San Jose, California Private Annuity Agreement: Understanding the Basics In San Jose, California, a private annuity agreement is a legal and financial arrangement between two parties, typically involving a transfer of assets in exchange for periodic income payments. It is a useful estate planning tool that allows individuals to transfer property, often a business or real estate, to a family member or trusted individual, while still receiving a regular stream of income during their lifetimes. Private annuities offer several advantages, including potential tax benefits and the ability to provide income security for the transferring party. However, it is crucial to understand the intricacies of this agreement before entering into it. Key Terms and Features: 1. Transfer of assets: A private annuity agreement involves the transfer of property, often in the form of a business, real estate, or other significant assets, from the original owner, also known as the annuitant or transferor, to the recipient, known as the annuity holder or transferee. 2. Periodic income payments: In return for transferring the property, the annuity holder agrees to make regular income payments to the original owner for the duration of their life. These payments can be fixed or variable and are typically guaranteed for a specific number of years. 3. Tax implications: Private annuity agreements may have significant tax implications for both parties involved. While the transferor can defer capital gains tax on the appreciated value of the asset, the annuity holder is liable for income tax on the payments received. Consulting with a tax professional is vital to fully understand the potential tax consequences. 4. Estate planning benefits: Private annuity agreements can be a valuable estate planning tool as they enable the transfer of wealth to the next generation while minimizing estate taxes. By removing the asset from the transferor's taxable estate, they can potentially reduce the estate tax burden on their heirs. Types of San Jose, California Private Annuity Agreements: 1. Traditional private annuity: This is the most common form of private annuity agreement, involving the transfer of assets in exchange for lifelong income payments. The annuity holder assumes the risk of the transferor's longevity while receiving any potential appreciation in the asset value. 2. Self-canceling installment note (SKIN): A SKIN is a variation of private annuity where the transferor's debt obligation is terminated upon their death, ensuring that the asset reverts to their estate without additional tax consequences. This can be a reliable option for those concerned about the annuity holder's ability to fulfill the payment obligations. 3. Inter-family private annuity: This arrangement involves transferring assets within family members, often from parents to children, providing an opportunity for wealth preservation and asset succession planning. In conclusion, the San Jose, California Private Annuity Agreement is a valuable estate planning tool for individuals aiming to transfer significant assets while securing a lifelong income stream. These agreements offer tax advantages and can assist in wealth preservation, but it is crucial to consider the specific circumstances and consult with appropriate professionals before proceeding with this financial arrangement.

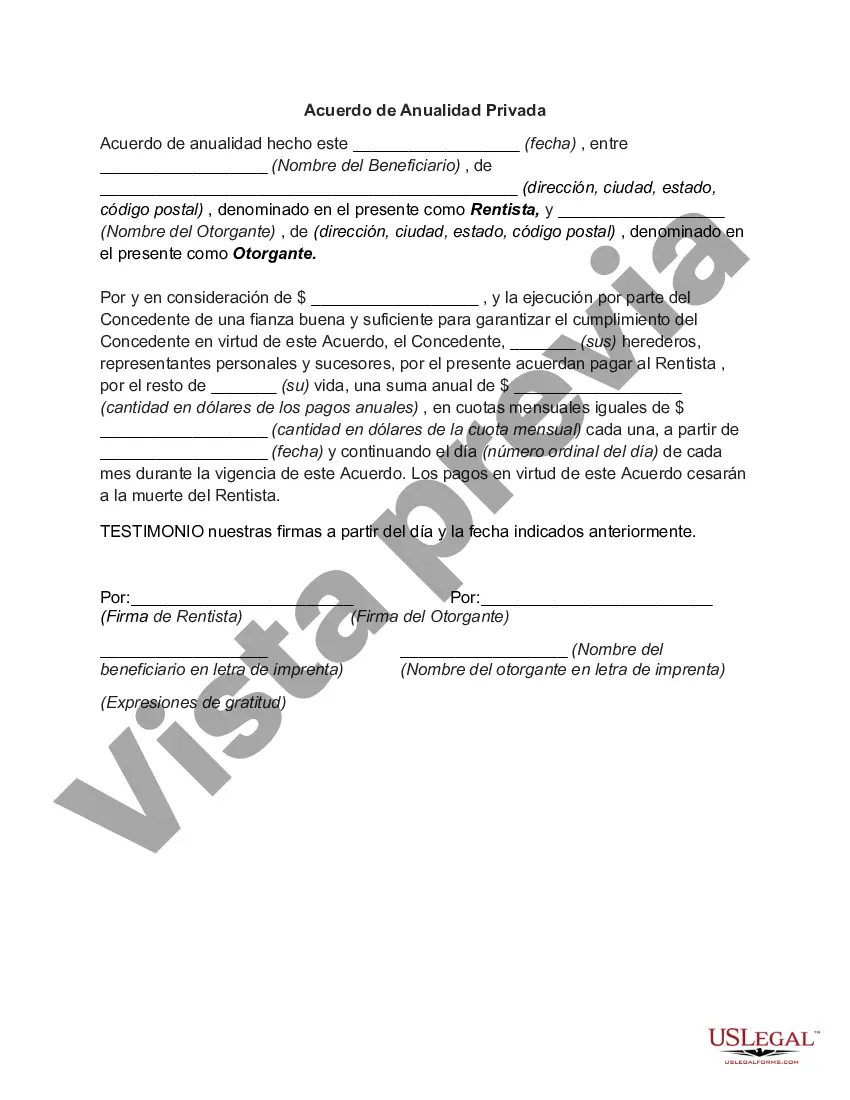

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Acuerdo de Anualidad Privada - Private Annuity Agreement

Description

How to fill out San Jose California Acuerdo De Anualidad Privada?

If you need to get a reliable legal form supplier to find the San Jose Private Annuity Agreement, look no further than US Legal Forms. No matter if you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can browse from over 85,000 forms categorized by state/county and case.

- The self-explanatory interface, number of supporting resources, and dedicated support team make it simple to find and complete various papers.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

Simply type to look for or browse San Jose Private Annuity Agreement, either by a keyword or by the state/county the form is created for. After locating needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply find the San Jose Private Annuity Agreement template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be immediately available for download once the payment is processed. Now you can complete the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes these tasks less expensive and more affordable. Create your first company, arrange your advance care planning, draft a real estate contract, or complete the San Jose Private Annuity Agreement - all from the convenience of your sofa.

Join US Legal Forms now!