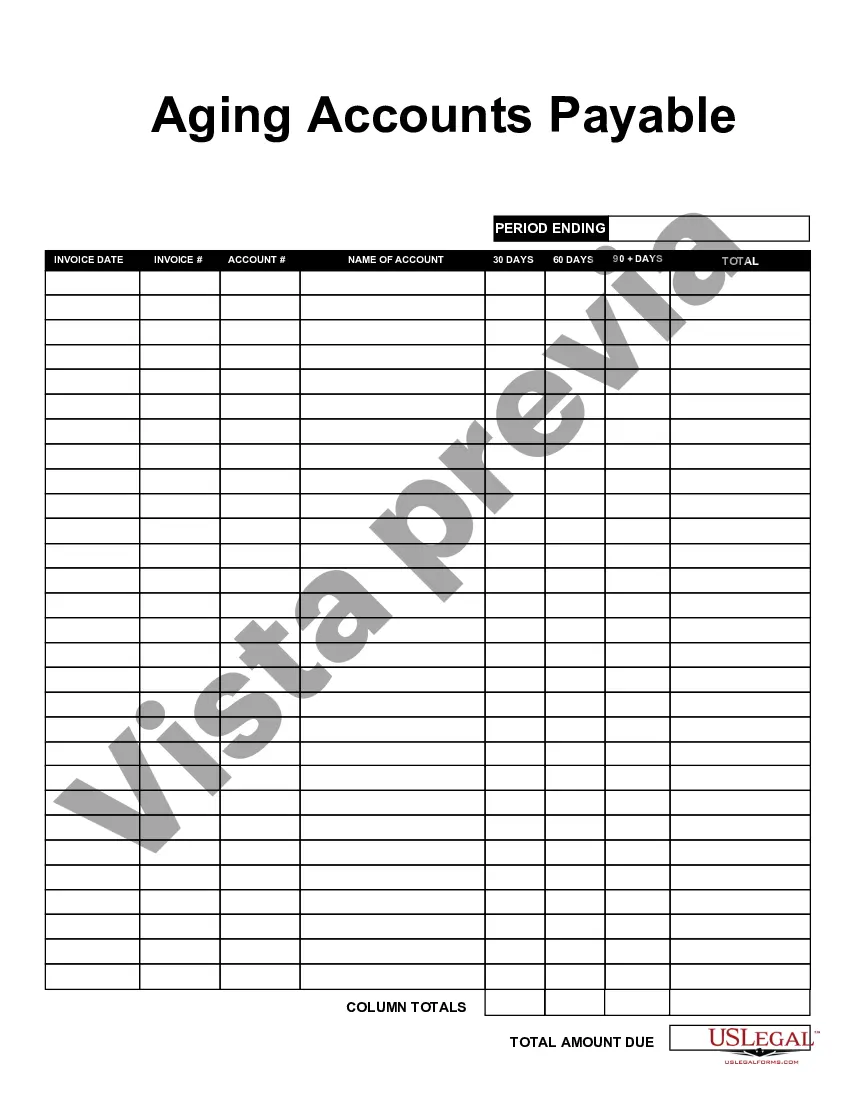

Kings New York Aging Accounts Payable is a financial process that tracks outstanding payments owed by Kings New York, a company based in New York. It refers to the systematic analysis of unpaid bills or invoices that have not been settled within specific time frames. This term is commonly used in accounting to keep track of accounts that have been outstanding for a certain period, categorized based on their due dates. There are three main types of Kings New York Aging Accounts Payable based on the due dates of invoices or bills: 1. Current Accounts Payable: This category comprises invoices that are not yet due or are due within a company's normal payment terms. These are usually accounts payable that are expected to be paid within 30 days or mutually agreed upon payment terms. 2. 1-30 Days Aging Accounts Payable: This group includes invoices or bills that have exceeded the normal payment terms and are usually overdue by a maximum of 30 days. It indicates a slight delay in payment but not yet considered a significant concern. 3. Over 30 Days Aging Accounts Payable: This category encompasses invoices or bills that have not been paid within 30 days of their due date. It indicates a potential issue, as these obligations have been outstanding for an extended period and may require immediate attention to prevent further delays or potential financial penalties. Companies utilize Kings New York Aging Accounts Payable to closely monitor their outstanding obligations and ensure that payments are made promptly. It helps them keep track of their financial commitments and maintain healthy relationships with their vendors or suppliers. By accurately categorizing accounts based on their due dates, Kings New York can better prioritize payments and allocate resources effectively. Analyzing the aging accounts payable report also enables businesses to identify any inefficiencies or bottlenecks in their accounts payable processes and take necessary actions to streamline them. In conclusion, Kings New York Aging Accounts Payable is the systematic tracking and categorization of outstanding payments owed by Kings New York. With different categories like current, 1-30 days aging, and over 30 days aging, this process allows companies to manage their financial commitments effectively and take appropriate steps to ensure timely payments.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Antigüedad de cuentas por pagar - Aging Accounts Payable

