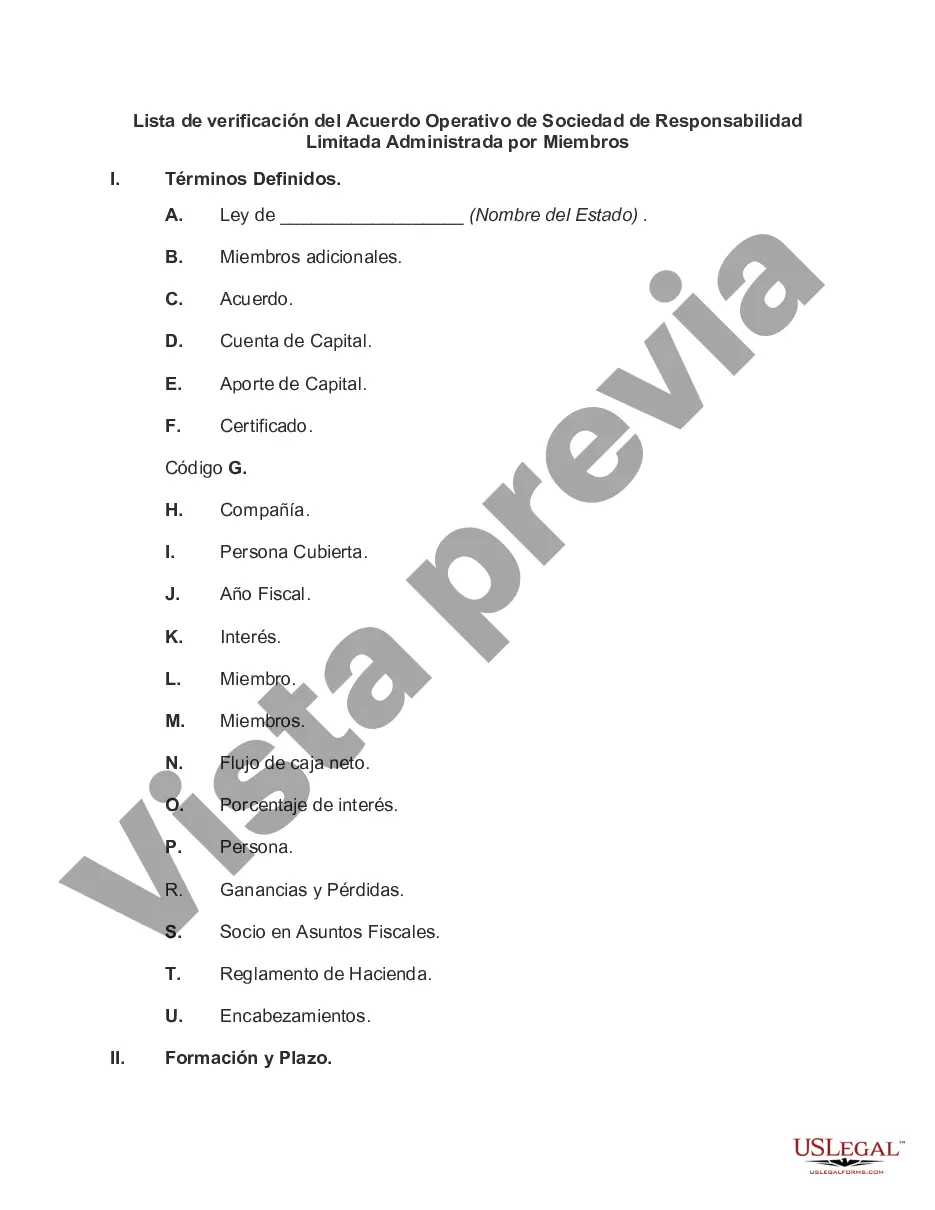

Cook Illinois Checklist of Member Managed Limited Liability Company Operating Agreement is a comprehensive document that outlines the guidelines and provisions for managing a member-managed limited liability company (LLC) in Cook County, Illinois. It ensures that all essential aspects of LLC operations are carefully addressed and provides a roadmap for managing day-to-day activities successfully. This operating agreement encompasses various critical aspects, including member rights and responsibilities, decision-making processes, profit distribution methods, and dispute resolution mechanisms. It serves as a contractual agreement between LLC members and governs the internal affairs of the company. Adhering to this checklist helps maintain transparency, accountability, and legal compliance in the business operations. Key sections covered in the Cook Illinois Checklist of Member Managed Limited Liability Company Operating Agreement include: 1. Formation: This section outlines the specific steps and processes required for the formation of the member-managed LLC in accordance with Cook County regulations. It specifies the registration requirements, necessary filings with the appropriate authorities, and the timeframe for completion. 2. Members: This section highlights the qualifications and limitations for individuals or entities to become members of the LLC. It explains the rights, duties, and obligations of members, including their voting rights, capital contributions, and agreed-upon profit share. 3. Management: The management section defines how the LLC will be managed by its members collectively. It clarifies the decision-making process, the role of each member, and their authority to bind the company in legal matters. Specific processes for calling and conducting meetings, drafting minutes, and record-keeping are also addressed. 4. Distribution of Profits and Losses: This section covers the allocation of profits and losses among the members based on their capital contribution or a mutually agreed-upon formula. It ensures fairness and transparency in profit-sharing and loss absorption. 5. Taxation: This section outlines the tax implications of operating a member-managed LLC in Cook County, Illinois. It discusses the tax treatment of profits and losses, any tax elections made by the LLC, and the responsibilities of individual members for reporting their share of the company's profits on their personal tax returns. 6. Transfer of Membership Interest: This section specifies the conditions under which members can transfer or assign their ownership interests in the LLC. It may outline the process for obtaining the consent of existing members, as well as any restrictions or limitations on such transfers. 7. Dissolution and Termination: This section details the circumstances and procedures for dissolving the LLC, such as unanimous member consent, bankruptcy, or expiration of a predefined term. It explains the distribution of assets and settling of liabilities during the dissolution process. It is important to note that there may be different variations or customized versions of the Cook Illinois Checklist of Member Managed Limited Liability Company Operating Agreement to suit specific business requirements. These variations may include additional clauses or modifications to address unique situations or industry-specific regulations. It is recommended to consult legal professionals or business advisors to ensure the adequacy and compliance of the operating agreement with applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Lista de verificación del Acuerdo Operativo de Sociedad de Responsabilidad Limitada Administrada por Miembros - Checklist of Member Managed Limited Liability Company Operating Agreement

Description

How to fill out Cook Illinois Lista De Verificación Del Acuerdo Operativo De Sociedad De Responsabilidad Limitada Administrada Por Miembros?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare formal paperwork that varies throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any individual or business objective utilized in your county, including the Cook Checklist of Member Managed Limited Liability Company Operating Agreement.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Cook Checklist of Member Managed Limited Liability Company Operating Agreement will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to obtain the Cook Checklist of Member Managed Limited Liability Company Operating Agreement:

- Ensure you have opened the proper page with your regional form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form satisfies your needs.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Cook Checklist of Member Managed Limited Liability Company Operating Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!