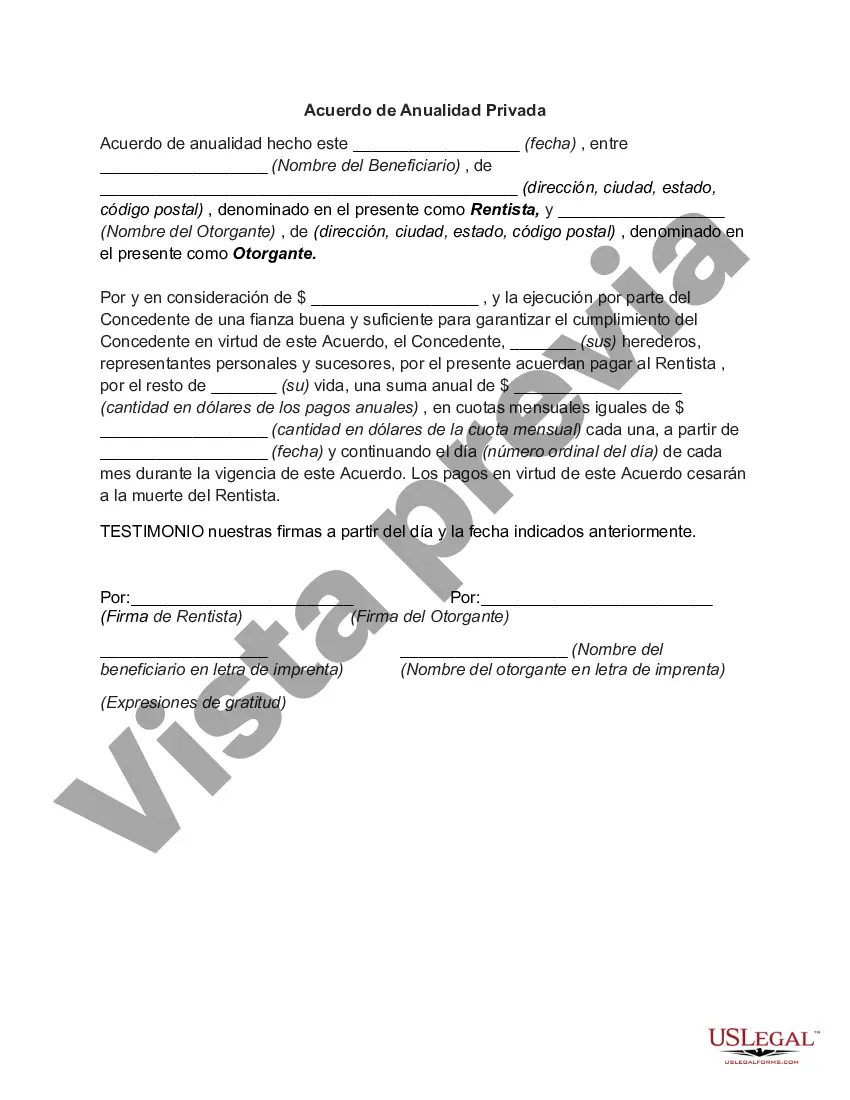

A Dallas Texas Private Annuity Agreement is a legal arrangement made between two parties where one party transfers assets or property to the other party in exchange for a guaranteed stream of income for a fixed period of time. This type of agreement is typically used for estate planning purposes, allowing the transfer of assets while providing an income stream for the transferor. The Dallas Texas Private Annuity Agreement is governed by state laws and must adhere to specific regulations to ensure its validity and effectiveness. It is important to consult with a legal professional experienced in annuity agreements to draft and execute the agreement properly. There are different types of Private Annuity Agreements that individuals in Dallas, Texas may consider based on their specific needs and goals. These include: 1. Lifetime Private Annuity: This type of agreement provides a series of payments for the lifetime of the transferor, ensuring a stable income source throughout their retirement years. 2. Term Certain Private Annuity: Instead of lasting for the lifetime of the transferor, this agreement provides fixed payments for a predetermined period. This can be beneficial when the transferor needs income for a specific time frame, such as to fund education expenses or pay off debts. 3. Joint and Survivor Private Annuity: In this agreement, both the transferor and another individual (typically a spouse) receive annuity payments for their lifetimes. This ensures a continuous income for both parties, even after the death of one. 4. Deferred Private Annuity: Unlike immediate annuities, this type of agreement allows the transferor to defer annuity payments to a later date. This may be suitable for individuals who want to accumulate a larger income stream over time or delay the tax consequences of transferring assets. When entering into a Dallas Texas Private Annuity Agreement, it is crucial to consider factors such as the financial stability of the transferee, tax implications, and ensuring the agreement meets the transferor's long-term financial goals. Seeking advice from financial advisors and legal professionals can help individuals make informed decisions and ensure the agreement aligns with their specific circumstances. Overall, a Dallas Texas Private Annuity Agreement can be a valuable tool for individuals seeking to transfer assets while securing a steady income stream. However, careful consideration and guidance from professionals are crucial to ensure the agreement is well-structured and in compliance with the applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Acuerdo de Anualidad Privada - Private Annuity Agreement

Description

How to fill out Dallas Texas Acuerdo De Anualidad Privada?

Preparing papers for the business or individual demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to generate Dallas Private Annuity Agreement without professional assistance.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Dallas Private Annuity Agreement by yourself, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Dallas Private Annuity Agreement:

- Look through the page you've opened and verify if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that suits your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any use case with just a few clicks!