Queens, New York Cash Disbursements and Receipts: A Comprehensive Overview In Queens, New York, cash disbursements and receipts play a vital role in keeping the financial transactions of various entities, including businesses, government agencies, and individuals, in check. By understanding the nuances and importance of cash disbursements and receipts, individuals and organizations ensure transparency, accountability, and financial stability. Cash Disbursements: Cash disbursements refer to the outflow of funds or the payment of money from an entity or individual. It encompasses various activities such as bill payments, procurement of goods and services, employee salaries, vendor payments, taxes, and more. Companies in Queens, New York, rely on efficient cash disbursement processes to maintain smooth operations and manage their financial obligations effectively. 1. Types of Cash Disbursements: a. Accounts Payable: This involves the regular payments made by businesses to their suppliers, vendors, or service providers in exchange for goods received or services rendered. b. Payroll: Cash disbursements related to employee salaries, wages, commissions, bonuses, and benefits. Companies in Queens, New York, must ensure accurate and timely payroll disbursements to maintain a motivated workforce. c. Taxes: Cash outflows in the form of tax payments, including income tax, sales tax, property tax, and payroll taxes, ensuring compliance with local, state, and federal tax regulations. d. Operating Expenses: Regular cash disbursements include rent, utilities, insurance premiums, maintenance, marketing expenditures, and other costs incurred to sustain day-to-day business operations. e. Loan Repayments: Cash disbursements made to repay borrowed funds, including principal and interest payments, to financial institutions or lenders. f. Other Disbursements: Miscellaneous cash outflows, such as charitable donations, legal fees, professional services payments, travel expenses, and more. Cash Receipts: Cash receipts, on the other hand, represent the inflow of funds into an entity or individual's financial account. Receipts can originate from various sources, including sales revenue, loan proceeds, investments, grants, receivables, and more. Proper management of cash receipts ensures accurate financial reporting, liquidity management, and effective financial planning in Queens, New York. 1. Types of Cash Receipts: a. Sales Revenue: Primary cash receipts for businesses, generated from the sale of products, services, or goods to customers or clients. This includes both cash and credit card payments. b. Accounts Receivable: Cash inflows from outstanding invoices or credit sales previously extended to customers or clients, collected within the specified payment period. c. Loans and Investments: Cash receipts resulting from loans acquired or investments made by an entity, including interest income, dividends, or capital gains. d. Grants and Donations: Cash inflows received as grants from government agencies, nonprofit organizations, or philanthropic individuals to support specific projects or initiatives. e. Rental Income: Cash receipts from leasing or renting out properties, equipment, or assets. f. Other Receipts: Miscellaneous cash inflows, such as refunds, rebates, insurance claims, and any other unexpected gains. Managing Cash Disbursements and Receipts in Queens, New York: Efficiently managing cash disbursements and receipts is crucial for any individual or organization in Queens, New York, to maintain financial stability and make informed decisions. Utilizing accounting software, establishing robust internal controls, reconciling bank statements regularly, and employing professional financial services can significantly aid in streamlining these processes. Adhering to financial regulations and maintaining accurate records are imperative to avoid non-compliance penalties and ensure the long-term financial health of entities in Queens, New York.

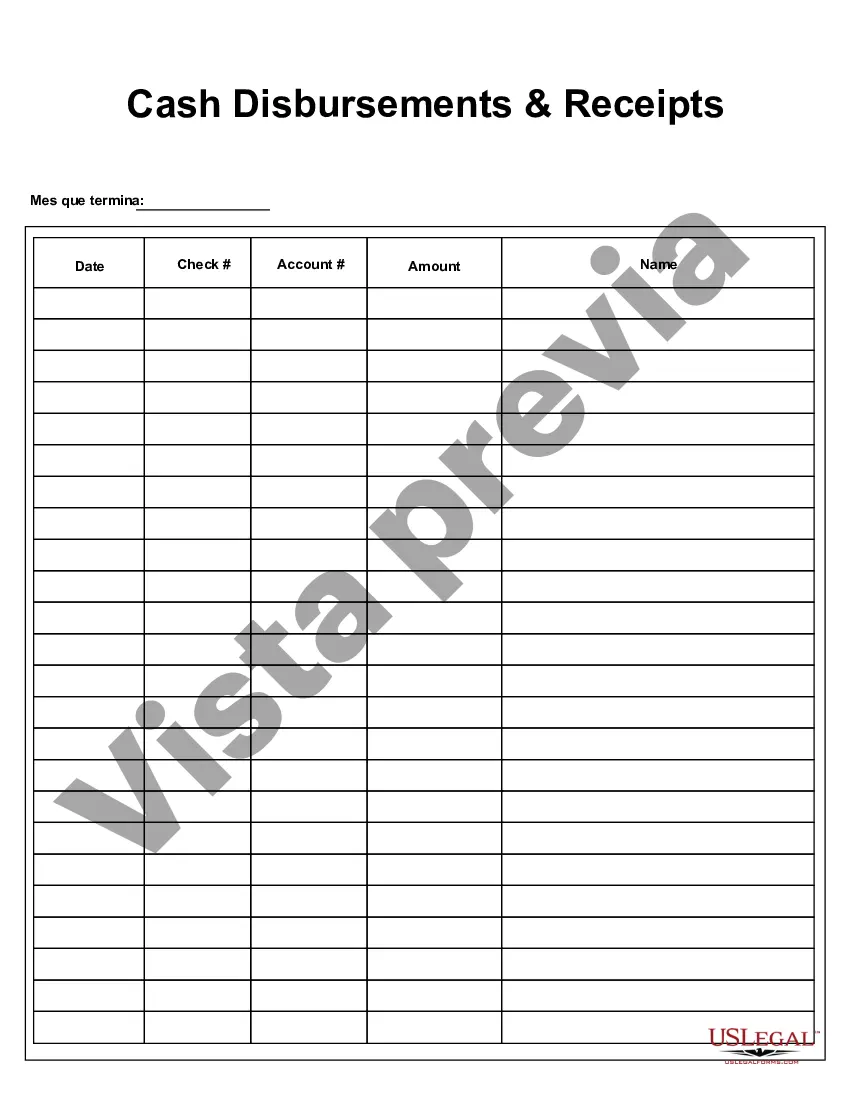

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Desembolsos y recibos de efectivo - Cash Disbursements and Receipts

Description

How to fill out Queens New York Desembolsos Y Recibos De Efectivo?

Do you need to quickly draft a legally-binding Queens Cash Disbursements and Receipts or probably any other document to handle your own or business matters? You can go with two options: hire a legal advisor to write a valid paper for you or create it completely on your own. Luckily, there's a third solution - US Legal Forms. It will help you get neatly written legal paperwork without paying unreasonable fees for legal services.

US Legal Forms provides a huge catalog of over 85,000 state-specific document templates, including Queens Cash Disbursements and Receipts and form packages. We offer documents for a myriad of use cases: from divorce paperwork to real estate documents. We've been out there for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the needed document without extra troubles.

- To start with, double-check if the Queens Cash Disbursements and Receipts is adapted to your state's or county's regulations.

- If the document comes with a desciption, make sure to verify what it's suitable for.

- Start the searching process over if the document isn’t what you were seeking by utilizing the search bar in the header.

- Choose the plan that best fits your needs and move forward to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Queens Cash Disbursements and Receipts template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. Moreover, the paperwork we offer are updated by law professionals, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!