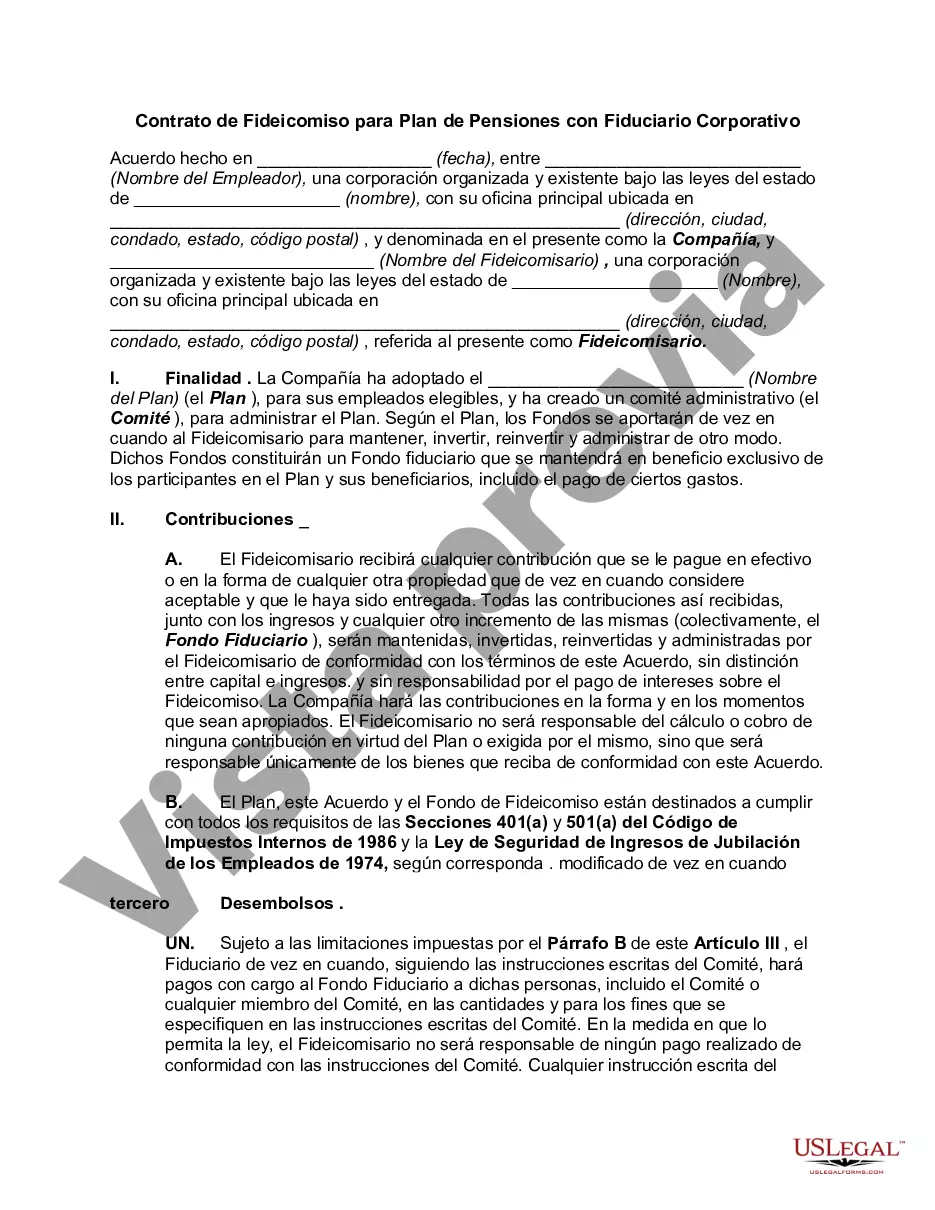

A San Jose California Trust Agreement for Pension Plan with Corporate Trustee is a legally binding document that outlines the terms and conditions for managing a pension plan in San Jose, California. It is established to ensure the safekeeping and effective management of the pension funds, aiming to provide financial security to employees upon retirement. The Trust Agreement serves as a written contract between the plan sponsor, typically an employer, and the corporate trustee responsible for overseeing the pension plan. The corporate trustee is an independent entity, often a financial institution, appointed to act on behalf of the plan participants and beneficiaries. The agreement covers numerous aspects related to the pension plan, including investment management, contribution schedules, benefit distribution rules, fiduciary responsibilities, and dispute resolution procedures. It outlines the roles and responsibilities of both the plan sponsor and the corporate trustee, ensuring compliance with state and federal laws, such as the Employee Retirement Income Security Act (ERICA). There could be different types of San Jose California Trust Agreements for Pension Plans with Corporate Trustees, depending on the specific needs and goals of the employer and the participants. Some possible types include: 1. Defined Benefit Trust Agreement: This type of trust agreement is designed for pension plans that guarantee a fixed retirement benefit based on factors such as salary, years of service, and age. It outlines the terms of benefit calculation, funding requirements, and investment strategies to ensure sufficient assets are available to meet the promised benefits. 2. Defined Contribution Trust Agreement: Unlike defined benefit plans, defined contribution plans specify the amount contributed to the plan by the employer and/or the employee. The trust agreement for this type of pension plan determines the investment options available to participants and includes provisions for managing the individual accounts, such as asset allocation and withdrawal rules. 3. Cash Balance Trust Agreement: Cash balance plans combine elements of defined benefit and defined contribution plans. The trust agreement outlines the methodology for determining contribution credits and the calculation of benefits, which are based on a hypothetical account balance that grows with contributions and interest credits. 4. Taft-Hartley Trust Agreement: This type of trust agreement is specifically designed for multi-employer pension plans in industries like construction, transportation, or entertainment. It establishes the governance structure and decision-making processes in collective bargaining agreements, allowing multiple employers to participate in the pension plan for the benefit of their unionized workers. In conclusion, a San Jose California Trust Agreement for Pension Plan with Corporate Trustee is a comprehensive legal document that defines the terms and obligations for managing a pension plan in San Jose, California. The agreement can vary in its specifics, taking into account the type of plan, such as defined benefit, defined contribution, cash balance, or Taft-Hartley plans, to suit the unique needs of the plan sponsor and participants.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Contrato de Fideicomiso para Plan de Pensiones con Fiduciario Corporativo - Trust Agreement for Pension Plan with Corporate Trustee

Description

How to fill out San Jose California Contrato De Fideicomiso Para Plan De Pensiones Con Fiduciario Corporativo?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and many other life scenarios require you prepare formal paperwork that varies throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any personal or business purpose utilized in your county, including the San Jose Trust Agreement for Pension Plan with Corporate Trustee.

Locating samples on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the San Jose Trust Agreement for Pension Plan with Corporate Trustee will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to get the San Jose Trust Agreement for Pension Plan with Corporate Trustee:

- Make sure you have opened the right page with your regional form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the suitable subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the San Jose Trust Agreement for Pension Plan with Corporate Trustee on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!