Hennepin Minnesota Balance Sheet Deposits Hennepin County, located in Minnesota, is a financial hub that offers various banking services, including deposit accounts. The Hennepin Minnesota Balance Sheet Deposits refer to the financial records that outline the amount of money deposited by customers in Hennepin County's banking institutions. These deposits play a crucial role in shaping the county's economic landscape and serving as a foundation for various financial activities. There are several types of deposits found on Hennepin Minnesota's balance sheet, each tailored to meet specific customer needs: 1. Checking Account Deposits: This type of deposit is used for daily transactions and provides customers immediate access to their funds. Checking accounts often offer features like check-writing privileges, debit cards, and online banking services, making them highly convenient for everyday use. 2. Savings Account Deposits: Savings accounts are intended for customers looking to accumulate funds over time while earning interest on their deposits. These accounts typically have restrictions on the number of monthly withdrawals, encouraging account holders to save for future goals such as emergencies, education, or major purchases. 3. Certificates of Deposit (CDs): CDs are fixed-term deposits where customers agree to keep their funds locked for a specified period, ranging from a few months to several years. This type of deposit usually offers higher interest rates compared to regular savings accounts, making it an attractive option for individuals seeking higher returns on their investment. 4. Money Market Account Deposits: Money market accounts (MMS) combine features of both savings and checking accounts. They offer higher interest rates than regular savings accounts while providing limited check-writing capabilities and higher minimum balance requirements. MMS are often favored by individuals who want the best of both worlds — higher returns and easy access to their funds. 5. Time Deposits: Time deposits, also known as term deposits, are similar to CDs, allowing customers to invest their funds for a fixed duration. These deposits generally offer slightly higher interest rates than regular savings accounts, but they provide a bit more flexibility, as the terms are typically shorter. The Hennepin Minnesota Balance Sheet Deposits serve as an essential indicator of the county's overall financial health. They assist banks and other financial institutions in lending activities, as they rely on the deposits to fund loans and investments. Furthermore, these deposits contribute to the stability of the local economy, as they demonstrate the confidence and trust individuals place in Hennepin County's financial institutions. In summary, Hennepin Minnesota Balance Sheet Deposits encompass a range of account types such as checking accounts, savings accounts, certificates of deposits (CDs), money market accounts (MMS), and time deposits. These deposits play a fundamental role in shaping both individual and county-wide financial landscapes, fostering economic growth and stability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Balance Depósitos - Balance Sheet Deposits

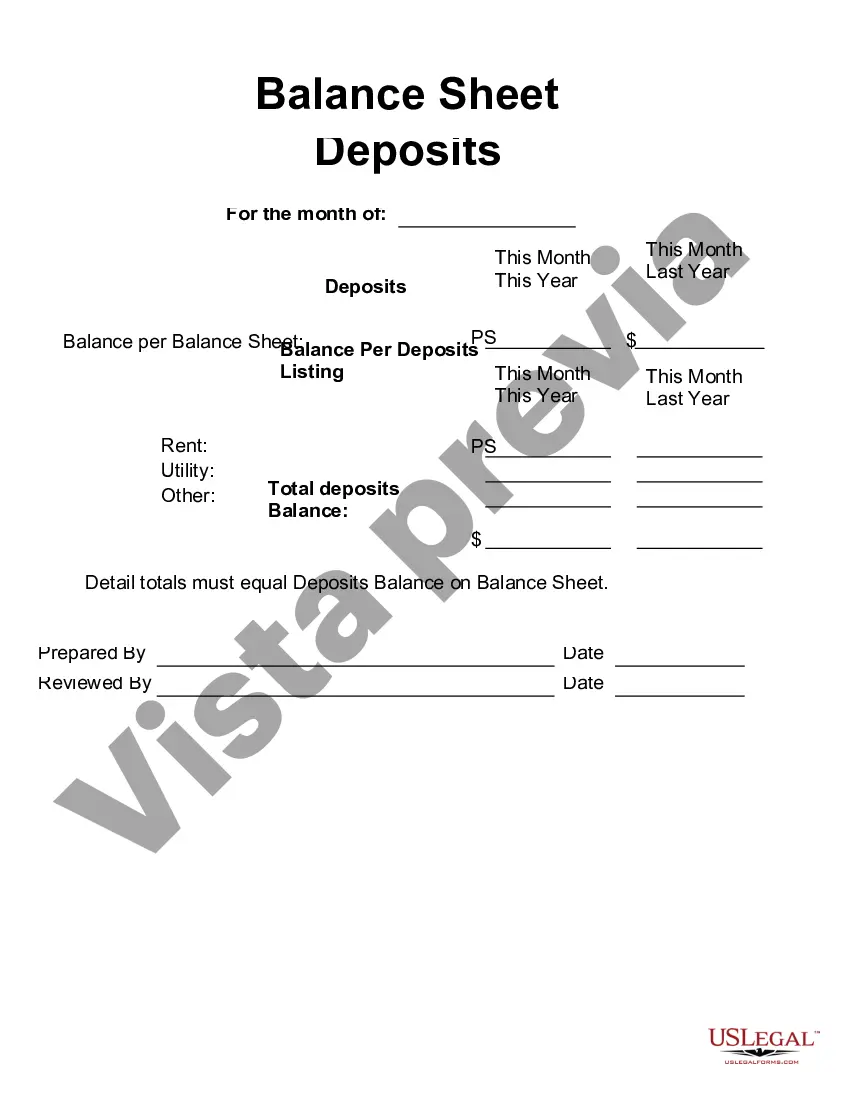

Description

How to fill out Hennepin Minnesota Balance Depósitos?

If you need to find a trustworthy legal form supplier to get the Hennepin Balance Sheet Deposits, consider US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can browse from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of learning resources, and dedicated support team make it simple to find and execute various papers.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply select to look for or browse Hennepin Balance Sheet Deposits, either by a keyword or by the state/county the document is created for. After locating required template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply find the Hennepin Balance Sheet Deposits template and check the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and click Buy now. Create an account and select a subscription option. The template will be immediately ready for download once the payment is completed. Now you can execute the form.

Handling your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes this experience less costly and more affordable. Set up your first company, arrange your advance care planning, draft a real estate agreement, or execute the Hennepin Balance Sheet Deposits - all from the comfort of your sofa.

Sign up for US Legal Forms now!