Dallas Texas Cash Disbursements and Receipts refer to the financial transactions involving the outflow and inflow of cash within the city of Dallas, Texas. These transactions play a crucial role in various organizations, businesses, and governmental entities operating in Dallas, as they record and manage the movement of cash for various purposes. Cash disbursements involve the payment of money by an entity, organization, or individual in Dallas, Texas. This may include the payment of salaries, wages, bills, invoices, purchases, taxes, loans, and other expenses. Cash disbursements require careful monitoring and control to ensure accurate and efficient record-keeping and prevent any potential financial mismanagement. On the other hand, cash receipts pertain to the money received by an organization, business, or individual in Dallas, Texas. This can include revenues from sales, rentals, investments, grants, donations, fees, and other sources. Recording cash receipts accurately is essential for maintaining financial transparency, analyzing revenue performance, and ensuring the alignment of cash flow with business objectives. In Dallas, the city government practices cash disbursements and receipts for managing its budget, expenditures, and revenues efficiently. Similarly, businesses, ranging from small enterprises to large corporations, also engage in cash disbursements and receipts to maintain financial stability and growth. Nonprofit organizations in Dallas also heavily rely on managing their cash disbursements and receipts to effectively pursue their missions and serve the community. Several types of Dallas Texas Cash Disbursements can be categorized based on their purpose or nature. These may include payroll disbursements, operational expenses disbursements, procurement disbursements, taxation disbursements, loan disbursements, and utility bill disbursements. Each type has its unique characteristics and requires appropriate documentation and authorization based on established protocols and regulations. Likewise, various types of Dallas Texas Cash Receipts can be distinguished depending on their origin or category. Common types include sales receipts, rental receipts, service fee receipts, investment receipts, charitable donation receipts, government grant receipts, and loan receipts. Accurate collection and documentation of cash receipts enable organizations to measure their financial performance, allocate resources effectively, and ensure compliance with relevant tax regulations and reporting requirements. Overall, Dallas Texas Cash Disbursements and Receipts are integral components of financial management and accountability for both public and private entities. Maintaining accurate records, adopting appropriate controls, and adhering to legal and regulatory frameworks ensure transparency and facilitate efficient cash flow management in Dallas, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Desembolsos y recibos de efectivo - Cash Disbursements and Receipts

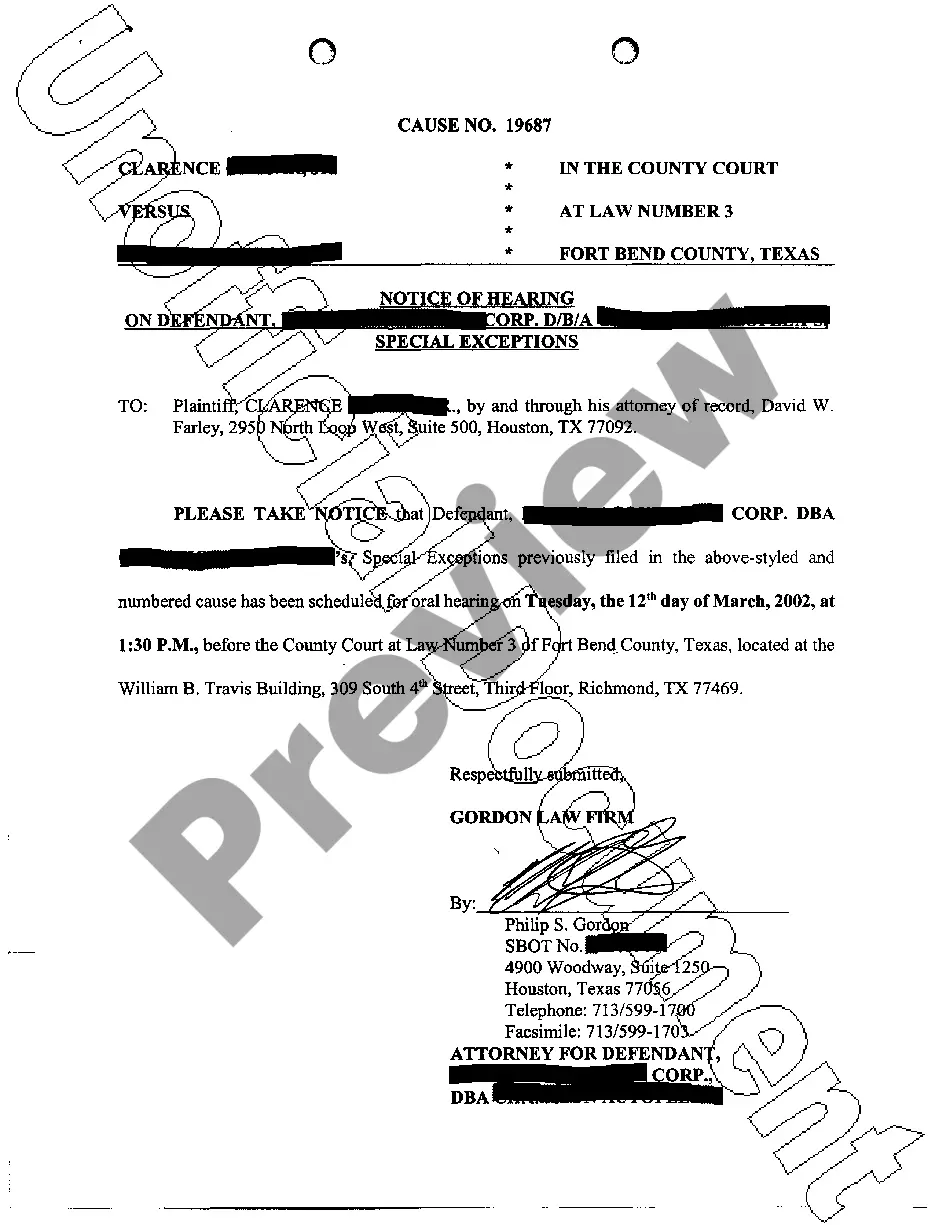

Description

How to fill out Dallas Texas Desembolsos Y Recibos De Efectivo?

How much time does it usually take you to draft a legal document? Given that every state has its laws and regulations for every life sphere, locating a Dallas Cash Disbursements and Receipts meeting all local requirements can be exhausting, and ordering it from a professional attorney is often costly. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, gathered by states and areas of use. Aside from the Dallas Cash Disbursements and Receipts, here you can get any specific form to run your business or personal deeds, complying with your regional requirements. Experts check all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can retain the file in your profile anytime later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Dallas Cash Disbursements and Receipts:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Dallas Cash Disbursements and Receipts.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!