A Santa Clara California Private Annuity Agreement is a legal contract between two parties where one party, known as the annuitant, transfers ownership of their assets to another party, known as the annuity holder, in exchange for regular payments (annuity). This agreement provides a method for individuals in Santa Clara, California, to transfer their assets while receiving a fixed income stream. The annuity payments generally continue for the lifetime of the annuitant, offering financial security and stability. One type of Santa Clara California Private Annuity Agreement is the Lifetime Private Annuity. In this arrangement, the annuitant transfers their assets to the annuity holder in return for annuity payments that last for the duration of their lifetime. This type of agreement is particularly suitable for individuals looking for a consistent income during retirement. Another type of Private Annuity Agreement in Santa Clara, California, is the Term Certain Private Annuity. Unlike the Lifetime Private Annuity, this agreement offers annuity payments for a fixed period as determined by the parties involved. It is commonly used for estate planning purposes or to support beneficiaries for a specific period. The Santa Clara California Private Annuity Agreement provides several benefits. Firstly, it allows the annuitant to transfer their assets while avoiding immediate taxation on the capital gains. This strategy can be especially advantageous for individuals with highly appreciated assets. Secondly, it offers flexibility in income planning by tailoring annuity payment schedules to meet specific financial needs. When drafting a Private Annuity Agreement in Santa Clara, California, it is crucial to consult with legal and financial professionals to ensure compliance with local laws and regulations. They can provide guidance in determining the appropriate terms and payment structure, considering factors such as the annuitant's life expectancy, income needs, and tax implications. In summary, a Private Annuity Agreement in Santa Clara, California, is a useful financial tool for individuals looking to transfer their assets while securing a consistent income stream. The two main types include the Lifetime Private Annuity and the Term Certain Private Annuity. Proper legal and financial advice is essential to ensure the agreement aligns with the annuitant's financial goals and complies with relevant laws in Santa Clara, California.

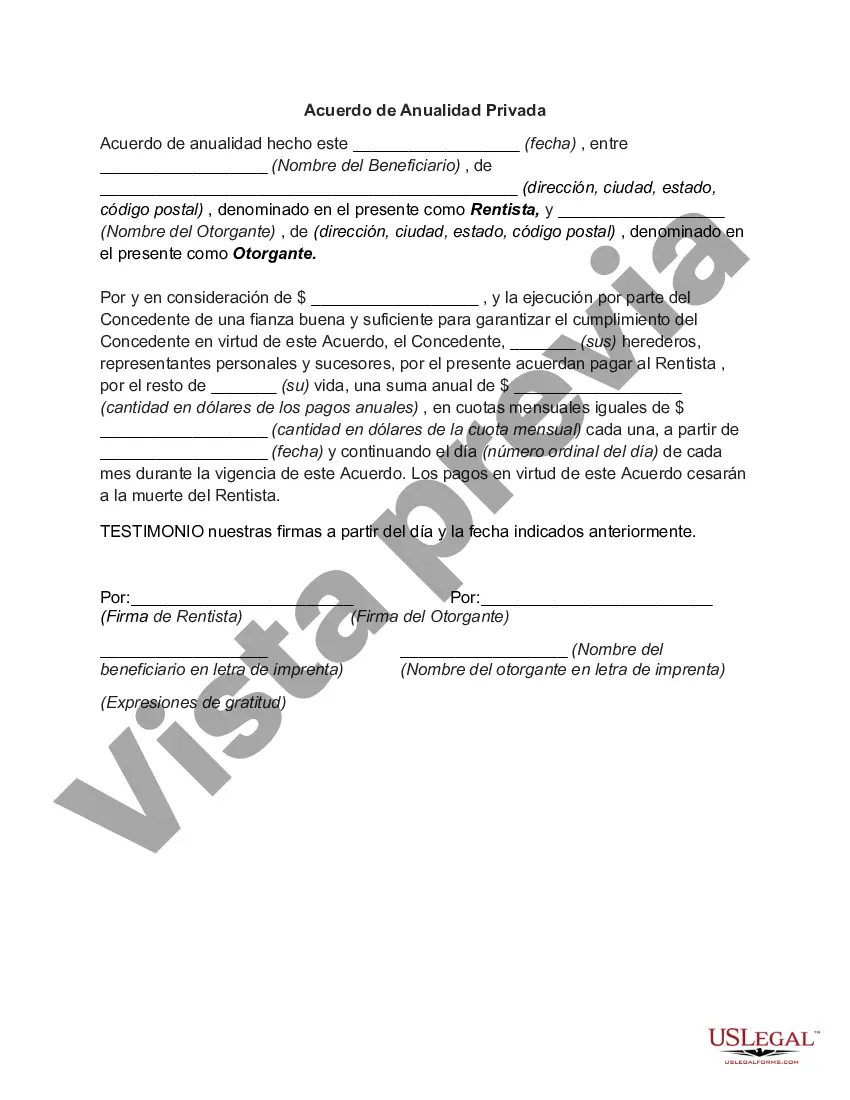

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Acuerdo de Anualidad Privada - Private Annuity Agreement

Description

How to fill out Santa Clara California Acuerdo De Anualidad Privada?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Santa Clara Private Annuity Agreement, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you purchase a sample, it remains available in your profile for future use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Santa Clara Private Annuity Agreement from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Santa Clara Private Annuity Agreement:

- Examine the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document once you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!