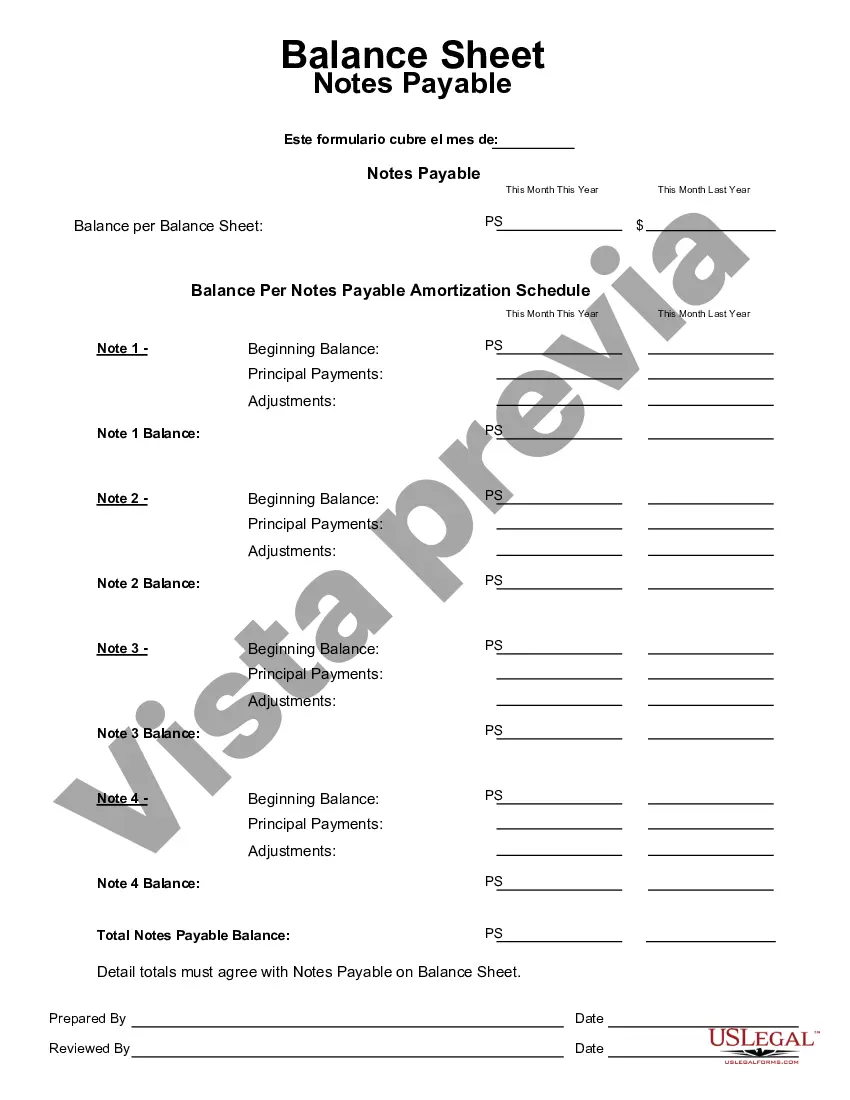

Wayne, Michigan — Balance Sheet Notes Payable: Understanding the Different Types In the realm of accounting, Wayne, Michigan's balance sheet notes payable refers to a significant element that plays a vital role in determining a company's financial health and obligations. Notes payable on a balance sheet represent the debts a company owes to external creditors. These creditors could be banks, financial institutions, or other entities that have lent money to the company. 1. Long-Term Notes Payable: Long-term notes payable are obligations that extend beyond one year or the operating cycle of the business, whichever is longer. Companies often obtain long-term loans for major investments or capital-intensive projects. These loans typically have lower interest rates due to their extended repayment periods. 2. Short-Term Notes Payable: Short-term notes payable, on the other hand, represent debts that are due within one year or the operating cycle. These could include bank loans, lines of credit, or any other liabilities requiring prompt payment. Businesses often utilize short-term loans to manage their working capital needs or to finance day-to-day operations. 3. Term Loans: Term loans are a common type of balance sheet notes payable in Wayne, Michigan, where the borrower receives a lump sum amount and agrees to repay it over a fixed duration. These loans usually carry predetermined interest rates and require regular installment payments, typically monthly or quarterly. 4. Mortgage Loans: Mortgage loans pertain specifically to real estate transactions. They are widely used by companies in Wayne, Michigan, to finance the purchase or construction of properties such as office buildings, manufacturing facilities, or warehouses. Mortgage loans provide the lender with collateral in the form of the property itself, reducing the risk associated with the loan. 5. Revolving Lines of Credit: Revolving lines of credit offer businesses the flexibility to borrow funds as needed up to a predetermined credit limit. Unlike traditional loans, businesses can repay and redraw funds multiple times within the agreed timeframe. Companies in Wayne, Michigan, often use revolving lines of credit to manage seasonal fluctuations, meet short-term obligations, or seize unforeseen investment opportunities. 6. Lease Obligations: While not primarily categorized as balance sheet notes payable, lease obligations can have a significant impact on a company's financial position. These obligations arise from long-term equipment or property leases. Depending on the terms of the lease, they might be classified as either operating leases or finance leases, affecting how they are reported on the balance sheet. Understanding the various types of balance sheet notes payable assists businesses and investors in evaluating a company's debt structure, financial stability, and ability to meet its obligations. Wayne, Michigan, being home to diverse industries, witnesses the utilization of these different note payable instruments, each designed to cater to specific financial requirements. Note: The content above uses relevant keywords such as "Wayne, Michigan," "balance sheet notes payable," "long-term notes payable," "short-term notes payable," "term loans," "mortgage loans," "revolving lines of credit," and "lease obligations."

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Balance Notas por Pagar - Balance Sheet Notes Payable

Description

How to fill out Wayne Michigan Balance Notas Por Pagar?

If you need to find a trustworthy legal form provider to get the Wayne Balance Sheet Notes Payable, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate template.

- You can search from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, number of supporting materials, and dedicated support team make it simple to get and execute various paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply type to search or browse Wayne Balance Sheet Notes Payable, either by a keyword or by the state/county the document is created for. After finding the necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Wayne Balance Sheet Notes Payable template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Create an account and select a subscription option. The template will be immediately ready for download as soon as the payment is completed. Now you can execute the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes these tasks less expensive and more reasonably priced. Set up your first company, arrange your advance care planning, draft a real estate agreement, or complete the Wayne Balance Sheet Notes Payable - all from the convenience of your home.

Sign up for US Legal Forms now!