Bexar Texas Cash Register Payout refers to the process of withdrawing funds from a cash register in Bexar County, Texas. This transaction can occur for various reasons, such as cashing out at the end of a business day, reimbursing an employee for petty cash expenses, or making change for customers. The primary purpose of a cash register payout is to accurately track and account for the cash flow within a business. By withdrawing funds from the cash register, a business can maintain an accurate record of its daily sales and expenses. This practice helps to ensure transparency, prevent theft or fraud, and reconcile cash transactions. In Bexar County, Texas, cash register payout is a common practice across various industries, including retail stores, restaurants, and service-based businesses. It is an essential part of maintaining financial integrity and internal control systems. Different types of Bexar Texas Cash Register Payout may include: 1. Daily Cash Register Payout: A routine procedure performed at the end of each business day to withdraw the cash accumulated in the cash register. This involves counting the total cash, deducting any necessary expenses or operational costs, and finally, withdrawing the remaining funds. 2. Petty Cash Reimbursement: For businesses that utilize a petty cash fund to cover small, everyday expenses, a payout may occur to reimburse employees or specific individuals who have utilized funds for authorized purchases. This process ensures that the petty cash fund stays balanced and accurately accounted for. 3. Customer Change Payout: In situations where a customer pays with a higher denomination than the cost of their purchase, a cash register payout is necessary to provide the customer with the correct change. This ensures accuracy in transactions and customer satisfaction. In any Bexar Texas Cash Register Payout scenario, businesses must adhere to transparent financial practices, accurate record-keeping, and follow any local, state, or federal guidelines regarding cash handling and reporting. These practices help maintain the financial stability and integrity of a business while providing accurate financial insights for decision-making purposes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bexar Texas Pago de caja registradora - Cash Register Payout

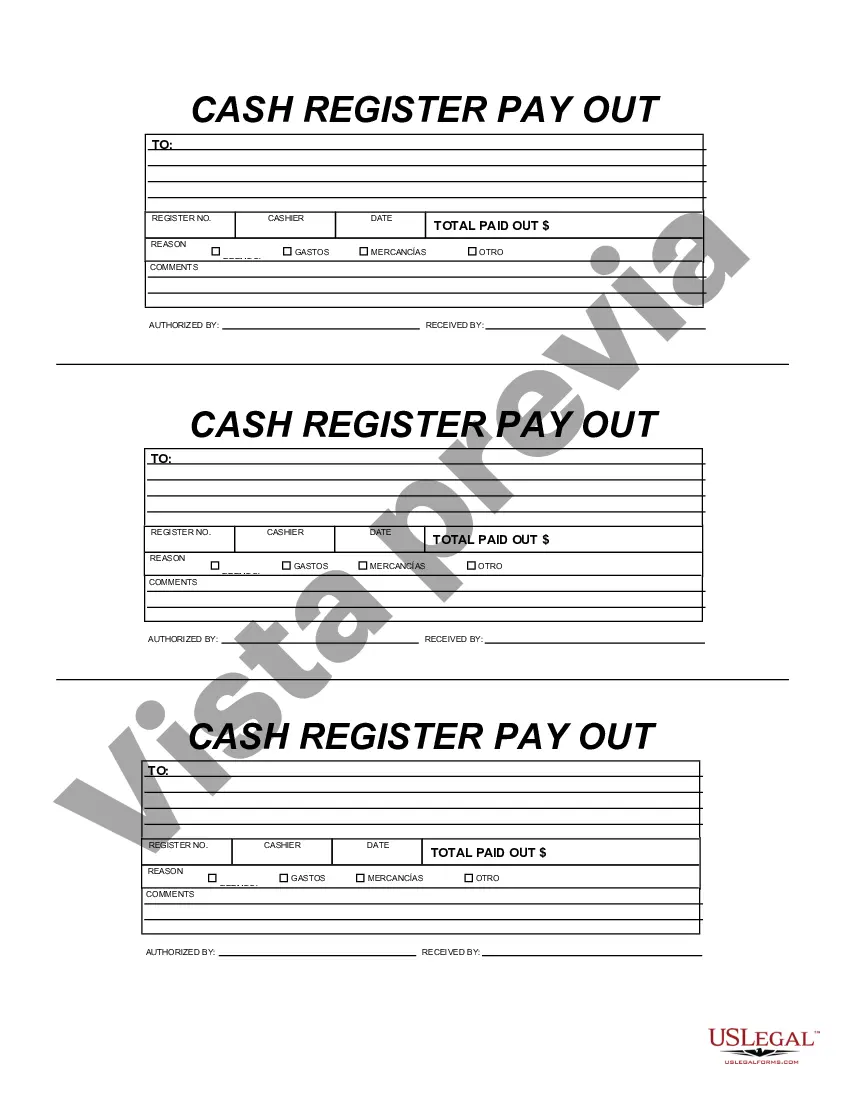

Description

How to fill out Bexar Texas Pago De Caja Registradora?

Drafting paperwork for the business or individual demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft Bexar Cash Register Payout without professional help.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Bexar Cash Register Payout on your own, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed document.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Bexar Cash Register Payout:

- Look through the page you've opened and verify if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that satisfies your requirements, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any situation with just a few clicks!