Cook Illinois Finance is a reputable company that offers a comprehensive range of financing solutions for equipment needs. One of their prominent offerings is the Cook Illinois Finance Lease of Equipment, which provides businesses with an opportunity to acquire necessary equipment without the burden of upfront costs. A Cook Illinois Finance Lease of Equipment is a financial arrangement in which Cook Illinois Finance purchases the equipment on behalf of the business and leases it to them for a predetermined period. This arrangement allows businesses to enjoy the benefits of equipment usage while minimizing the impact on their capital expenditure. There are different types of Cook Illinois Finance Lease of Equipment that cater to various business requirements. These types include: 1. Capital Lease: Under this type of lease, the business acquires the equipment on a long-term basis and bears the risk and rewards associated with ownership. The leased equipment is treated as an asset on the lessee's balance sheet, and the lessee also benefits from any potential tax advantages. 2. Operating Lease: In an operating lease, the business leases the equipment for a shorter period, typically resembling the useful life of the equipment. The lessor, Cook Illinois Finance, retains ownership of the equipment throughout the lease term. Operating leases are often used for equipment that rapidly advances or becomes obsolete. 3. Sale and Leaseback: This type of lease allows businesses to sell their existing equipment to Cook Illinois Finance and then lease it back. It frees up valuable capital tied up in owned equipment while still enabling continued usage. Cook Illinois Finance offers flexible terms and repayment options for their lease of equipment, tailored to meet the unique needs of businesses. With competitive interest rates and a straightforward application process, Cook Illinois Finance Lease of Equipment provides a viable solution for businesses seeking to acquire essential equipment without significant upfront costs. In summary, Cook Illinois Finance Lease of Equipment offers businesses the opportunity to access the necessary equipment required for their operations while preserving capital and reducing the financial strain of upfront purchases. With different types of leases available, businesses can choose the option that best suits their needs, whether it's for long-term ownership, short-term usage, or unlocking capital through sale and leaseback. Cook Illinois Finance's expertise in equipment financing ensures a seamless process and reliable support for businesses in their pursuit of growth and success.

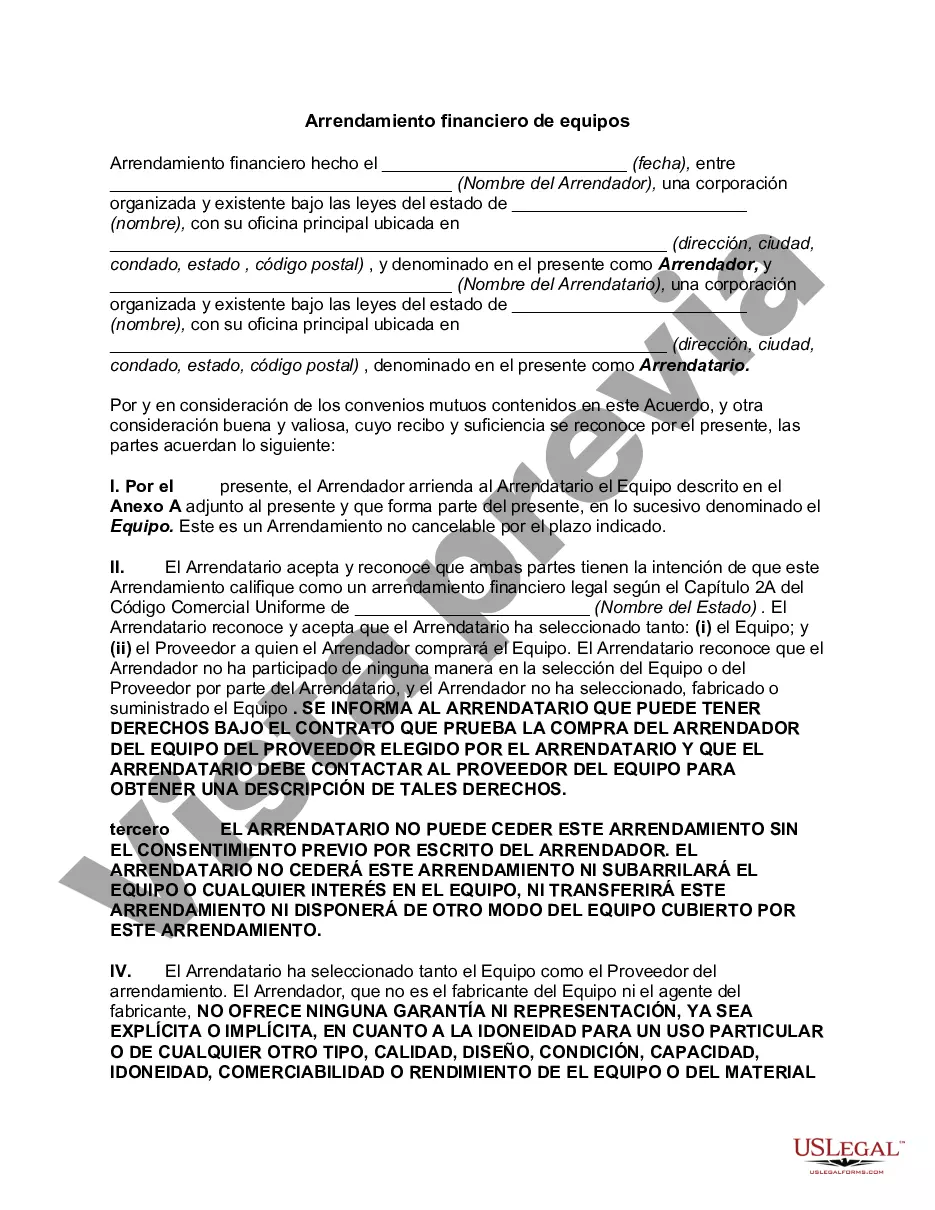

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Arrendamiento financiero de equipos - Finance Lease of Equipment

Description

How to fill out Cook Illinois Arrendamiento Financiero De Equipos?

How much time does it usually take you to draft a legal document? Since every state has its laws and regulations for every life scenario, finding a Cook Finance Lease of Equipment meeting all regional requirements can be tiring, and ordering it from a professional lawyer is often pricey. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, gathered by states and areas of use. In addition to the Cook Finance Lease of Equipment, here you can get any specific document to run your business or personal deeds, complying with your county requirements. Professionals check all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can get the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Cook Finance Lease of Equipment:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Cook Finance Lease of Equipment.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!