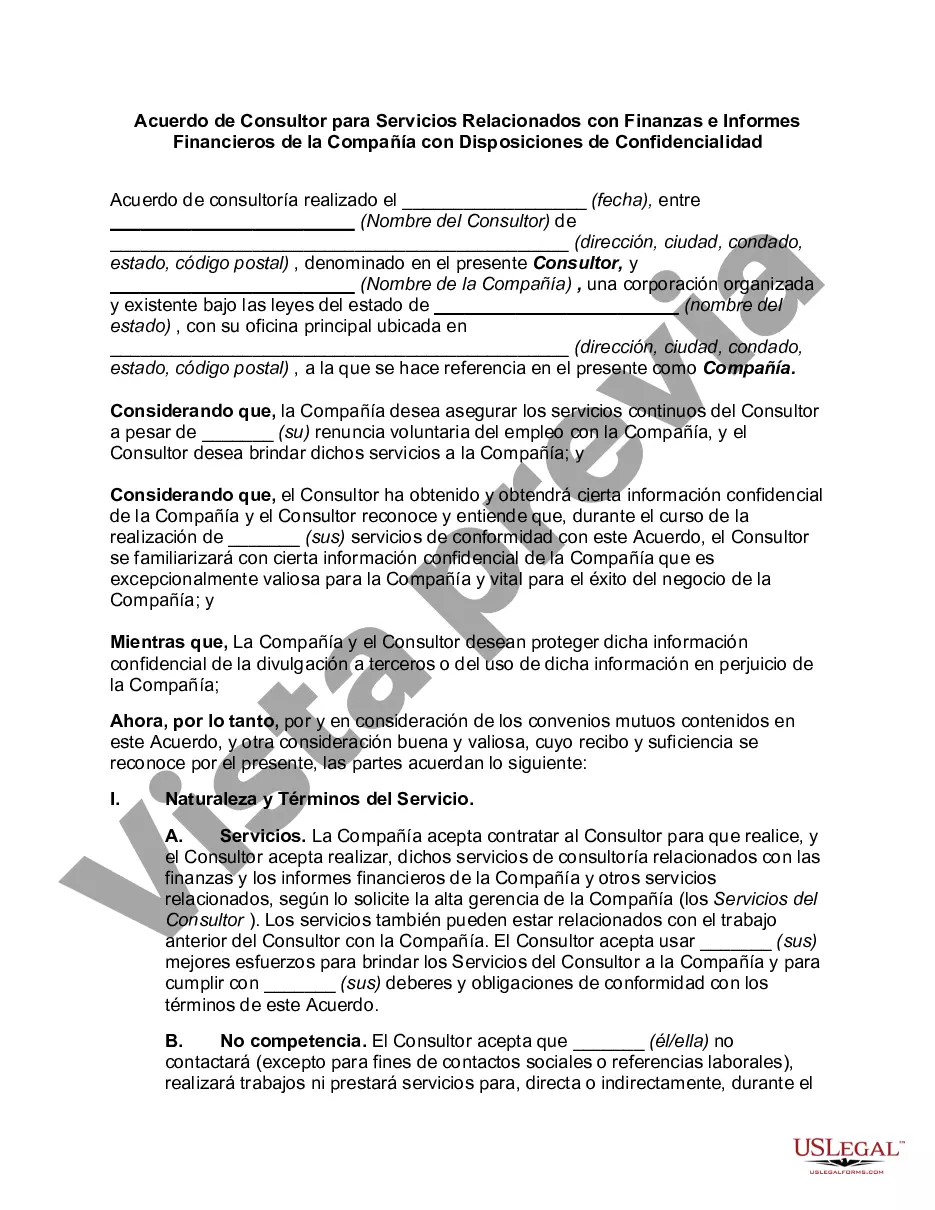

Allegheny Pennsylvania Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions The Allegheny Pennsylvania Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions is a legally binding agreement that outlines the terms and conditions between a consultant and a company operating in Allegheny, Pennsylvania. This agreement governs the services provided by the consultant pertaining to financial matters and reporting while imposing strict confidentiality provisions to safeguard sensitive company information. This comprehensive and detailed agreement addresses the specific needs and requirements of companies seeking services in Allegheny, Pennsylvania relating to finances and financial reporting. It ensures that the consultant understands the company's expectations and obligations involved in providing financial services while safeguarding the confidentiality of pertinent financial and business information. Some key provisions included in this agreement may cover: 1. Scope of Services: Clearly defining the scope and nature of financial services to be provided by the consultant, including areas such as financial analysis, budgeting, forecasting, tax planning, and financial statements' preparation. 2. Compensation and Payment Terms: Outlining the payment structure, rate, and method of compensation for the consultant's services rendered, including any additional expenses reimbursable by the company. 3. Duration and Termination: Establishing the duration of the agreement and specifying the conditions under which either party may terminate the agreement, ensuring fairness and protecting the rights of both parties. 4. Confidentiality: Imposing strict confidentiality provisions to protect sensitive financial data, trade secrets, intellectual property, and any proprietary information about the company that may come to the consultant's knowledge during their engagement. 5. Non-Disclosure and Non-Compete: Preventing the consultant from disclosing or using any confidential information obtained from the company for personal gain or for the benefit of competitors, both during and after the agreement's termination. 6. Independent Contractor Relationship: Clarifying that the consultant is an independent contractor and not an employee of the company, highlighting the absence of any employment benefits, taxes, or legal obligations associated with an employer-employee relationship. 7. Governing Law and Dispute Resolution: Specifying the jurisdiction of Allegheny, Pennsylvania as the applicable law governing the agreement, and defining the process for resolving any potential disputes or conflicts that may arise. Different types of Allegheny Pennsylvania Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions may include specific variations tailored to the unique needs of different sectors or industries within Allegheny, Pennsylvania. For example, there may be specialized agreements for financial consulting services in the healthcare, technology, or manufacturing sectors, each addressing industry-specific regulations and requirements. Overall, the Allegheny Pennsylvania Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions is a crucial legal instrument that ensures effective and secure financial consulting services while protecting the company's valuable information and interests within the jurisdiction of Allegheny, Pennsylvania.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Acuerdo de Consultor para Servicios Relacionados con Finanzas e Informes Financieros de la Compañía con Disposiciones de Confidencialidad - Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions

