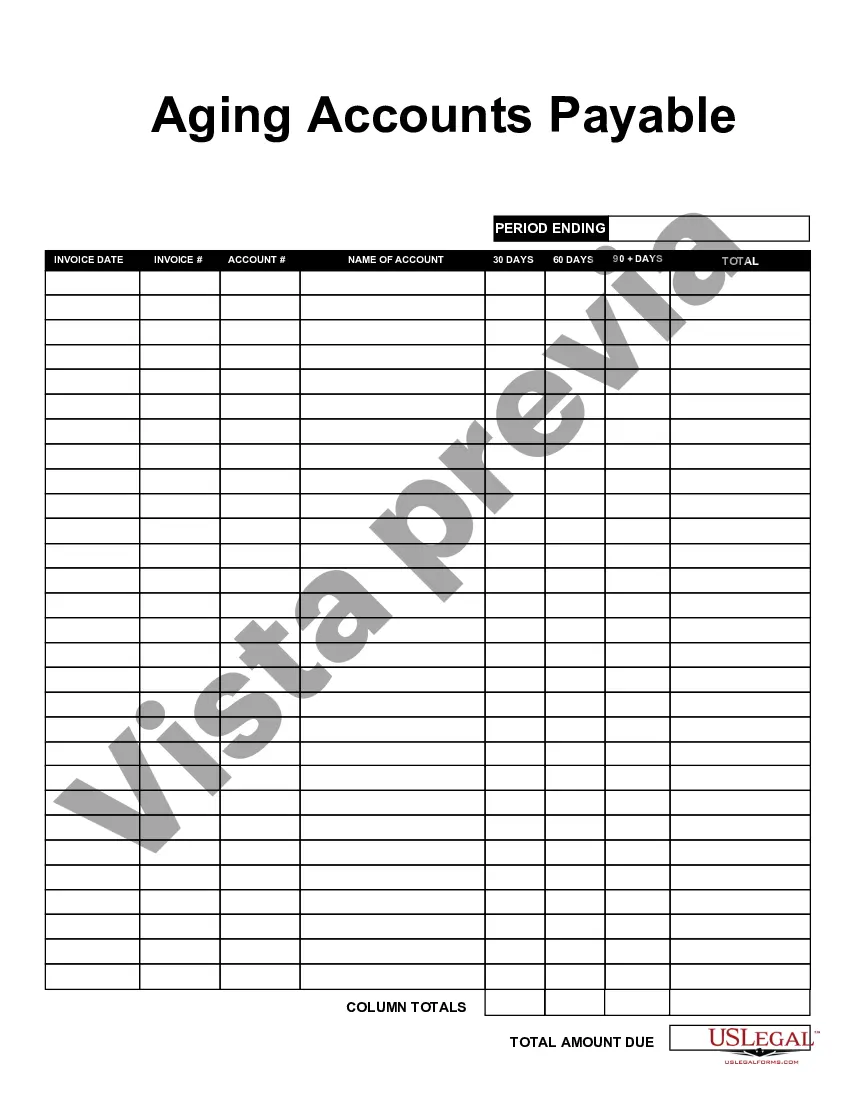

Harris Texas Aging Accounts Payable refers to the process of tracking and monitoring the outstanding payments that a company owes to its vendors or suppliers in the Harris County, Texas area. It involves categorizing and analyzing the unpaid invoices based on their due dates to determine the liquidity and financial health of the business. The term "aging" implies that the unpaid invoices are segregated into different time periods, ranging from current (not yet due) to past due (overdue). By analyzing the Aging Accounts Payable report, businesses can understand which vendors need to be prioritized for payment and manage their cash flow more effectively. In the context of Harris County, Texas, there are various types of Aging Accounts Payable that companies may encounter: 1. Current Accounts Payable: This category includes invoices that are not yet due in terms of payment. These invoices typically represent the recent purchases or services provided, and businesses typically have a grace period for payment before they become overdue. 2. 30-Day Aging Accounts Payable: This category includes invoices that are 30 days past their due date. Usually, businesses try to settle these invoices within this period to maintain strong vendor relationships and avoid any late payment penalties. 3. 60-Day Aging Accounts Payable: This category includes invoices that are 60 days overdue. It indicates a delay in payment beyond the usual grace period. Prompt action is required to address these overdue payments and mitigate any negative impact on business relationships. 4. 90-Day Aging Accounts Payable: This category includes invoices that have been overdue for 90 days or more. These invoices require immediate attention as they represent significant delays in payments. Proactive measures need to be taken to resolve outstanding issues and prevent further consequences such as vendor dissatisfaction or credit implications. Managing Harris Texas Aging Accounts Payable is crucial for businesses to maintain a healthy financial position, avoid late payment fees, and sustain positive vendor relationships. Accurate record-keeping, regular reconciliation, and timely communication with vendors are essential to effectively handle the various types of Aging Accounts Payable. By staying proactive and diligent, businesses can ensure smooth operations and maintain a good reputation in the Harris County, Texas business community.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Antigüedad de cuentas por pagar - Aging Accounts Payable

Description

How to fill out Harris Texas Antigüedad De Cuentas Por Pagar?

How much time does it typically take you to draft a legal document? Given that every state has its laws and regulations for every life situation, finding a Harris Aging Accounts Payable meeting all regional requirements can be tiring, and ordering it from a professional lawyer is often costly. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. Aside from the Harris Aging Accounts Payable, here you can get any specific form to run your business or personal deeds, complying with your regional requirements. Experts check all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can get the document in your profile at any time in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Harris Aging Accounts Payable:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Harris Aging Accounts Payable.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!