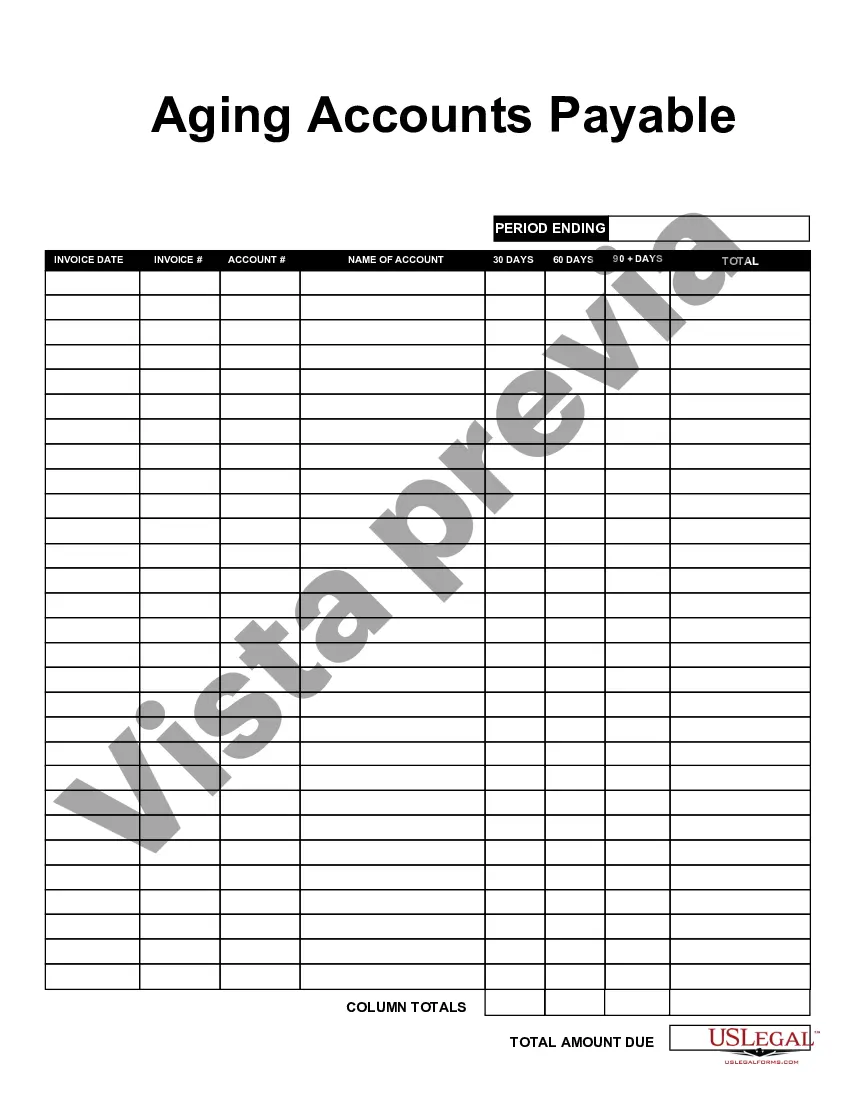

Miami-Dade Florida Aging Accounts Payable refers to the process of tracking and managing outstanding debts owed by vendors or suppliers to the Miami-Dade County government. This financial operation is crucial for maintaining accurate records, ensuring timely payments, and managing the cash flow of the county's accounts payable department. Miami-Dade County, located in the southeastern part of Florida, is the most populous county in the state. With a diverse and vibrant economy, the county relies on a wide range of vendors and suppliers to fulfill its day-to-day operational needs. The Aging Accounts Payable process helps the county monitor and manage its outstanding debts, ultimately ensuring efficient financial management. The Aging Accounts Payable process involves categorizing outstanding invoices based on their due dates and the length of time they have been unpaid. This categorization helps the county identify and prioritize overdue debts, enabling them to take appropriate actions to collect payments or resolve outstanding issues. There are different types of Miami-Dade Florida Aging Accounts Payable categories commonly used, such as: 1. Current Accounts Payable: These are outstanding invoices that are due for payment within a short period, typically within 30 days. The county's accounts payable team focuses on settling these liabilities promptly to maintain good relationships with their vendors and suppliers. 2. Past Due Accounts Payable: These are invoices that have surpassed the due date, typically older than 30 days. The county's Aging Accounts Payable team places high priority on resolutions for past due invoices to prevent burdening the county's financial resources and potential damage to relationships with vendors. 3. Overdue Accounts Payable: These are invoices that have remained unpaid for an extended period, usually surpassing 60 or 90 days. Overdue accounts payable require immediate attention as they pose a potential risk to the county's cash flow and reputation. 4. Disputed or Outstanding Issues: These refer to invoices where discrepancies or unresolved issues exist between the county and the vendor or supplier. These issues may arise due to discrepancies in pricing, quality disputes, or delivery problems. Resolving these disputes is crucial to maintaining healthy business relationships and preventing future complications. The Miami-Dade Florida Aging Accounts Payable process streamlines the management of outstanding debts owed by vendors or suppliers. By categorizing invoices based on their due dates, the county can effectively prioritize and address late payments, disputed invoices, and outstanding issues. This helps maintain strong financial management practices while ensuring the smooth operation of Miami-Dade County's accounts payable department.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Antigüedad de cuentas por pagar - Aging Accounts Payable

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-120-AZ

Format:

Word

Instant download

Description

Descargar en formato PDF o Word rellenable.

Miami-Dade Florida Aging Accounts Payable refers to the process of tracking and managing outstanding debts owed by vendors or suppliers to the Miami-Dade County government. This financial operation is crucial for maintaining accurate records, ensuring timely payments, and managing the cash flow of the county's accounts payable department. Miami-Dade County, located in the southeastern part of Florida, is the most populous county in the state. With a diverse and vibrant economy, the county relies on a wide range of vendors and suppliers to fulfill its day-to-day operational needs. The Aging Accounts Payable process helps the county monitor and manage its outstanding debts, ultimately ensuring efficient financial management. The Aging Accounts Payable process involves categorizing outstanding invoices based on their due dates and the length of time they have been unpaid. This categorization helps the county identify and prioritize overdue debts, enabling them to take appropriate actions to collect payments or resolve outstanding issues. There are different types of Miami-Dade Florida Aging Accounts Payable categories commonly used, such as: 1. Current Accounts Payable: These are outstanding invoices that are due for payment within a short period, typically within 30 days. The county's accounts payable team focuses on settling these liabilities promptly to maintain good relationships with their vendors and suppliers. 2. Past Due Accounts Payable: These are invoices that have surpassed the due date, typically older than 30 days. The county's Aging Accounts Payable team places high priority on resolutions for past due invoices to prevent burdening the county's financial resources and potential damage to relationships with vendors. 3. Overdue Accounts Payable: These are invoices that have remained unpaid for an extended period, usually surpassing 60 or 90 days. Overdue accounts payable require immediate attention as they pose a potential risk to the county's cash flow and reputation. 4. Disputed or Outstanding Issues: These refer to invoices where discrepancies or unresolved issues exist between the county and the vendor or supplier. These issues may arise due to discrepancies in pricing, quality disputes, or delivery problems. Resolving these disputes is crucial to maintaining healthy business relationships and preventing future complications. The Miami-Dade Florida Aging Accounts Payable process streamlines the management of outstanding debts owed by vendors or suppliers. By categorizing invoices based on their due dates, the county can effectively prioritize and address late payments, disputed invoices, and outstanding issues. This helps maintain strong financial management practices while ensuring the smooth operation of Miami-Dade County's accounts payable department.