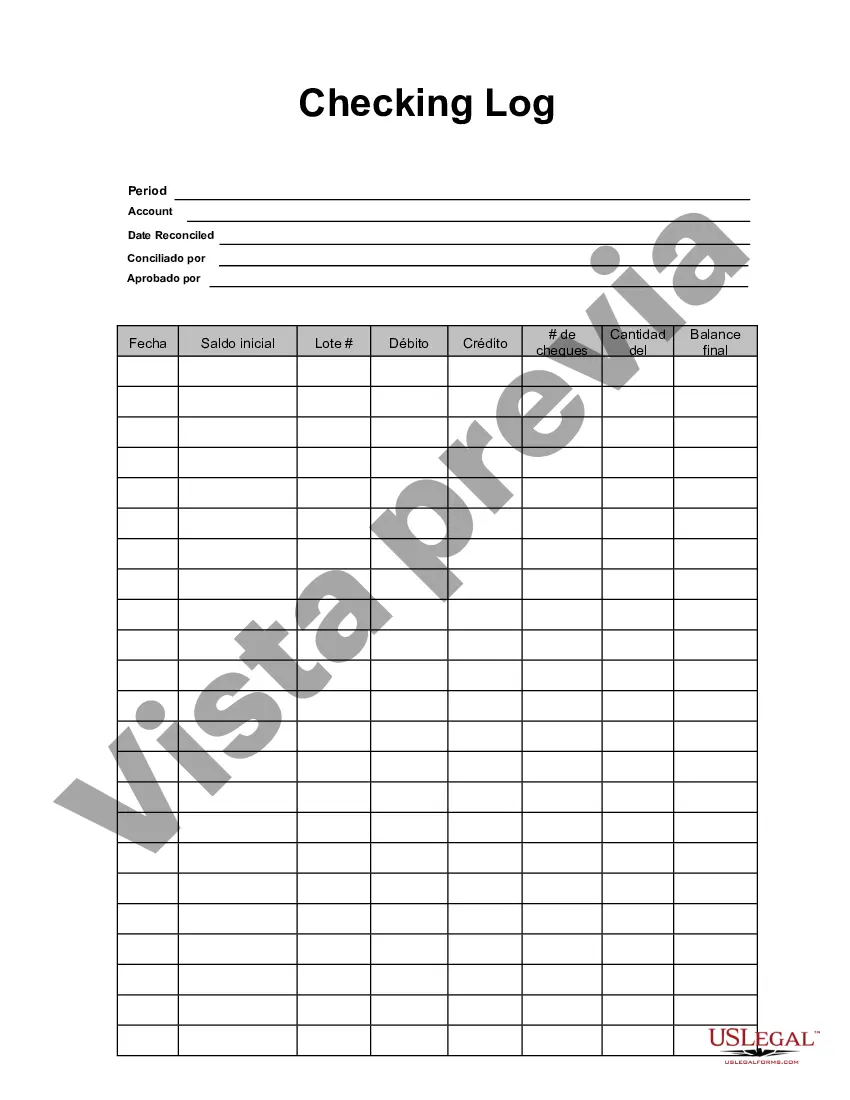

Nassau New York Checking Log is a vital document used by financial institutions and businesses in Nassau County, New York, to record and track various financial transactions related to checking accounts. This comprehensive log ensures accurate and organized record-keeping, facilitating better financial management and customer service. There are different types of Nassau New York Checking Logs that may be used by different organizations, including banks, credit unions, and accounting firms. Some notable types of checking logs include: 1. Personal Checking Log: Designed for individual account holders, this type of checking log helps individuals track their income, expenses, and balances associated with their checking accounts. 2. Business Checking Log: Specifically tailored for businesses, this type of checking log allows organizations to track their income and expenses, including vendor payments, employee salaries, and other financial transactions related to their checking accounts. 3. Bank Checking Log: Financial institutions, such as banks and credit unions, utilize this type of checking log to record and monitor transactions made by their clients. It helps in ensuring accuracy, detecting potential errors, and maintaining a clear audit trail. 4. Accounting Checking Log: This specialized checking log is typically used by accounting firms to streamline their financial record-keeping processes. It enables accountants to accurately monitor clients' checking account transactions and aids in reconciling their financial statements. 5. Online Checking Log: With the advent of technology, numerous digital platforms and mobile apps offer virtual versions of checking logs. These online logs provide real-time monitoring of account activities, transaction history, and balance tracking, making it convenient for users to manage their checking accounts remotely. Regardless of the type, a Nassau New York Checking Log typically includes essential details such as account holder's name, account number, transaction date, description, deposit amounts, withdrawal amounts, running balance, and any additional remarks or notes. This meticulous documentation ensures transparency, enables timely identification of discrepancies, and supports accurate financial reporting for both individuals and organizations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Comprobación de registro - Checking Log

Description

How to fill out Nassau New York Comprobación De Registro?

Do you need to quickly draft a legally-binding Nassau Checking Log or probably any other document to manage your personal or business affairs? You can select one of the two options: contact a professional to write a valid document for you or draft it completely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you get professionally written legal papers without paying sky-high fees for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-compliant document templates, including Nassau Checking Log and form packages. We provide templates for a myriad of use cases: from divorce papers to real estate documents. We've been out there for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed document without extra troubles.

- First and foremost, carefully verify if the Nassau Checking Log is tailored to your state's or county's laws.

- If the document comes with a desciption, make sure to verify what it's intended for.

- Start the search over if the form isn’t what you were seeking by using the search bar in the header.

- Select the plan that best fits your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Nassau Checking Log template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to buy and download legal forms if you use our catalog. Additionally, the templates we provide are reviewed by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!