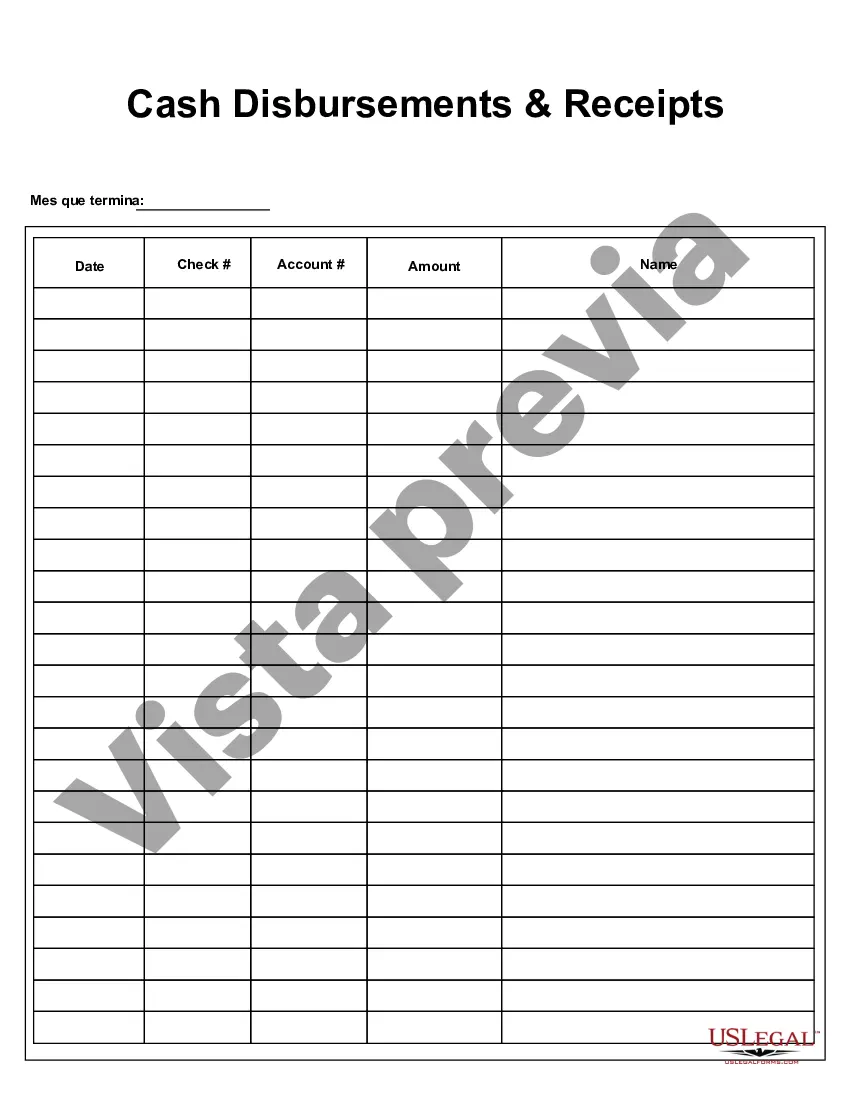

Allegheny Pennsylvania Cash Disbursements and Receipts play a crucial role in the financial transactions and management of funds for Allegheny County, located in Pennsylvania, United States. Cash disbursements refer to the payments made by the county for various expenses incurred, whereas cash receipts signify the inflow of funds received by the county from different sources. The Allegheny Pennsylvania Cash Disbursements involve multiple categories, such as payroll disbursements, vendor payments, contractual obligations, utilities and maintenance disbursements, capital outlay disbursements, and debt service payments. Payroll disbursements pertain to the payment of salaries, wages, and benefits to the county's employees. Vendor payments encompass payments made to suppliers, contractors, and service providers for goods delivered or services rendered. Contractual obligations represent payments made under the terms of contracts, agreements, or leases entered into by Allegheny County. This includes lease rental payments for county-owned properties or equipment, professional services availed, and various contractual commitments fulfilled. Utilities and maintenance disbursements cover expenses related to utilities such as water, electricity, gas, and maintenance services for county facilities, infrastructure, and equipment. Capital outlay disbursements refer to the expenditures made for the acquisition or improvement of long-term assets, including land, buildings, machinery, and equipment. Such investments aim to enhance the county's infrastructure, expand public services, or upgrade existing facilities. Debt service payments involve the repayment of principal and interest on loans or bonds issued by Allegheny County to finance various projects or initiatives. On the other hand, Allegheny Pennsylvania Cash Receipts include revenues collected by the county through diverse sources. This encompasses tax collections, fees, fines, grants, intergovernmental revenue, investment income, and other miscellaneous receipts. Tax collections comprise property tax, sales tax, income tax, and other local taxes levied within the county. Fee revenues incorporate charges for county services, licenses, permits, and registrations. Fines refer to penalties imposed on individuals or businesses for violations or non-compliance with county regulations or laws. Grants represent funds received from federal, state, or private sources to support specific programs, initiatives, or projects. Intergovernmental revenue refers to funds transferred from other government entities or agencies to Allegheny County for shared programs, mandates, or collaborations. Investment income represents the returns earned on the county's investments, including interest, dividends, or capital gains. Lastly, miscellaneous receipts include revenues from various sources that do not fall under the aforementioned categories, such as donations, asset sales, reimbursements, or insurance settlements. In summary, Allegheny Pennsylvania Cash Disbursements and Receipts encompass a wide range of financial transactions undertaken by Allegheny County. Understanding and effectively managing these disbursements and receipts are crucial for maintaining the county's financial stability, providing essential public services, and ensuring proper utilization of taxpayer funds.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Desembolsos y recibos de efectivo - Cash Disbursements and Receipts

Description

How to fill out Allegheny Pennsylvania Desembolsos Y Recibos De Efectivo?

If you need to find a trustworthy legal form supplier to find the Allegheny Cash Disbursements and Receipts, consider US Legal Forms. No matter if you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed template.

- You can search from over 85,000 forms arranged by state/county and case.

- The intuitive interface, number of learning resources, and dedicated support team make it simple to locate and execute different papers.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

Simply type to look for or browse Allegheny Cash Disbursements and Receipts, either by a keyword or by the state/county the form is created for. After locating needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Allegheny Cash Disbursements and Receipts template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Create an account and choose a subscription plan. The template will be immediately available for download as soon as the payment is processed. Now you can execute the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes these tasks less costly and more affordable. Set up your first company, organize your advance care planning, draft a real estate agreement, or execute the Allegheny Cash Disbursements and Receipts - all from the comfort of your sofa.

Join US Legal Forms now!