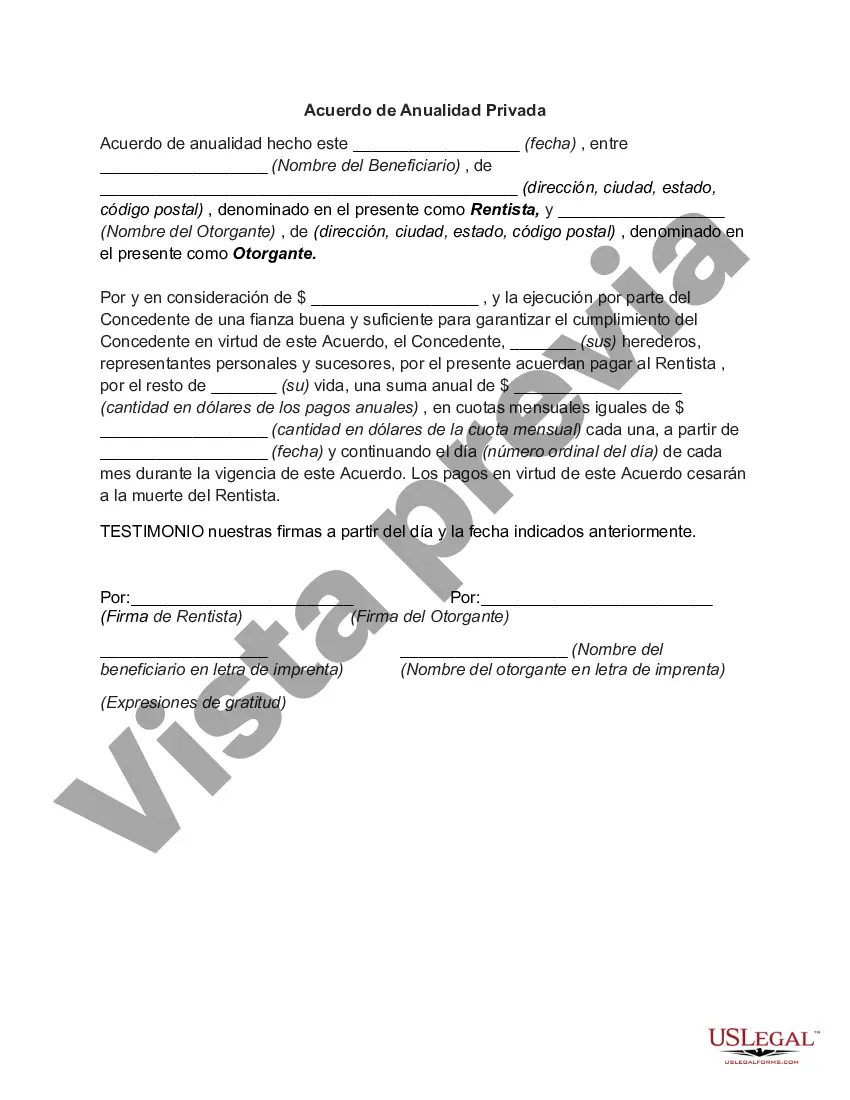

Hennepin Minnesota Private Annuity Agreement is a legal contract that allows an individual to transfer assets to another party in exchange for a stream of income that is guaranteed for the rest of their life. This agreement is governed by specific laws and regulations applicable to the Hennepin County in Minnesota. In a Hennepin Minnesota Private Annuity Agreement, the transferring party, known as the annuitant, transfers assets such as real estate, stocks, or business interests, to another party called the annuity issuer. The annuity issuer, typically a family member or a trust, assumes the responsibility of making regular payments to the annuitant for the remainder of their life. These payments are usually fixed and can be made annually, semi-annually, quarterly, or monthly. The Private Annuity Agreement provides several advantages for the annuitant. Firstly, it allows them to defer capital gains taxes on the transferred assets until they start receiving payments. Secondly, it enables them to remove these assets from their taxable estate, reducing potential estate taxes. Lastly, it can be an effective estate planning tool, allowing the annuitant to pass on their wealth to future generations while minimizing tax liabilities. It is important to note that there are some variations of Hennepin Minnesota Private Annuity Agreements. These include: 1. Installment Sale Private Annuity: This type of agreement involves the sale of property or assets to a trust or family member, with the payments structured as an annuity. 2. Self-Canceling Installment Note (SKIN) Private Annuity: In this variation, the annuity payments cease upon the annuitant's death, resulting in a cancellation of the remaining payment obligations. 3. Granter Retained Annuity Trust (GREAT): While not strictly a Private Annuity Agreement, a GREAT allows the transfer of assets into a trust while the granter retains an annuity payment for a fixed term. These types of Hennepin Minnesota Private Annuity Agreements offer flexibility and tax advantages suited to different situations and estate planning objectives. It is important to consult with a qualified attorney or financial advisor to understand the specific legal and financial implications of each type and to determine which one is most appropriate for individual circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Acuerdo de Anualidad Privada - Private Annuity Agreement

Description

How to fill out Hennepin Minnesota Acuerdo De Anualidad Privada?

If you need to get a trustworthy legal paperwork provider to obtain the Hennepin Private Annuity Agreement, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed form.

- You can select from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, number of learning materials, and dedicated support make it simple to find and execute various papers.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply select to search or browse Hennepin Private Annuity Agreement, either by a keyword or by the state/county the document is created for. After locating necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Hennepin Private Annuity Agreement template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be instantly available for download once the payment is completed. Now you can execute the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes these tasks less pricey and more affordable. Create your first company, arrange your advance care planning, draft a real estate contract, or complete the Hennepin Private Annuity Agreement - all from the comfort of your home.

Join US Legal Forms now!