Description

How to fill out Allegheny Pennsylvania Acuerdo De Consultor Para Servicios Relacionados Con Finanzas E Informes Financieros De La Compañía Con Disposiciones De Confidencialidad?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Allegheny Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business occasions. All the documents can be used multiple times: once you obtain a sample, it remains available in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Allegheny Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Allegheny Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions:

- Analyze the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template once you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

¿Que criterios de seleccion se deben tomar en cuenta en una Consultoria? En una consultoria se deben tomar en cuenta los aspectos tecnicos sobre los que se evaluara la calidad y, los aspectos economicos, sobre los que se calificara el costo.

Son contratos de consultoria los que celebren las entidades estatales referidos a los estudios necesarios para la ejecucion de proyectos de inversion, estudios de diagnostico, prefactibilidad o factibilidad para programas o proyectos especificos, asi como a las asesorias tecnicas de coordinacion, control y supervision.

Siete Elementos Clave de un Acuerdo de Consultoria Efectivo Alcance de los Servicios. El proposito principal de cualquier acuerdo es facilitar lo que una parte hara por la otra.Obligaciones.Cuotas y Gastos.Periodo de Tiempo.Derechos de Propiedad y Confidencialidad.Garantia.Terminos Generales.

El proceso de consultoria es una actividad conjunta del consultor y del cliente destinada a resolver un problema concreto y a aplicar los cambios deseados en la organizacion del cliente. Este proceso tiene un comienzo (se establece la relacion y se inicia el trabajo) y un fin (la partida del consultor).

Son contratos de consultoria los que celebren las entidades estatales referidos a los estudios necesarios para la ejecucion de proyectos de inversion, estudios de diagnostico, prefactibilidad o factibilidad para programas o proyectos especificos, asi como a las asesorias tecnicas de coordinacion, control y supervision.

Proyecto de Consultoria y sus Etapas Clave Procesos de una consultoria.Detalle de la propuesta de consultoria para el proyecto.Aceptacion de la propuesta y formalizacion del acuerdo.Obligaciones del consultor del proyecto.Deberes o responsabilidades del cliente.Comunicacion fluida y Plan de reportes de Proyecto.

El proceso de consultoria es una actividad conjunta del consultor y del cliente destinada a resolver un problema concreto y a aplicar los cambios deseados en la organizacion del cliente. Este proceso tiene un comienzo (se establece la relacion y se inicia el trabajo) y un fin (la partida del consultor).

En resumen lo que se debe lograr esta etapa: Intercambio de expectativas de metas, roles y responsabilidades. Acuerdo sobre terminos, metodos y tecnicas a utilizar. Preparacion inicial de todos los implicados y en especial los equipos de consultores internos.

Seleccion de Consultores Individuales Procedimiento de seleccion para contratar servicios de consultoria diferentes a consultoria de obras, en los que no se necesita equipos de personal ni apoyo profesional adicional.