A San Jose California Independent Sales Representative Agreement with a Developer of Computer Software is a legally binding contract between an individual or company acting as an independent sales representative and a software developer. This agreement incorporates specific provisions that are intended to meet the criteria outlined in the Internal Revenue Service’s (IRS) 20 Part Test for Determining Independent Contractor Status. By including these provisions, both parties aim to establish the independent contractor relationship, rather than an employer-employee relationship, for tax purposes. The agreement typically covers several key areas to ensure clarity and protection for both the sales representative and the software developer. These areas may vary based on specific circumstances, but commonly include: 1. Parties Involved: Clearly identifying the independent sales representative and the software developer, including their full legal names and addresses. 2. Scope of Work: Outlining the details of the sales representative's responsibilities, which typically include promoting, marketing, and selling the software developed by the company. Specific territories or markets may be defined, along with any exclusivity or non-compete clauses. 3. Compensation and Expenses: Providing details on how the sales representative will be compensated for their services, such as through a commission-based structure. Additional provisions concerning expense reimbursement may be included, specifying which costs will be covered and how they will be reimbursed. 4. Contract Duration: Specifying the duration of the agreement, which can be for a fixed term (e.g., one year) or an ongoing period unless terminated by either party. 5. Compliance with Laws: Stating that both parties will comply with all relevant laws, including employment and taxation laws, to maintain an independent contractor relationship. 6. Independent Contractor Status: Including provisions that clearly establish the intention and understanding that the sales representative is an independent contractor, not an employee of the software developer, according to the guidelines set forth by the IRS. This may involve addressing factors such as control, financial independence, contract terms, and the provision of equipment and supplies. 7. Confidentiality and Non-Disclosure: Incorporating provisions to safeguard any confidential information or proprietary software provided to the sales representative, and preventing unauthorized disclosure or use. 8. Termination: Outlining the circumstances under which either party may terminate the agreement, including notice requirements and any potential consequences or penalties. 9. Governing Law and Jurisdiction: Specifying the governing law of the agreement (California state law, for example) and the jurisdiction where any disputes will be resolved (San Jose, California, or another agreed location). It's important to note that while this description provides a general overview of a typical San Jose California Independent Sales Representative Agreement with a Developer of Computer Software with Provisions Intended to Satisfy the IRS's 20 Part Test for Determining Independent Contractor Status, specific agreements may vary depending on the unique circumstances and preferences of the parties involved. It is advisable to consult with an attorney or legal professional experienced in contract law and taxation to ensure compliance with relevant laws and to customize the agreement appropriately.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Acuerdo de representante de ventas independiente con desarrollador de software de computadora con disposiciones destinadas a satisfacer la prueba de 20 partes del Servicio de Impuestos Internos para determinar el estado de contratista independiente - Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status

Description

How to fill out San Jose California Acuerdo De Representante De Ventas Independiente Con Desarrollador De Software De Computadora Con Disposiciones Destinadas A Satisfacer La Prueba De 20 Partes Del Servicio De Impuestos Internos Para Determinar El Estado De Contratista Independiente?

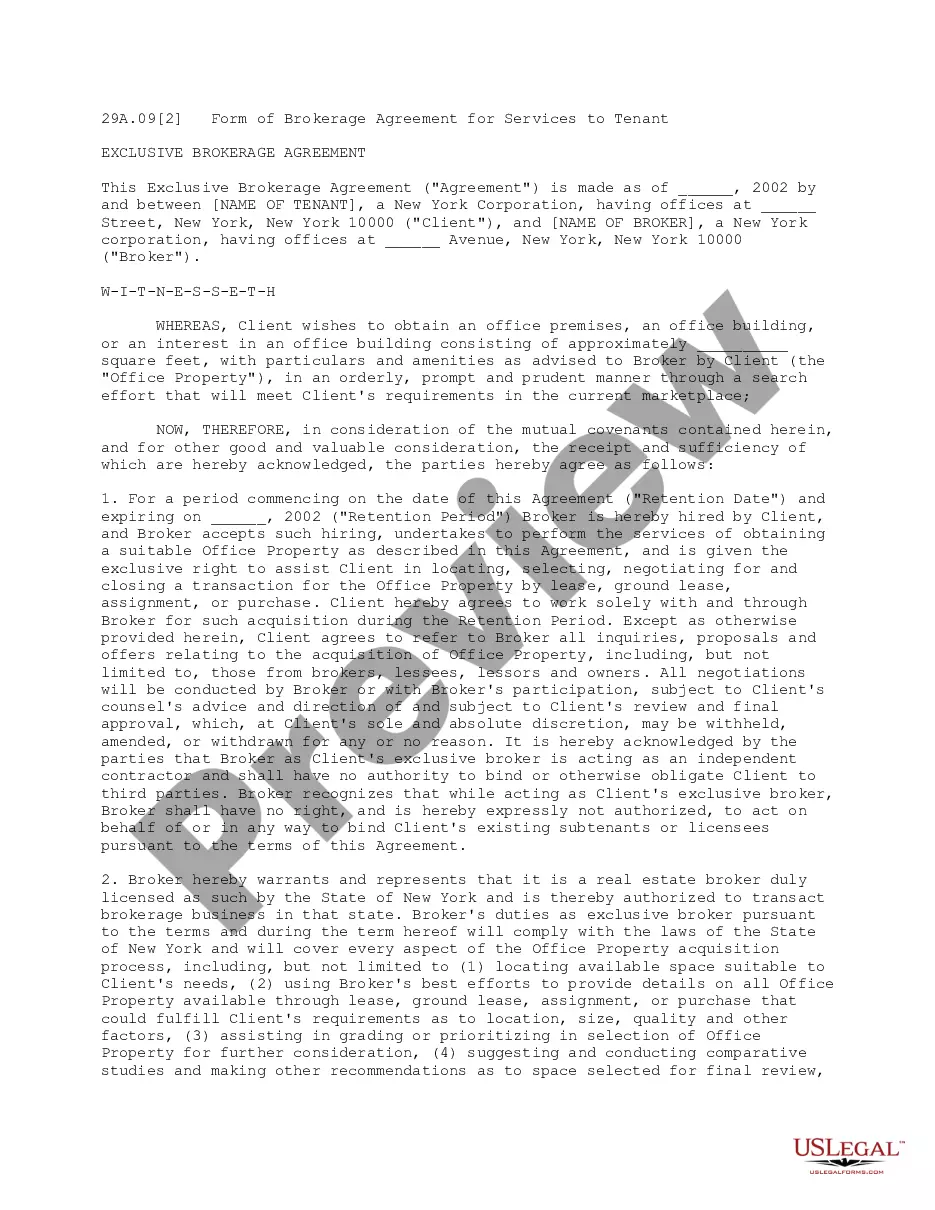

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the San Jose Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the San Jose Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the San Jose Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status:

- Analyze the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template when you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!