Cuyahoga Ohio Balance Sheet Deposits refer to the financial information contained in the balance sheet of financial institutions operating in Cuyahoga County, Ohio. The balance sheet is a crucial document that presents the financial position of a bank or credit union, showcasing its assets, liabilities, and shareholders' equity at a specific point in time. In Cuyahoga County, the balance sheet deposits comprise various types of deposits, including: 1. Demand Deposits: These are funds held in a checking account that can be withdrawn at any time without any notice or penalty. Demand deposits are typically used for everyday transactions and do not accrue interest. 2. Time Deposits: These are deposits that have a specific maturity date and earn interest. Time deposits require the depositor to leave the funds untouched for a predetermined period, which could range from a few months to several years. Early withdrawals may result in penalties. 3. Savings Deposits: Savings deposits are accounts that offer a higher interest rate than demand deposits but typically have limitations on the number of transactions per month. These accounts are geared towards individuals or businesses that want to earn interest while maintaining access to their funds. 4. Certificates of Deposit (CDs): CDs are time deposits with a fixed term, usually ranging from a few months to several years. They provide a higher interest rate than savings accounts, but withdrawals before maturity could lead to penalties. 5. Money Market Accounts (MMS): MMS are interest-bearing deposit accounts that usually require a higher minimum balance than regular savings accounts. These accounts often allow limited transactions per month and offer a competitive interest rate. 6. Brokered Deposits: Brokered deposits are funds acquired by banks or credit unions through third-party brokers. These deposits are obtained from various investors and can be advantageous for financial institutions looking to attract additional funds. 7. Non-Interest-Bearing Deposits: Non-interest-bearing deposits refer to demand deposits or other accounts that do not earn any interest. These deposit accounts are typically used by businesses or individuals for day-to-day transactional purposes. Cuyahoga Ohio Balance Sheet Deposits, including the types mentioned above, are vital indicators of a financial institution's liquidity, stability, and ability to meet customers' demands for cash withdrawals while also funding lending activities. Regular monitoring of these deposits aids in assessing the overall financial health and performance of the banking industry in Cuyahoga County, Ohio.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Balance Depósitos - Balance Sheet Deposits

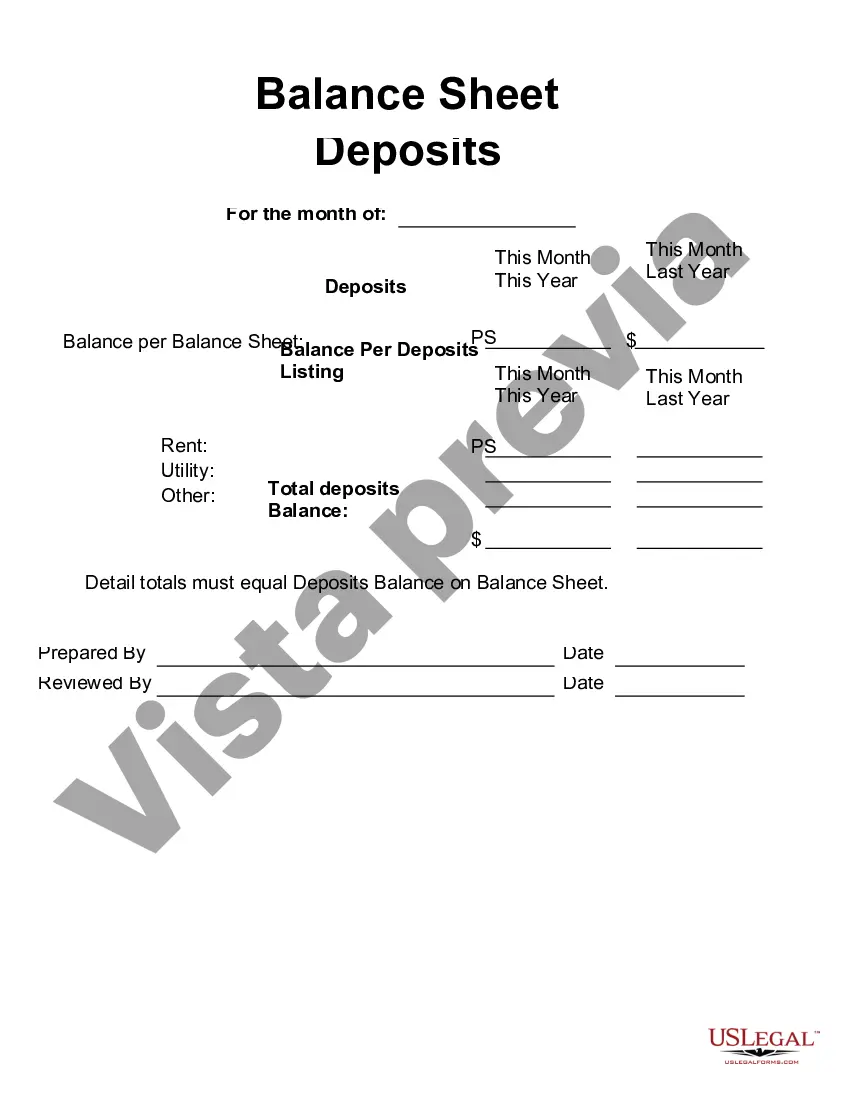

Description

How to fill out Cuyahoga Ohio Balance Depósitos?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare official paperwork that varies throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any personal or business objective utilized in your county, including the Cuyahoga Balance Sheet Deposits.

Locating samples on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Cuyahoga Balance Sheet Deposits will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to obtain the Cuyahoga Balance Sheet Deposits:

- Make sure you have opened the correct page with your regional form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form satisfies your needs.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Cuyahoga Balance Sheet Deposits on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!