Fulton Georgia Balance Sheet Notes Payable refers to a section in the financial statements of Fulton, Georgia, which provides information about the amount of debt obligations the city has incurred that are payable to external parties. This section is an essential component of the balance sheet, as it supports the city's financial transparency and accountability. Notes payable on Fulton Georgia's balance sheet represent the city's short-term or long-term debts due to be repaid in the future. These debts are typically incurred by the city to fund various projects, infrastructure development, or to meet ongoing operational needs. Fulton Georgia may have different types of notes payable listed in their balance sheet, including: 1. General Obligation Bonds: These are debt instruments issued by Fulton Georgia to finance major capital projects or initiatives benefiting the entire community. General obligation bonds are generally backed by the city's full faith, credit, and taxing power. 2. Revenue Bonds: Fulton Georgia may also issue revenue bonds to finance specific infrastructure projects, such as water treatment facilities or transportation systems. Revenue bonds are secured by the revenues generated from the project they fund, rather than by the city's general taxing power. 3. Short-term Promissory Notes: These are short-term borrowings typically used by Fulton Georgia to meet immediate cash flow needs. Promissory notes generally have a maturity period of less than a year and are repaid from the city's available cash or by issuing long-term bonds if necessary. 4. Loans and Lines of Credit: Fulton Georgia may avail itself of loans or establish lines of credit with various financial institutions or governmental bodies. These credit facilities enable the city to borrow funds on an as-needed basis to support ongoing operations or finance specific projects. 5. Special Assessment District Bonds: In some cases, Fulton Georgia may create special assessment districts to finance public improvements, such as street repairs or lighting projects. The costs associated with these improvements are levied on the properties within the district, and the city issues bonds secured by these assessments. It is important to note that the specific types of notes payable on Fulton Georgia's balance sheet may vary depending on the city's financial strategies, infrastructure needs, and projects undertaken. These notes payable are disclosed in the balance sheet notes section to provide greater transparency and insight into the city's financial health, obligations, and repayment schedules.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Balance Notas por Pagar - Balance Sheet Notes Payable

