Cuyahoga Ohio Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance is a contractual arrangement between employers and employees in Cuyahoga County, Ohio, that offers a nonqualified retirement plan funded by life insurance policies. This type of agreement provides employees with an additional retirement savings option beyond traditional retirement plans like 401(k)s and pensions. The plan is funded through the purchase of life insurance policies on key employees' lives. The employer pays the premiums, which are not tax-deductible, and the policy's cash value grows over time, creating a source of investment and income for retirement. Upon the employee's retirement or death, the plan pays out a death benefit or retirement income, providing financial security for the employee or their beneficiaries. It's important to note that there might be variations in Cuyahoga Ohio Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance, including: 1. Defined Contribution Nonqualified Retirement Plan: Under this type of agreement, the employer contributes a specified amount or percentage of the employee's annual salary towards the nonqualified retirement plan. The ultimate retirement benefit depends on the performance of the life insurance policy and the contributions made. 2. Deferred Compensation Arrangement: In this variation, the employer defers a portion of the employee's current compensation to be paid out as retirement income in the future. The deferred amount is invested through life insurance policies, allowing it to grow tax-deferred until distribution. 3. Executive Bonus Plans: These plans involve the employer providing an additional bonus to key employees, which they can use to purchase life insurance policies. The bonus is typically taxable to the employee, but the life insurance policy's cash value grows tax-deferred, creating a potential source of retirement income. Cuyahoga Ohio Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance offers several benefits for both the employer and the employee. From the employer's perspective, it allows for attracting and retaining top talent, providing a competitive benefit package, and potentially offering tax advantages. For employees, it offers an additional retirement savings opportunity with potential tax efficiencies, flexibility, and asset protection. Overall, a Cuyahoga Ohio Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance serves as a valuable tool to help employees secure their financial future while offering employers a means to incentivize and reward their workforce.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Contrato de Trabajo con Plan de Retiro No Cualificado Financiado con Seguro de Vida - Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance

Description

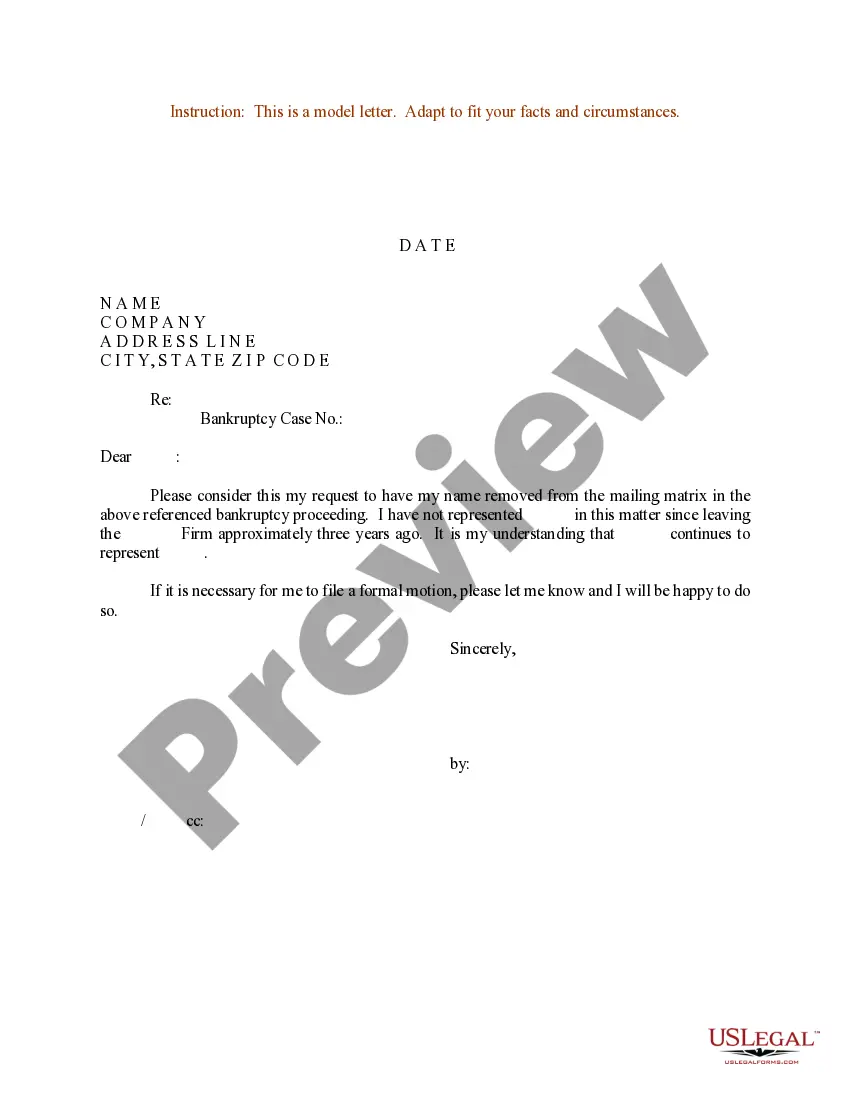

How to fill out Cuyahoga Ohio Contrato De Trabajo Con Plan De Retiro No Cualificado Financiado Con Seguro De Vida?

How much time does it usually take you to draw up a legal document? Because every state has its laws and regulations for every life situation, locating a Cuyahoga Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance suiting all local requirements can be tiring, and ordering it from a professional lawyer is often costly. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, collected by states and areas of use. In addition to the Cuyahoga Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance, here you can get any specific form to run your business or personal affairs, complying with your county requirements. Professionals verify all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can get the file in your profile at any time later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you get your Cuyahoga Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Cuyahoga Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!