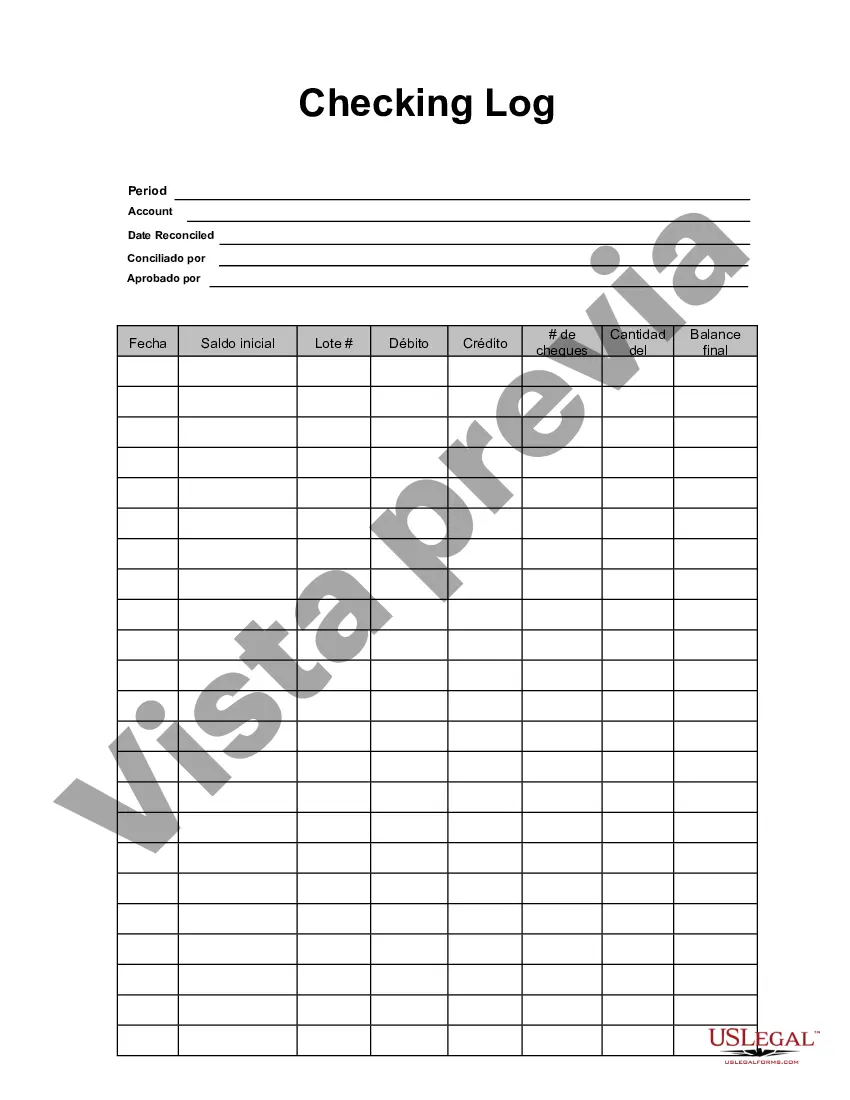

Travis Texas Checking Log serves as an essential tool for monitoring and tracking financial transactions within the state of Texas. It is primarily used by individuals, businesses, and financial institutions to keep a detailed record of deposits, withdrawals, and other related activities in checking accounts. This log is designed to ensure accuracy, transparency, and efficient management of funds. The Travis Texas Checking Log provides a comprehensive view of an individual or organization's banking activities, enabling them to maintain organized financial records, reconcile discrepancies, and effectively manage their finances. It also helps in keeping track of issued checks, incoming deposits, and debits or credits made to the account. By consistently maintaining a meticulous checking log, individuals can monitor their spending habits, identify potential fraudulent activities, and plan their budget accordingly. Different types of Travis Texas Checking Logs include: 1. Personal Checking Log: This type of checking log caters to individuals who want to keep a detailed record of their personal banking transactions. It helps individuals track their expenses, monitor their account balance, and maintain a clear understanding of their financial health. 2. Business Checking Log: Specifically designed for businesses, this type of checking log enables companies to record business-related transactions accurately. It allows businesses to separate personal and business expenses, track income and expenses, and analyze their cash flow to make informed financial decisions. 3. Financial Institution Checking Log: Financial institutions, such as banks and credit unions, utilize this type of log to track all checking account activities of their customers. It serves as an internal record-keeping system and helps institutions ensure compliance with regulations, provide accurate statements, and address customer inquiries or disputes. In conclusion, Travis Texas Checking Log plays a crucial role in maintaining accurate and organized financial records for individuals, businesses, and financial institutions. It allows individuals to manage their personal finances effectively, while businesses can better track their expenses and profits. Moreover, financial institutions rely on these logs to uphold transparency, compliance, and customer satisfaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Comprobación de registro - Checking Log

Description

How to fill out Travis Texas Comprobación De Registro?

Creating documents, like Travis Checking Log, to manage your legal matters is a challenging and time-consumming task. Many situations require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can get your legal issues into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal forms created for various scenarios and life situations. We make sure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Travis Checking Log template. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before downloading Travis Checking Log:

- Make sure that your template is specific to your state/county since the regulations for writing legal papers may vary from one state another.

- Discover more information about the form by previewing it or going through a brief intro. If the Travis Checking Log isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to start using our website and get the form.

- Everything looks great on your end? Click the Buy now button and choose the subscription option.

- Pick the payment gateway and type in your payment information.

- Your template is ready to go. You can go ahead and download it.

It’s easy to locate and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!