A Sacramento California Private Annuity Agreement is a legally binding contract entered into by two parties — an annuitant and an obligor – typically for estate planning purposes. This agreement involves the transfer of certain assets or property from the annuitant (usually an individual) to the obliged (often a trust or an individual) in exchange for a promise of periodic annuity payments. In this arrangement, the annuitant transfers ownership of the property to the obliged, who becomes responsible for making regular annuity payments to the annuitant for the remainder of their life or for a specified term. The annuitant benefits from a guaranteed income stream, while the obliged gains ownership and control over the transferred assets. There are various types of Private Annuity Agreements that can be implemented in Sacramento, California, based on specific estate planning needs: 1. Traditional Private Annuity Agreement: This is the primary type of Private Annuity Agreement, where the annuity payments are solely based on the life expectancy of the annuitant. Payments are calculated using an actuarial formula that considers the annuitant's age, the transferred property's value, and prevailing interest rates. 2. Self-Canceling Private Annuity (SKIN) Agreement: In a SKIN Agreement, the annuity liability cancels if the annuitant passes away within a specified term, typically three years. If such an event occurs, the transferred property reverts to the annuitant's estate and is not subject to estate taxes. 3. Granter Retained Annuity Trust (GREAT): While not strictly a Private Annuity Agreement, a GREAT involves transferring assets into an irrevocable trust and receiving an annuity payment from the trust for a predetermined term. This arrangement allows the annuitant to transfer assets to beneficiaries with potential estate tax benefits. 4. Installment Sale with Private Annuity: This variant combines a private annuity with an installment sale. The annuitant transfers property to the obliged and receives an annuity payment, while the remaining purchase price is made through installment payments. Sacramento California Private Annuity Agreements offer individuals an opportunity to plan their estate and manage their assets efficiently. However, due to the complex nature of these agreements and their potential tax implications, it is crucial to consult with experienced legal and financial professionals to ensure compliance with state and federal laws as well as to maximize the benefits of this arrangement.

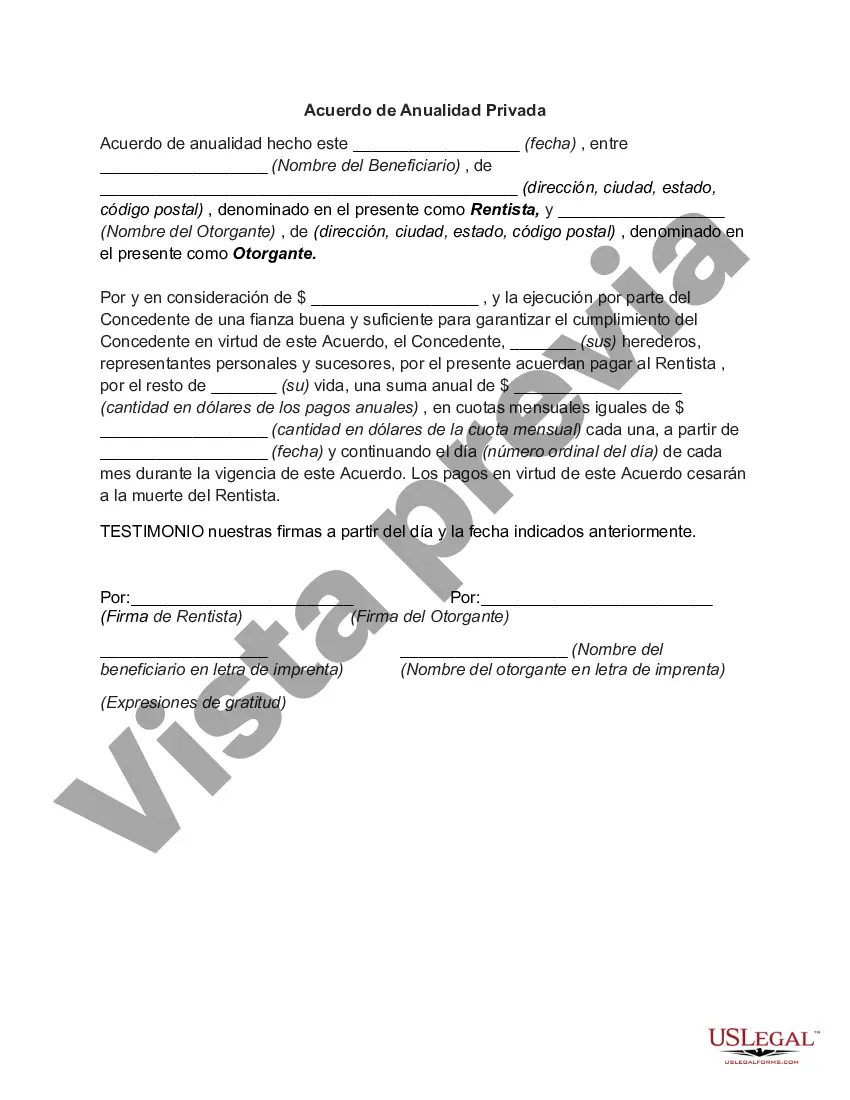

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sacramento California Acuerdo de Anualidad Privada - Private Annuity Agreement

Description

How to fill out Sacramento California Acuerdo De Anualidad Privada?

Creating legal forms is a must in today's world. However, you don't always need to look for qualified assistance to draft some of them from scratch, including Sacramento Private Annuity Agreement, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in various types ranging from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching process less overwhelming. You can also find information resources and tutorials on the website to make any activities associated with paperwork completion straightforward.

Here's how to purchase and download Sacramento Private Annuity Agreement.

- Take a look at the document's preview and outline (if provided) to get a general information on what you’ll get after getting the form.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can affect the legality of some records.

- Examine the related forms or start the search over to find the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment method, and purchase Sacramento Private Annuity Agreement.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Sacramento Private Annuity Agreement, log in to your account, and download it. Needless to say, our website can’t take the place of a lawyer completely. If you have to cope with an exceptionally complicated case, we recommend using the services of a lawyer to check your document before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Become one of them today and purchase your state-compliant paperwork with ease!