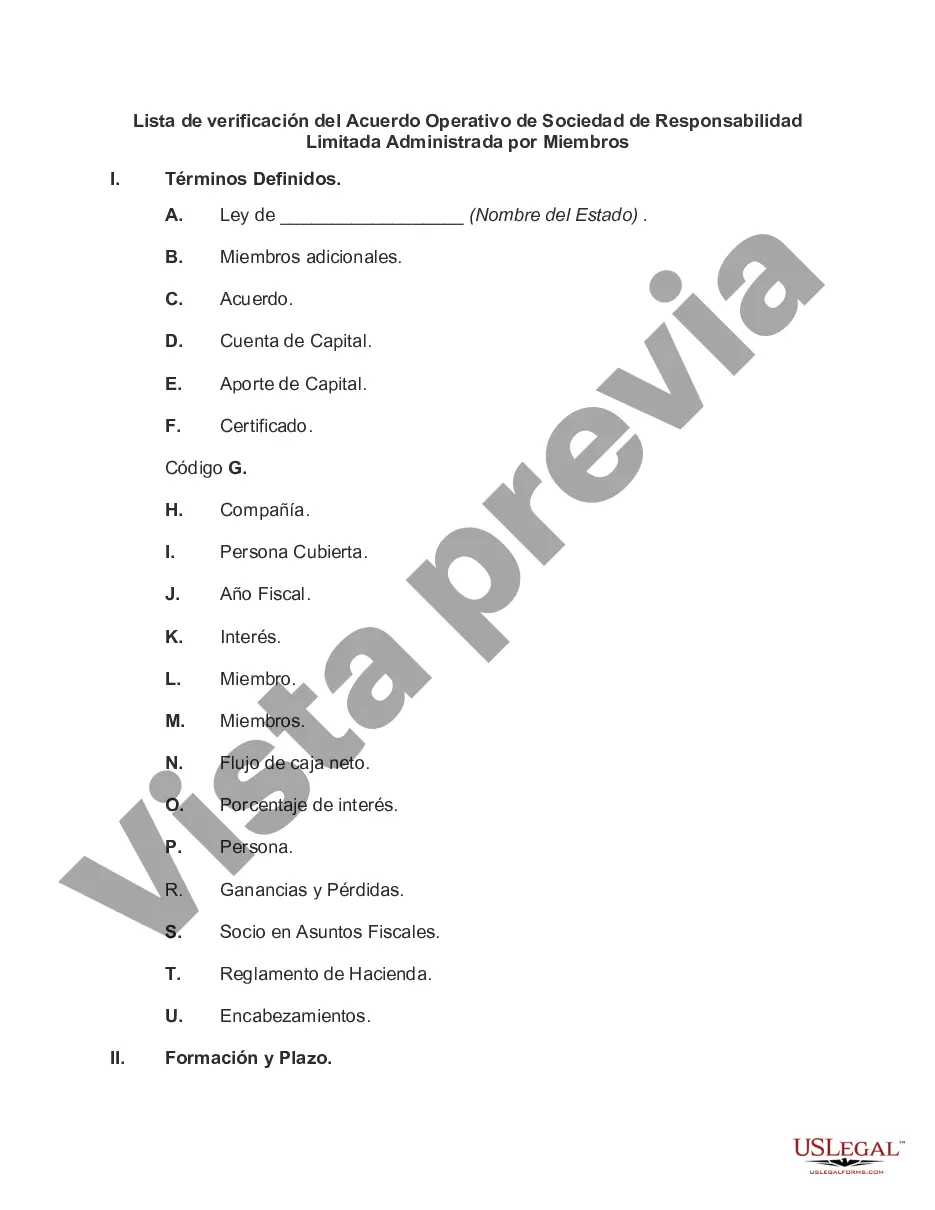

Miami-Dade County is located in the southern part of Florida and is the most populous county in the state. It covers approximately 2,431 square miles and is home to over 2.7 million residents. Miami-Dade is known for its vibrant culture, beautiful beaches, and thriving economy. The county is a major international hub, attracting tourists and businesses from all over the world. A Member Managed Limited Liability Company (LLC) Operating Agreement is a legal document that outlines the rights, responsibilities, and operating procedures of a member-managed LLC in Miami-Dade County, Florida. This agreement is crucial for ensuring the smooth functioning of the LLC and establishing clear guidelines for its members. The Miami-Dade Florida Checklist of Member Managed Limited Liability Company Operating Agreement includes important provisions that every LLC should consider. These provisions may vary based on the specific needs and goals of the LLC. Some key components typically included in the checklist are: 1. Name and Purpose: Specify the name of the LLC, its principal place of business, and the purpose for which the LLC is formed. The purpose can be broad or specific, depending on the nature of the business. 2. Members: Identify the names and addresses of all members involved in the LLC, along with their respective ownership percentages or capital contributions. This section also includes information on admitting new members or the procedures for transferring membership interests. 3. Management: Define whether the LLC will be member-managed or manager-managed. In a member-managed LLC, all members actively participate in the management and decision-making processes. In contrast, a manager-managed LLC designates specific individuals or entities to handle day-to-day operations. 4. Meetings and Voting: Outline the procedures for calling and conducting meetings, including the quorum required for making decisions. Specify the voting rights of each member, whether based on ownership percentages or other agreed-upon measures. 5. Profit and Loss Allocation: Determine how profits and losses will be allocated among members. This can be based on ownership percentages or other distribution models agreed upon by the members. 6. Capital Contributions and Distributions: Establish guidelines for initial capital contributions required from members and any additional future contributions. Detail how distributions or dividends will be made to members and under what circumstances. 7. Dissolution and Termination: Outline the conditions under which the LLC may be dissolved or terminated. This includes triggering events such as unanimous consent, bankruptcy, or the death of a member. Miami-Dade County may have specific requirements or considerations for LLC operating agreements. It is advisable to consult an attorney experienced in Florida LLC laws to ensure compliance with local regulations and to address any county-specific needs. In conclusion, a Miami-Dade Florida Checklist of Member Managed Limited Liability Company Operating Agreement is an essential legal document that governs the operations and responsibilities of an LLC in Miami-Dade County, Florida. It provides a comprehensive framework for members to manage their LLC effectively and avoid potential conflicts or misunderstandings.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Lista de verificación del Acuerdo Operativo de Sociedad de Responsabilidad Limitada Administrada por Miembros - Checklist of Member Managed Limited Liability Company Operating Agreement

