Travis Texas Aging Accounts Payable refers to a financial management process where the accounts payable department of a company in Travis, Texas, tracks and manages outstanding invoices and unpaid bills. This procedure aims to monitor the payment status of these accounts to ensure prompt settlement and maintain healthy relationships with vendors and suppliers. By utilizing different aging categories, companies can gain insights into their financial standing and take corrective actions if necessary. There are several types of Travis Texas Aging Accounts Payable that can be categorized based on the time period elapsed since the invoices were generated. These categories include: 1. Current Accounts Payable: This category represents the invoices that are due within a typically less than 30-day period. These invoices are considered up-to-date and often indicate healthy cash flow management. 2. 30-Day Aging Accounts Payable: This category represents invoices that are 30 days past their due dates. Companies monitor such accounts closely as it may suggest potential issues with cash flow or delayed payments. 3. 60-Day Aging Accounts Payable: These invoices have reached the 60-day past due mark. Businesses need to address these accounts promptly as they could indicate financial strains, internal inefficiencies, or other underlying problems. 4. 90-Day Aging Accounts Payable: Invoices that exceed 90 days past their due dates fall into this category. These accounts require immediate attention as they indicate significant payment delays, potential disputes, or financial instability. Managing Travis Texas Aging Accounts Payable involves constant monitoring of these categories to mitigate the risk of delayed payments, avoid damaging relationships with suppliers, and maintain a positive credit standing. Companies usually implement automated accounting systems to efficiently track and categorize their aging accounts payable. By doing so, they can generate reports and analyses that help strategize for timely payments, negotiate better terms, and optimize vendor relationships. In conclusion, Travis Texas Aging Accounts Payable is a crucial financial management process that allows businesses to efficiently track and manage their unpaid invoices. Categorizing accounts based on the time period elapsed since the due date provides valuable insights into the company's financial health and enables proactive measures to ensure timely settlements and maintain strong vendor relationships.

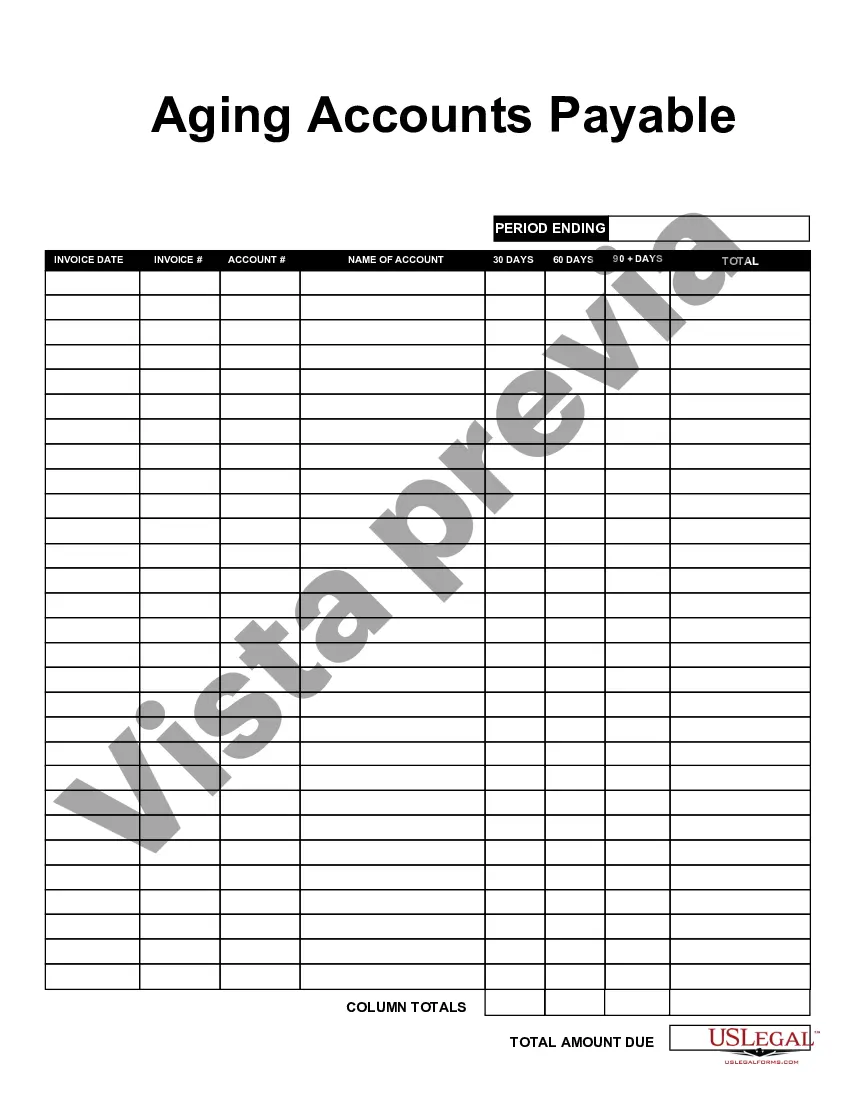

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Antigüedad de cuentas por pagar - Aging Accounts Payable

Description

How to fill out Travis Texas Antigüedad De Cuentas Por Pagar?

Whether you plan to open your company, enter into a deal, apply for your ID update, or resolve family-related legal issues, you must prepare certain documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any individual or business case. All files are collected by state and area of use, so picking a copy like Travis Aging Accounts Payable is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few more steps to get the Travis Aging Accounts Payable. Adhere to the guide below:

- Make sure the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to obtain the sample when you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Travis Aging Accounts Payable in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!