The Contra Costa California Independent Contractor Agreement for Accountant and Bookkeeper is a legally binding document that outlines the terms and conditions between an independent contractor and the client for accounting and bookkeeping services in Contra Costa County, California. This agreement ensures clarity and protect the rights and responsibilities of both parties involved in the professional relationship. The agreement typically provides a detailed description of the services to be provided by the accountant and bookkeeper, such as financial record keeping, financial statement preparation, tax preparation, and payroll services. It may also include additional services agreed upon by both parties. Keywords: Contra Costa California, independent contractor agreement, accountant, bookkeeper, services, financial record keeping, financial statement preparation, tax preparation, payroll services. Different types of Contra Costa California Independent Contractor Agreement for Accountant and Bookkeeper may include: 1. Basic Independent Contractor Agreement: This agreement outlines the general terms and conditions for accounting and bookkeeping services, including service descriptions, payment terms, and termination clauses. 2. Non-Disclosure Agreement (NDA): This agreement ensures the protection of confidential and sensitive information shared between the client and the accountant/bookkeeper. 3. Scope of Work Agreement: This type of agreement defines the specific scope of services that the independent contractor will provide and clarifies any limitations or exclusions. 4. Payment Agreement: This contract focuses on the payment terms, including rates, invoicing procedures, and reimbursement policies. 5. Partnership Agreement: In some cases, the accountant or bookkeeper may enter into a partnership with the client, and the agreement outlines the terms and conditions of their collaboration. 6. Termination Agreement: This agreement specifically deals with the process and conditions of terminating the professional relationship, including notice periods and potential penalties. Keywords: Basic Independent Contractor Agreement, Non-Disclosure Agreement, Scope of Work Agreement, Payment Agreement, Partnership Agreement, Termination Agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Contra Costa California Acuerdo de contratista independiente para contador y tenedor de libros - Independent Contractor Agreement for Accountant and Bookkeeper

Description

How to fill out Contra Costa California Acuerdo De Contratista Independiente Para Contador Y Tenedor De Libros?

