Harris Texas Balance Sheet Deposits are a category of financial assets held by the Harris County government in Texas. These deposits represent funds that the county receives and holds in various financial institutions to meet its operational needs, such as funding public projects, paying salaries, or covering emergency expenses. The balance sheet deposits of Harris County are crucial for maintaining liquidity, ensuring financial stability, and providing the necessary cash flow for the county's day-to-day operations. These deposits can be classified into different types based on their characteristics and purpose. 1. General Deposits: These are the most common type of balance sheet deposits held by Harris County. General deposits include funds received from various sources, such as property taxes, sales taxes, fees, and fines. They serve as a pool of funds available for general operational expenses and resource allocation. 2. Special Deposits: This category includes funds held for specific purposes, such as grants, bonds, or special tax allocations. Special deposits are often restricted to be used only for the purpose they were initially allocated. For instance, grants received for community development projects would be deposited into a separate account to ensure they are used solely for their intended purpose. 3. Reserve Deposits: These deposits are set aside by Harris County as a precautionary measure to cover future obligations or emergencies. The funds held in reserve deposits act as a safety net in case of unforeseen circumstances, economic downturns, or financial crises. They provide a cushion to ensure the county can meet its financial obligations without disrupting its operations. 4. Escrow Deposits: Escrow deposits are funds deposited with a third party, typically a financial institution, to facilitate specific transactions or contractual agreements. For example, Harris County may deposit funds into an escrow account when purchasing land or entering into long-term contracts with vendors. Escrow deposits ensure that the county and the counterparty involved in the transaction have financial security until the terms of the agreement are fulfilled. It is important for Harris County to actively manage and supervise these balance sheet deposits to optimize their usage effectively. By closely monitoring the inflow and outflow of these deposits, the county can ensure proper cash management, mitigate financial risks, and maximize returns on its deposited funds. The county's balance sheet should accurately reflect the amounts held in each deposit category, providing transparency and accountability to its stakeholders. In conclusion, Harris Texas Balance Sheet Deposits encompass various types of funds held by Harris County government. These deposits play a vital role in maintaining financial stability, meeting obligations, and supporting the county's operations. By managing these deposits efficiently, Harris County can ensure a strong financial foundation, enabling it to serve its residents effectively and invest in the development of the community.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Balance Depósitos - Balance Sheet Deposits

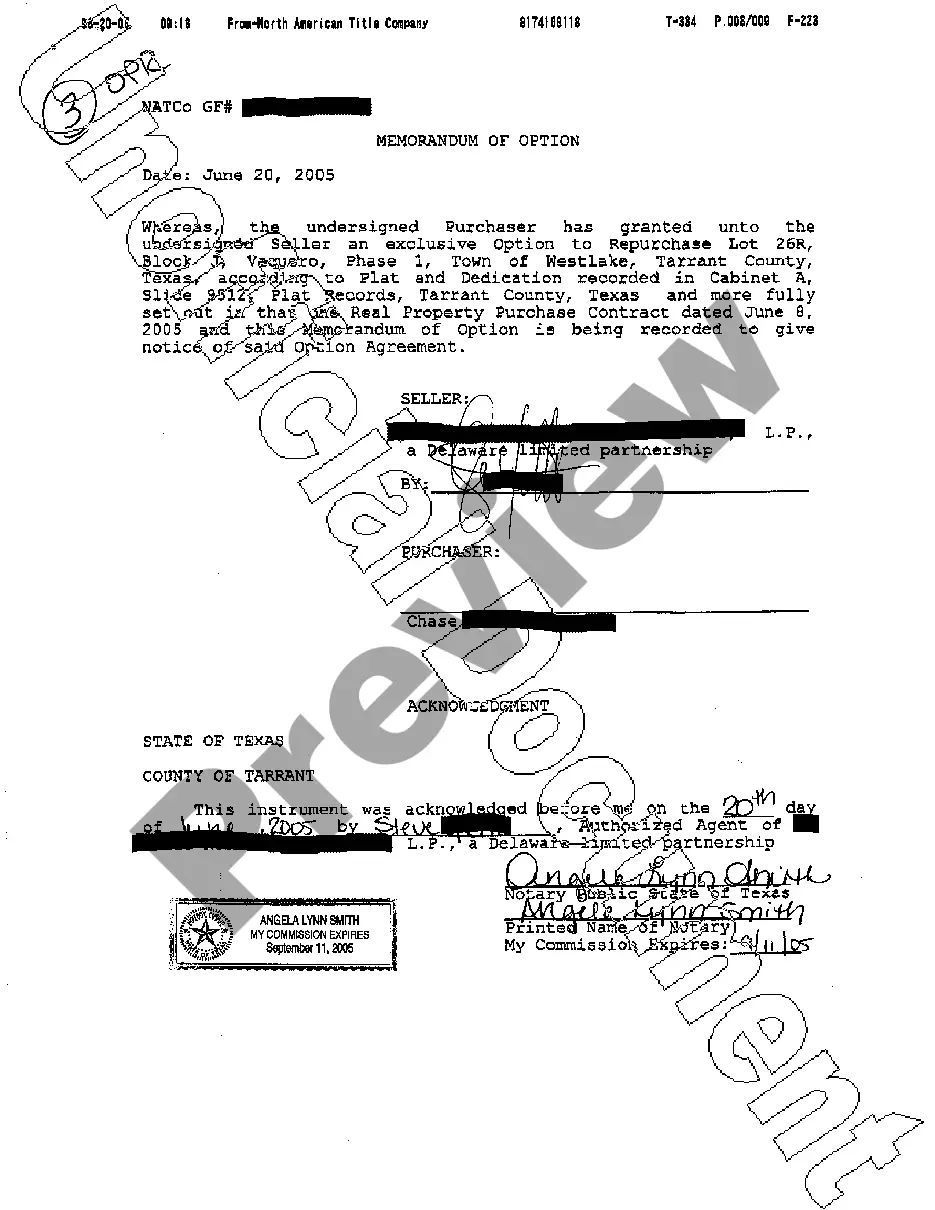

Description

How to fill out Harris Texas Balance Depósitos?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Harris Balance Sheet Deposits, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for various life and business occasions. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Harris Balance Sheet Deposits from the My Forms tab.

For new users, it's necessary to make some more steps to get the Harris Balance Sheet Deposits:

- Examine the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template once you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!