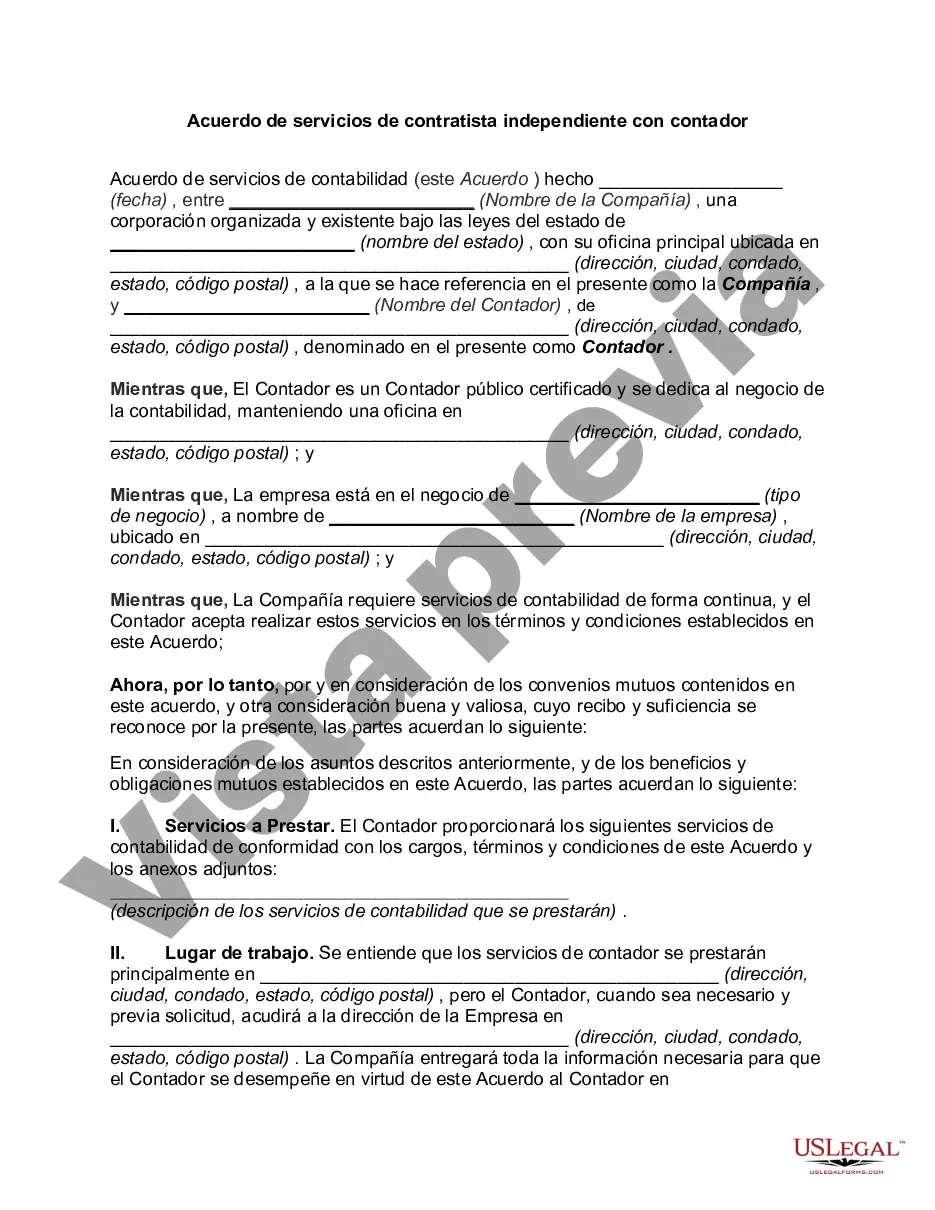

Franklin Ohio Independent Contractor Services Agreement with Accountant is a legally binding contract between an independent contractor and an accountant based in Franklin, Ohio. This agreement outlines the terms and conditions under which the independent contractor will provide accounting services to the accountant's business. Keywords: Franklin Ohio, independent contractor, services agreement, accountant, accounting services, terms and conditions Types of Franklin Ohio Independent Contractor Services Agreement with Accountant: 1. General Independent Contractor Services Agreement with Accountant: This type of agreement is the most common and covers a wide range of accounting services provided by the independent contractor to the accountant. It includes services such as bookkeeping, financial reporting, tax preparation, payroll, and financial analysis. 2. Specific Independent Contractor Services Agreement with Accountant: This agreement is tailored for specific accounting services that the independent contractor will provide. It may focus on a particular area of expertise, such as tax consultation, auditing, or forensic accounting. The terms and scope of the services are clearly defined in this type of agreement. 3. Non-Disclosure Independent Contractor Services Agreement with Accountant: This type of agreement is essential when the independent contractor will have access to sensitive financial information of the accountant's clients. It includes strict confidentiality clauses and protects the accountant's business from any unauthorized disclosure or misuse of data. 4. Term-Based Independent Contractor Services Agreement with Accountant: This agreement is for a specified period, such as a few months or years, during which the independent contractor will provide accounting services to the accountant. It includes provisions related to renewal, termination, and any restrictions post-termination. 5. Project-Based Independent Contractor Services Agreement with Accountant: When the accountant requires a specific accounting task or project to be completed, a project-based agreement is used. It clearly defines the project scope, deliverables, timeline, and compensation structure. This agreement is ideal for short-term collaborations. 6. Cost-Plus Independent Contractor Services Agreement with Accountant: This agreement is based on the cost-plus pricing model. The independent contractor invoices the accountant for the actual expenses incurred in performing the accounting services and adds a predetermined markup or fee. It is commonly used for specialized or complex accounting services. In summary, a Franklin Ohio Independent Contractor Services Agreement with an Accountant is a legally binding contract that outlines the terms, conditions, and scope of accounting services provided by an independent contractor to an accountant based in Franklin, Ohio. The agreement can vary based on the nature of the services, confidentiality requirements, duration, or pricing model.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Acuerdo de servicios de contratista independiente con contador - Independent Contractor Services Agreement with Accountant

Description

How to fill out Franklin Ohio Acuerdo De Servicios De Contratista Independiente Con Contador?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare formal documentation that differs from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any individual or business purpose utilized in your county, including the Franklin Independent Contractor Services Agreement with Accountant.

Locating templates on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Franklin Independent Contractor Services Agreement with Accountant will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guide to obtain the Franklin Independent Contractor Services Agreement with Accountant:

- Ensure you have opened the correct page with your local form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Franklin Independent Contractor Services Agreement with Accountant on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!