A Detailed Description of Franklin Ohio Private Annuity Agreement Franklin Ohio Private Annuity Agreement is a legal contract that allows individuals to transfer their assets, usually real estate or closely held businesses, to a trust in exchange for a stream of income for a specific period of time. This agreement is commonly used as an estate planning tool to pass on family-owned assets to the next generation while minimizing estate taxes. Keywords: Franklin Ohio, Private Annuity Agreement, legal contract, transfer assets, real estate, closely held businesses, stream of income, estate planning, family-owned assets, estate taxes. Different Types of Franklin Ohio Private Annuity Agreements: 1. Traditional Private Annuity Agreement: This is the standard form of the agreement where an individual transfers the ownership of their assets to a trust in exchange for a fixed and predetermined income stream for the rest of their life. 2. Installment Private Annuity Agreement: Under this type of agreement, the income stream is not immediate, but rather deferred for a specific period of time. The annuitant receives periodic payments after a certain waiting period. 3. Joint and Survivor Private Annuity Agreement: This agreement allows for multiple annuitants, usually a married couple, to receive income for as long as either of them is alive. It ensures financial security for both parties during their lifetimes. 4. Deferred Private Annuity Agreement: In this agreement, the annuitant defers the commencement of the income stream to a future date. This can be beneficial in situations where the annuitant wants to delay income and reduce their annual tax liability. 5. Charitable Private Annuity Agreement: This unique agreement involves the transfer of assets to a charitable organization in exchange for a guaranteed income stream for life. It allows individuals to support their favorite charities while securing a fixed income. 6. Combination Private Annuity Agreement: This type of agreement combines elements of different annuity agreements to meet the specific needs and goals of the individual. It provides flexibility in structuring the income stream based on their unique circumstances. Franklin Ohio Private Annuity Agreements offer various benefits, including tax deferral, asset protection, and estate tax reduction. However, it is crucial to consult with a qualified financial advisor or attorney when considering this estate planning tool to ensure it aligns with your specific financial goals and meets the legal requirements of Franklin Ohio.

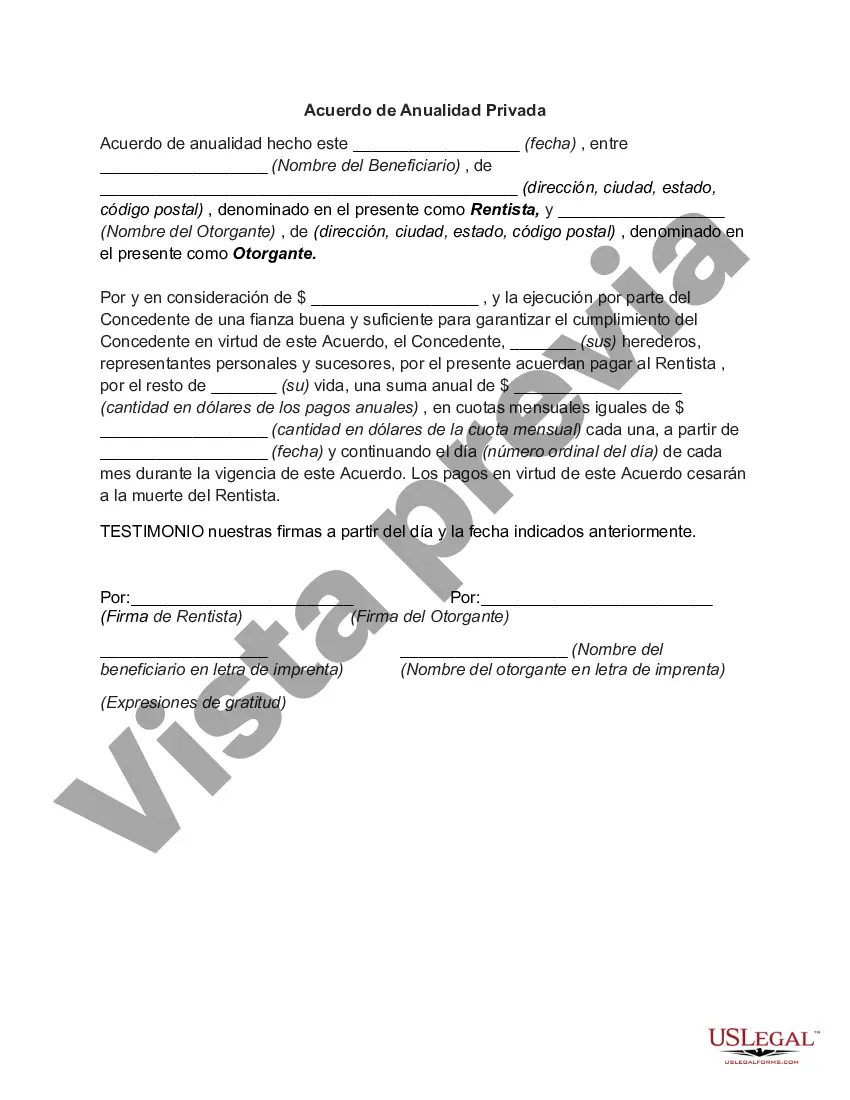

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Acuerdo de Anualidad Privada - Private Annuity Agreement

Description

How to fill out Franklin Ohio Acuerdo De Anualidad Privada?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from the ground up, including Franklin Private Annuity Agreement, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in different types ranging from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching process less overwhelming. You can also find information resources and guides on the website to make any activities associated with document completion straightforward.

Here's how to locate and download Franklin Private Annuity Agreement.

- Take a look at the document's preview and description (if available) to get a general idea of what you’ll get after downloading the document.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can affect the legality of some documents.

- Check the similar forms or start the search over to locate the correct file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a needed payment gateway, and purchase Franklin Private Annuity Agreement.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Franklin Private Annuity Agreement, log in to your account, and download it. Of course, our website can’t replace a legal professional entirely. If you need to cope with an exceptionally complicated case, we advise using the services of an attorney to check your form before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Become one of them today and get your state-compliant paperwork effortlessly!