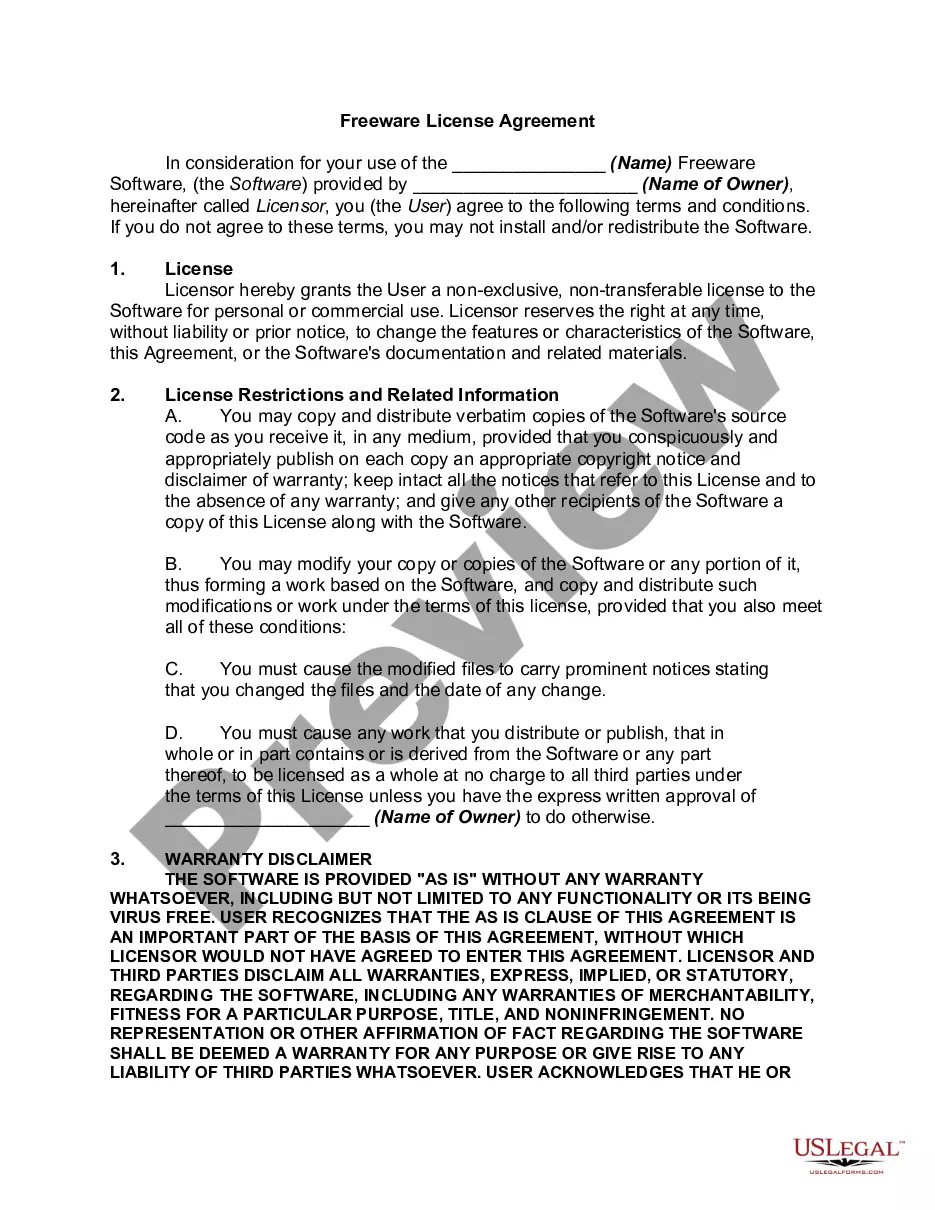

If you need to get a trustworthy legal paperwork provider to find the Contra Costa Independent Contractor Agreement for Accountant and Bookkeeper, consider US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate form.

- You can search from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, variety of learning materials, and dedicated support team make it simple to find and complete various papers.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

You can simply type to search or browse Contra Costa Independent Contractor Agreement for Accountant and Bookkeeper, either by a keyword or by the state/county the form is intended for. After finding the needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Contra Costa Independent Contractor Agreement for Accountant and Bookkeeper template and check the form's preview and description (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Create an account and select a subscription option. The template will be immediately available for download as soon as the payment is processed. Now you can complete the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes these tasks less costly and more affordable. Create your first company, organize your advance care planning, draft a real estate contract, or execute the Contra Costa Independent Contractor Agreement for Accountant and Bookkeeper - all from the convenience of your sofa.

Sign up for US Legal Forms now!

Form popularity

FAQ

Es el proceso de tomar los valores existentes en los soportes contables que sustentan la realizacion de los hechos economicos, y consignarlos en los diferentes libros de contabilidad, como el comprobante de contabilidad, el diario columnario, el mayor y balances y los libros auxiliares.

Antiguamente, se llamaba tenedor de libros a la persona encargada de hacer en los libros los asientos necesarios al buen orden y claridad de las operaciones de una casa de comercio. Era una profesion equivalente a la actual de contador publico o contable.

En el libro diario se recoge la actividad dia a dia a lo largo de un ejercicio contable mientras que en el libro mayor se registran las cuentas de todos los elementos patrimoniales.

Revise su sueldo Tras cinco anos de servicio, esta cifra se situa entre $13,750 y $29,127 al mes con una semana de trabajo de 48 horas.

Un tenedor de libros realiza sus tareas administrativamente mientras que un contador asume una funcion de asesoria para supervisar los estados financieros y cumplir con los requisitos establecidos por los bancos y agencias gubernamentales.

El tenedor de libros 2015bajo control y supervision del contador2015 se ocupa de: Recabar, registrar y clasificar las operaciones de empresa. Narrar en forma escrita los hechos contables.

Salario minimo y maximo de un Tenedores de libros - de $9,227 a $37,648 por mes - 2022.

Antiguamente, se llamaba tenedor de libros a la persona encargada de hacer en los libros los asientos necesarios al buen orden y claridad de las operaciones de una casa de comercio. Era una profesion equivalente a la actual de contador publico o contable.

Para ser ejecutada, la teneduria de libros requiere de una comunicacion fluida y directa entre las empresas y los contadores, ya que la actualizacion de los datos debe gestionarse constantemente y de acuerdo con los gastos e ingresos de la compania.