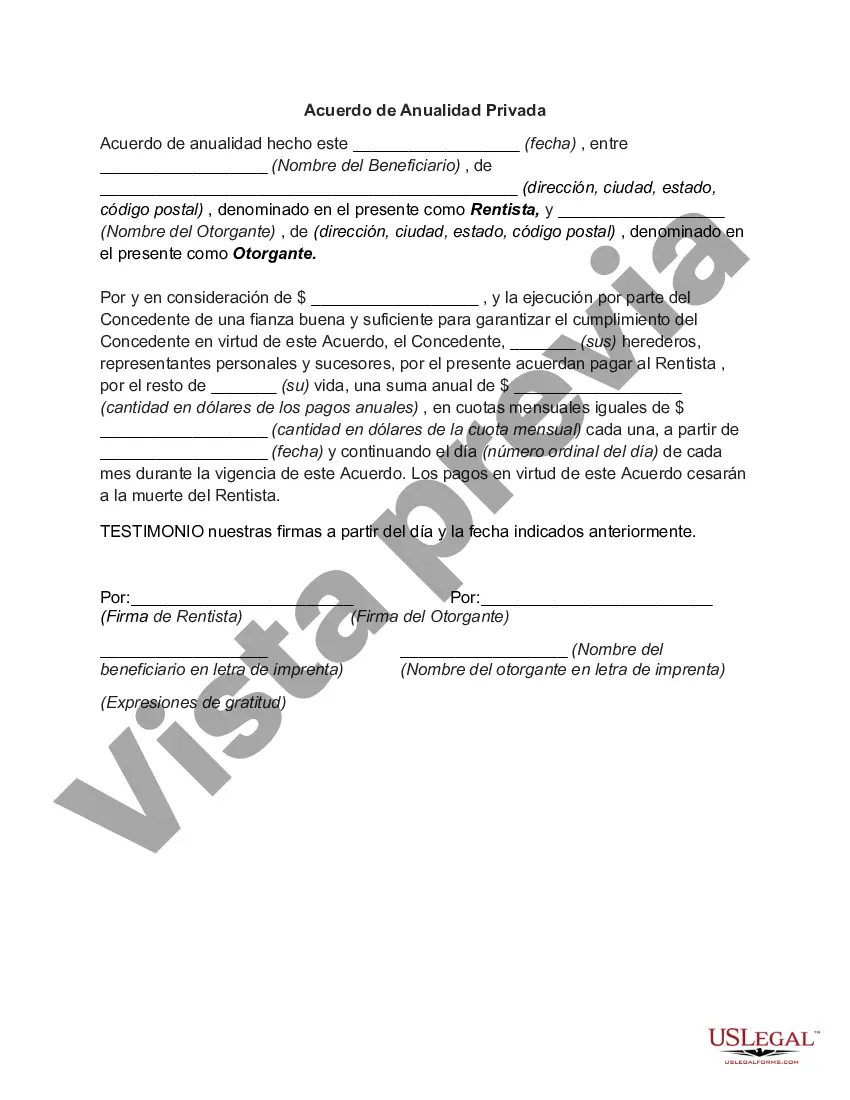

Allegheny Pennsylvania Private Annuity Agreement is a legal contract that enables individuals to transfer assets to a trust in exchange for a promise of lifetime income payments. It is commonly used as a strategic estate planning tool in Pennsylvania. This type of annuity agreement can provide several benefits for both the transferor (annuity seller) and the transferee (trust beneficiary). The transferor can achieve immediate tax advantages by avoiding capital gains tax on the appreciated assets. Meanwhile, the transferee can receive a reliable income stream for the agreed-upon period. The Allegheny Pennsylvania Private Annuity Agreement is tailored to meet the specific needs of residents in Allegheny County within the state of Pennsylvania. It adheres to the unique regulations and requirements of the area. However, it is essential to note that there are generally no specific different types of Allegheny Pennsylvania Private Annuity Agreements. This agreement operates on the principle that the transferor transfers assets, such as real estate, stocks, or a business, into an irrevocable trust called the annuity trust. In return, the trust promises to pay the transferor a fixed income for life. The income payments can begin immediately or at a specified future date. The annuity payments are primarily determined using a combination of factors such as the value of the transferred assets, the transferor's life expectancy, and prevailing interest rates. These factors collectively determine the payment amount and frequency. One significant advantage of the Allegheny Pennsylvania Private Annuity Agreement is the potential reduction of estate taxes. As the assets are held in an irrevocable trust, they are removed from the transferor's estate, potentially reducing the overall tax burden upon their passing. Additionally, the private annuity agreement can facilitate the smooth transfer of assets to the next generation while preserving family wealth. It provides greater control over the distribution of assets and can ensure a sustainable income for the transferor during their lifetime. Moreover, this agreement offers protection from potential creditors and claims against the estate. In conclusion, the Allegheny Pennsylvania Private Annuity Agreement is a specialized legal contract designed to assist residents of Allegheny County, Pennsylvania, in managing their estate and achieving tax benefits. It allows individuals to transfer assets into an irrevocable trust in exchange for a reliable income stream, while potentially reducing their estate tax liability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Acuerdo de Anualidad Privada - Private Annuity Agreement

Description

How to fill out Allegheny Pennsylvania Acuerdo De Anualidad Privada?

Drafting paperwork for the business or individual demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to draft Allegheny Private Annuity Agreement without professional assistance.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid Allegheny Private Annuity Agreement by yourself, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Allegheny Private Annuity Agreement:

- Look through the page you've opened and check if it has the sample you need.

- To do so, use the form description and preview if these options are available.

- To find the one that satisfies your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any use case with just a couple of clicks!