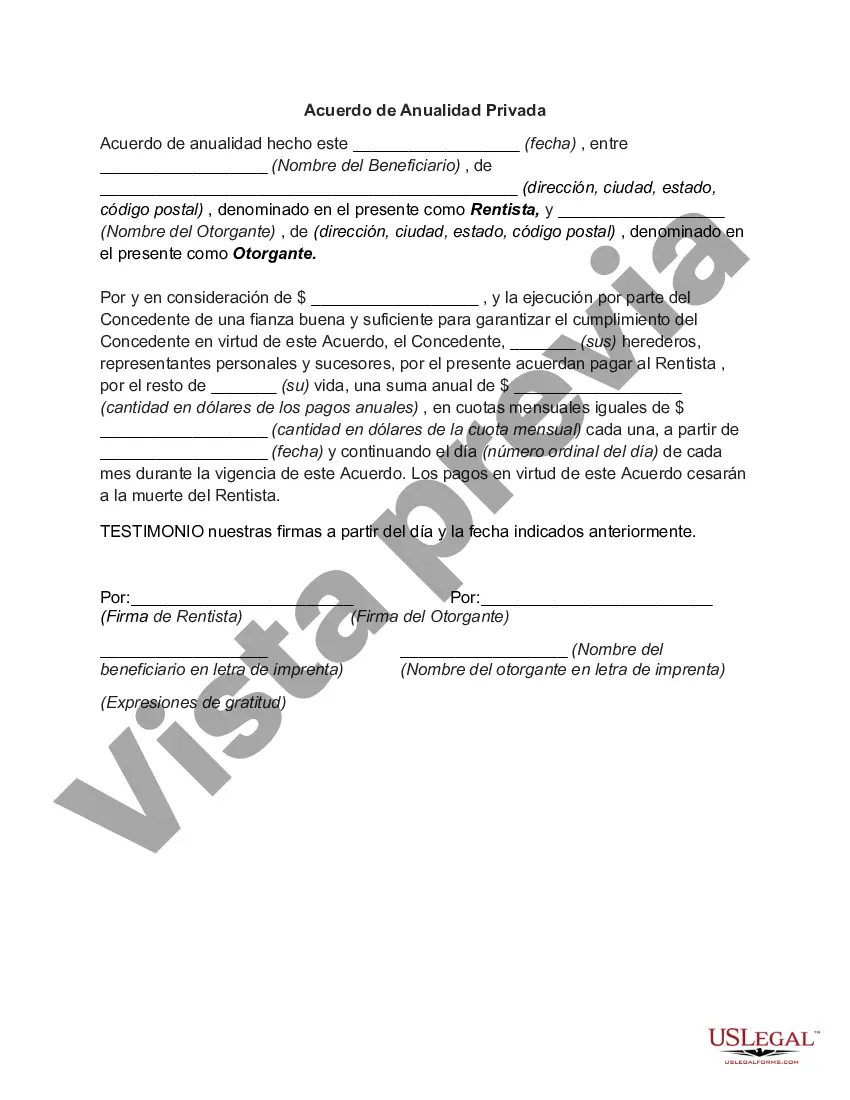

Middlesex Massachusetts Private Annuity Agreement refers to a legal contract that allows individuals in Middlesex County, Massachusetts, to transfer assets to a private annuity trust in exchange for regular annuity payments. This agreement serves as a means of estate planning and asset protection, particularly for individuals interested in reducing their estate tax liabilities and maintaining financial security during retirement. When entering into a Middlesex Massachusetts Private Annuity Agreement, the individual (the annuitant) transfers assets, such as real estate, businesses, or investments, to a trust. The trust, known as a private annuity trust, is established to hold these assets and generate income throughout the annuitant's lifetime. The annuitant then becomes the beneficiary of the private annuity trust, receiving regular annuity payments for a predetermined period or until their passing. The annuity payments are typically determined based on factors like the value of the transferred assets, the annuitant's life expectancy, and prevailing interest rates. One significant advantage of a Middlesex Massachusetts Private Annuity Agreement is the potential for estate tax reduction. By transferring assets to the trust, the annuitant effectively removes them from their taxable estate, thus potentially reducing estate taxes on those assets when transferred to future generations. Additionally, the annuitant retains the right to use and enjoy the transferred assets during their lifetime, maintaining control and benefit from the assets while alive. It allows individuals to secure a steady income stream for their retirement years, ensuring financial stability and peace of mind. It's important to note that Middlesex Massachusetts Private Annuity Agreements should be carefully structured and compliant with state and federal laws. They may involve complex legal and tax implications, so it is advisable to seek the guidance of a qualified attorney or financial advisor with expertise in estate planning and annuities. Different types of Middlesex Massachusetts Private Annuity Agreements may include variations in the terms and conditions, such as the length of annuity payments, the frequency of payments, and specific provisions based on the annuitant's unique circumstances. These can be tailored to meet individual needs while complying with legal requirements. In summary, a Middlesex Massachusetts Private Annuity Agreement allows individuals in Middlesex County, Massachusetts, to transfer assets to a private annuity trust in exchange for regular annuity payments. It serves as a valuable estate planning tool, offering potential tax benefits and ensuring financial security during retirement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Middlesex Massachusetts Acuerdo de Anualidad Privada - Private Annuity Agreement

Description

How to fill out Middlesex Massachusetts Acuerdo De Anualidad Privada?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask an attorney to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Middlesex Private Annuity Agreement, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case collected all in one place. Consequently, if you need the recent version of the Middlesex Private Annuity Agreement, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Middlesex Private Annuity Agreement:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your Middlesex Private Annuity Agreement and save it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!