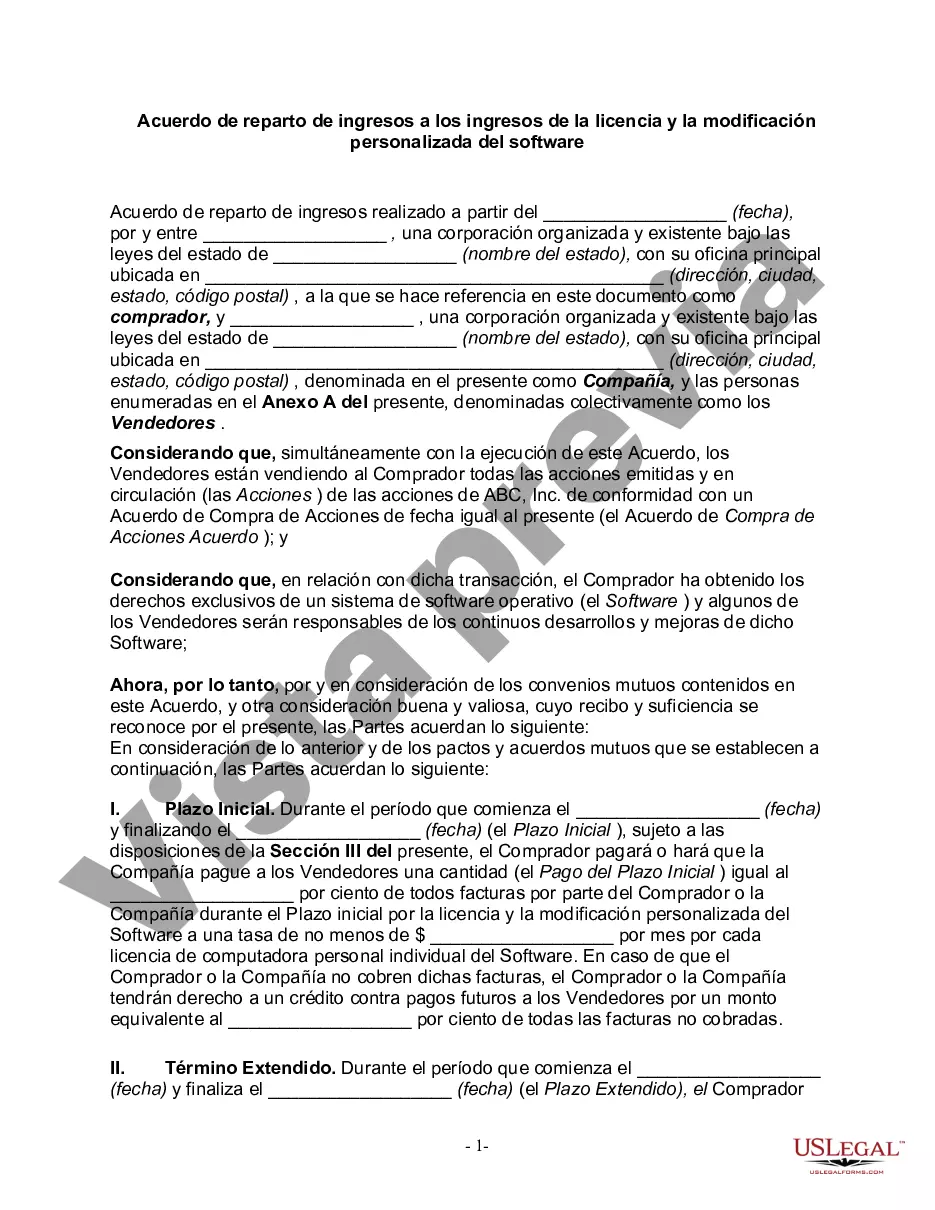

Franklin Ohio Revenue Sharing Agreement is a contractual arrangement that governs the distribution of income derived from licensing and custom modification of software in Franklin, Ohio. This agreement outlines the terms and conditions under which the revenue generated by the licensing and customization of software will be shared among the involved parties. Keywords: Franklin Ohio, revenue sharing agreement, income, licensing, custom modification, software. The Franklin Ohio Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software may include different types depending on the specific requirements and arrangements established between the parties involved. Some potential types of agreements may include: 1. Standard Revenue Sharing Agreement: This type of agreement establishes a straightforward revenue distribution model based on predefined percentages or ratios. The agreement outlines how the income generated from software licensing and custom modification will be distributed among the involved parties, such as software developers, licensors, and other stakeholders. 2. Tiered Revenue Sharing Agreement: In this type of agreement, the revenue distribution is structured into tiers or levels based on predefined performance metrics or milestones. The agreement may specify different revenue sharing ratios for different levels of achievement. For instance, higher revenue sharing ratios could be applicable once a certain sales target or revenue threshold is met. 3. Customized Revenue Sharing Agreement: This agreement can be tailored to meet the specific needs and requirements of the parties involved. It allows for flexibility in defining the revenue distribution model, such as incorporating variable factors like market demand, geographic distribution, or target customer segments. 4. Platform or Marketplace Revenue Sharing Agreement: This type of agreement is prevalent in situations where software is licensed or customized through an online platform or marketplace. The revenue sharing terms are typically defined by the platform owner or operator, and the agreement establishes how the income will be distributed between the platform and software developers or licensors. In conclusion, the Franklin Ohio Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software is a comprehensive contractual arrangement that governs the distribution of income generated through software licensing and customization. The specific type of revenue sharing agreement can vary based on factors like the involved parties' preferences, industry norms, and the unique circumstances of the software and market segment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Acuerdo de reparto de ingresos a los ingresos de la licencia y la modificación personalizada del software - Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software

Description

How to fill out Franklin Ohio Acuerdo De Reparto De Ingresos A Los Ingresos De La Licencia Y La Modificación Personalizada Del Software?

If you need to find a trustworthy legal paperwork provider to find the Franklin Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software, consider US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate template.

- You can browse from over 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of learning resources, and dedicated support team make it simple to find and execute different paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

Simply type to search or browse Franklin Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software, either by a keyword or by the state/county the document is intended for. After locating necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Franklin Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software template and check the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Register an account and choose a subscription plan. The template will be immediately ready for download as soon as the payment is processed. Now you can execute the form.

Handling your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes this experience less costly and more affordable. Set up your first business, arrange your advance care planning, draft a real estate contract, or complete the Franklin Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software - all from the convenience of your sofa.

Sign up for US Legal Forms now!