Description

How to fill out Kings New York Antigüedad De Cuentas Por Pagar?

If you need to get a trustworthy legal form supplier to find the Kings Aging Accounts Payable, consider US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed template.

- You can search from over 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of learning materials, and dedicated support team make it easy to locate and complete different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply type to look for or browse Kings Aging Accounts Payable, either by a keyword or by the state/county the document is created for. After locating necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Kings Aging Accounts Payable template and check the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Register an account and select a subscription option. The template will be immediately available for download once the payment is processed. Now you can complete the form.

Handling your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes this experience less expensive and more reasonably priced. Set up your first business, arrange your advance care planning, draft a real estate agreement, or execute the Kings Aging Accounts Payable - all from the comfort of your sofa.

Join US Legal Forms now!

Form popularity

FAQ

7 consejos para gestionar las cuentas por pagar a proveedores Nunca dejes de lado la comunicacion.Analiza todas tus posibilidades.Manten en orden las facturas.Negocia con tus proveedores.Incluye cada gasto.Verifica el registro de las compras.Automatiza tus cuentas por pagar.

Las cuentas por pagar son las cantidades en deuda de una compania a los acreedores por los servicios o bienes adquiridos. Si una tienda recibe bienes en adelanto sobre el pago, la compra se situa en el archivo de cuentas por pagar. Las cuentas por pagar puede corresponder a mercancia, servicios privados o publicos.

7 consejos para gestionar las cuentas por pagar a proveedores Nunca dejes de lado la comunicacion.Analiza todas tus posibilidades.Manten en orden las facturas.Negocia con tus proveedores.Incluye cada gasto.Verifica el registro de las compras.Automatiza tus cuentas por pagar.

Una cuenta a pagar es una cuenta que presenta saldo acreedor en el balance de la empresa. El origen de las cuentas por pagar deriva de determinadas operaciones, como la por ejemplo la compra de bienes materiales, la recepcion de un servicio o gastos incurridos entre otros.

Para llegar a este calculo se debe, en primer lugar, determinar el promedio de cuentas por cobrar sumando el saldo al inicio del ano mas el saldo al final del ano y luego se divide entre dos. Posteriormente, se debe dividir el total de ventas netas a credito entre el saldo neto de cuentas por cobrar.

Las Cuentas por pagar son aquellas deudas que una empresa contrae con diferentes acreedores o proveedores, producto de haber adquirido determinados bienes o servicios. Las Cuentas por pagar pueden ser definidas como obligaciones que contrae una empresa, como consecuencia de la actividad economica que realiza.

Las cuentas por pagar generalmente se clasifican como Cuentas por Pagar Comerciales (esto es, pagaderas por la compra de bienes fisicos que se registran como Inventario), y Cuentas por Pagar de Gastos diversos (esto es, pagaderas por la compra de bienes y servicios que se facturan).

Sus principales funciones seran... Controlar la emision formal de las facturas de proveedores. Controlar los tickets, documentos remitidos y facturas con las ordenes de compra y gestionar las aprobaciones internas. Efectuar el procesamiento y apropiacion contable de facturas en el sistema.

Cuentas por pagar a corto plazo (pasivos corrientes): Deben pagarse en menos de un ano. (Pagos semestrales, mensuales, etc.) Cuentas por pagar a largo plazo (pasivos no corrientes): Estas se pagan en un tiempo mayor a un ano.

Las cuentas por pagar se originan cuando al adquirir materiales u otros bienes o servicios necesarios para la empresa, no se cancelan inmediatamente. De esta manera las deudas deben formar parte del registro de los libros contables y cancelarlas a su acreedor en un tiempo determinado.