Description

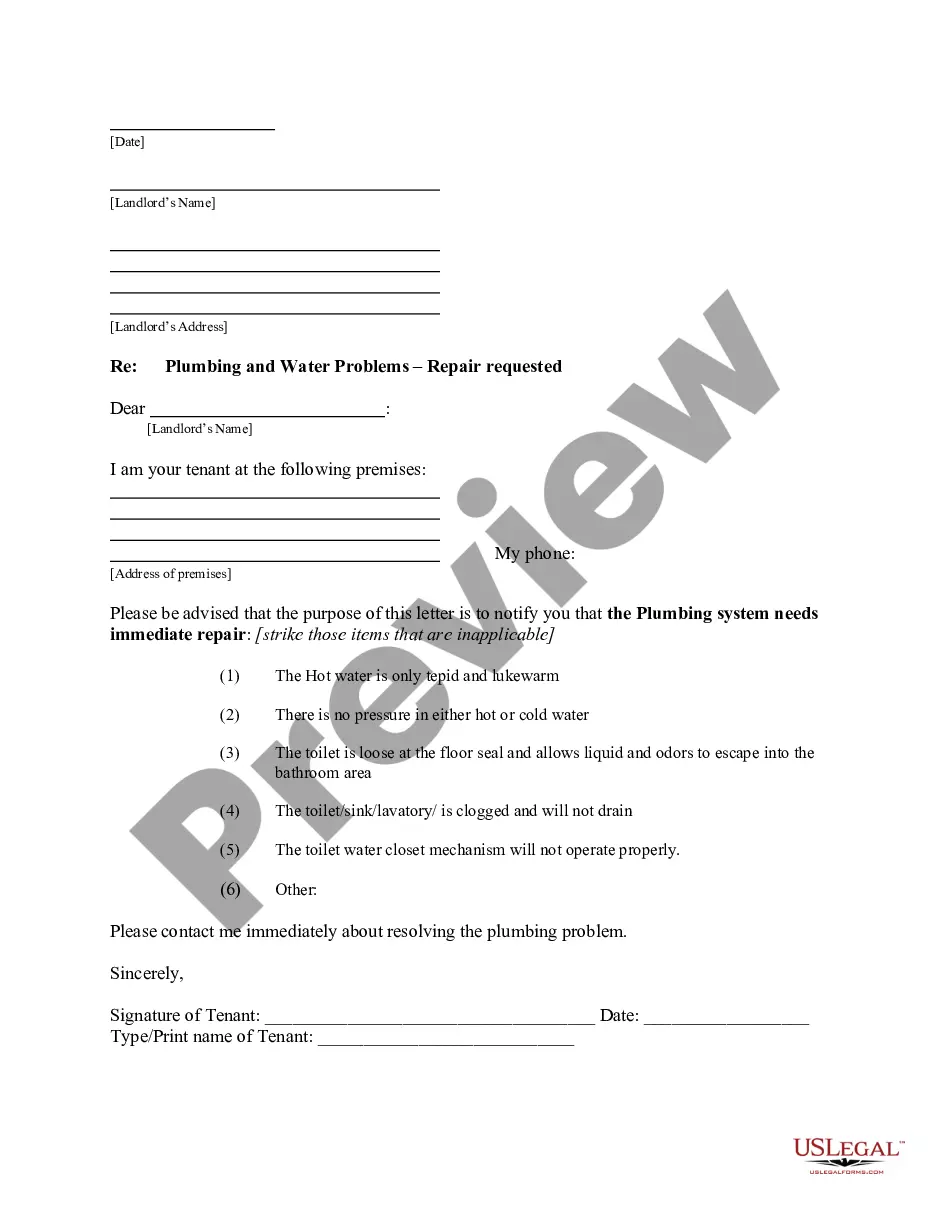

How to fill out Fulton Georgia Balance Notas Por Pagar?

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Fulton Balance Sheet Notes Payable, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for further use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Fulton Balance Sheet Notes Payable from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Fulton Balance Sheet Notes Payable:

- Take a look at the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the document when you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Las formulas de la ecuacion contable del balance general son: Activo = Pasivo + Capital. Pasivo = Activo - Capital. Capital = Activo Pasivo.

Recomendaciones para redactar las notas a los estados financieros No incluir copias textuales de las normas.Revelar las politicas contables que impliquen una eleccion.Mencionar las politicas contables disenadas para transacciones particulares.No incorporar politicas contables no utilizadas en el periodo actual.

¿Como elaborar un balance personal? 1 Detallar los activos. Prepara un listado con todos tus activos: los bienes que te pertenecen junto a su valor.2 Detallar los pasivos.3 Calcular el patrimonio.4 Elaborar el balance personal.5 Analizar el balance personal.6 Comparar balances personales.7 Tomar decisiones.

El balance inicial es aquel balance que se hace al momento de iniciar una empresa o un negocio, en el cual se registran los activos, pasivos y patrimonio con que se constituye y se inician operaciones. El balance general al inicio de operaciones. Ejemplo de balance inicial.

¿Como hacer un balance general paso a paso? Compila y registra los activos corrientes.Compila y registra los activos fijos.Registra los otros activos.Suma los tres tipos de activos.Registra los pasivos corrientes.Registra los pasivos fijos.Registra los otros pasivos.Suma los tres tipos de pasivos.

Esto implica que el documento se va a dividir en cuatro partes: Suma del total de los activos. Suma del total de los pasivos. Calculo del total del patrimonio. Suma del total del pasivo mas el total del patrimonio. El resultado obtenido deberia ser igual a la suma del total de los activos.

¿Como hacer un balance general paso a paso? Compila y registra los activos corrientes.Compila y registra los activos fijos.Registra los otros activos.Suma los tres tipos de activos.Registra los pasivos corrientes.Registra los pasivos fijos.Registra los otros pasivos.Suma los tres tipos de pasivos.

El balance general es una herramienta muy importante que nos ofrece informacion basica de la empresa en un solo vistazo. Por ejemplo cuanto efectivo tiene la empresa, la cantidad de deuda contraida o los bienes que dispone. Al disponer de tan amplia informacion es de vital importancia mantenerla en orden.

La estructura de un Balance General suele ser la misma en todas las empresas y se compone por tres elementos: Activos, Pasivos y Patrimonio neto o Capital.

¿Como se realizan los Balances? Registrar los activos circulantes. Identificar y registrar los activos fijos. Sumar el total de los activos. Contabilizar los pasos circulantes. Registrar todos los pasivos fijos. Realizar la suma total de los pasivos. Ingresar los montos en la cuenta de capital y obtener la suma total.