State:

Multi-State

County:

Miami-Dade

Control #:

US-13188BG

Format:

Word

Instant download

Description

This is a checklist of things that should be in a member managed limited liability company operating agreement.

Miami-Dade County is located in the southern part of Florida and is the most populous county in the state. It covers approximately 2,431 square miles and is home to over 2.7 million residents. Miami-Dade is known for its vibrant culture, beautiful beaches, and thriving economy. The county is a major international hub, attracting tourists and businesses from all over the world. A Member Managed Limited Liability Company (LLC) Operating Agreement is a legal document that outlines the rights, responsibilities, and operating procedures of a member-managed LLC in Miami-Dade County, Florida. This agreement is crucial for ensuring the smooth functioning of the LLC and establishing clear guidelines for its members. The Miami-Dade Florida Checklist of Member Managed Limited Liability Company Operating Agreement includes important provisions that every LLC should consider. These provisions may vary based on the specific needs and goals of the LLC. Some key components typically included in the checklist are: 1. Name and Purpose: Specify the name of the LLC, its principal place of business, and the purpose for which the LLC is formed. The purpose can be broad or specific, depending on the nature of the business. 2. Members: Identify the names and addresses of all members involved in the LLC, along with their respective ownership percentages or capital contributions. This section also includes information on admitting new members or the procedures for transferring membership interests. 3. Management: Define whether the LLC will be member-managed or manager-managed. In a member-managed LLC, all members actively participate in the management and decision-making processes. In contrast, a manager-managed LLC designates specific individuals or entities to handle day-to-day operations. 4. Meetings and Voting: Outline the procedures for calling and conducting meetings, including the quorum required for making decisions. Specify the voting rights of each member, whether based on ownership percentages or other agreed-upon measures. 5. Profit and Loss Allocation: Determine how profits and losses will be allocated among members. This can be based on ownership percentages or other distribution models agreed upon by the members. 6. Capital Contributions and Distributions: Establish guidelines for initial capital contributions required from members and any additional future contributions. Detail how distributions or dividends will be made to members and under what circumstances. 7. Dissolution and Termination: Outline the conditions under which the LLC may be dissolved or terminated. This includes triggering events such as unanimous consent, bankruptcy, or the death of a member. Miami-Dade County may have specific requirements or considerations for LLC operating agreements. It is advisable to consult an attorney experienced in Florida LLC laws to ensure compliance with local regulations and to address any county-specific needs. In conclusion, a Miami-Dade Florida Checklist of Member Managed Limited Liability Company Operating Agreement is an essential legal document that governs the operations and responsibilities of an LLC in Miami-Dade County, Florida. It provides a comprehensive framework for members to manage their LLC effectively and avoid potential conflicts or misunderstandings.

Free preview