A Travis Texas Private Annuity Agreement is a legal contract made between two parties, commonly referred to as the annuitant (usually an older individual) and the obliged (often a younger family member or trusted individual). This agreement allows for the transfer of assets or property owned by the annuitant to the obliged, while providing a future annuity payment to the annuitant for a pre-determined period of time. Keywords: Travis Texas, Private Annuity Agreement, annuitant, obliged, assets, property, annuity payment. There are different types of Travis Texas Private Annuity Agreements, including: 1. Traditional Private Annuity Agreement: This refers to the standard type of agreement where the annuitant transfers ownership of assets or property to the obliged in exchange for annuity payments. The annuity payment is usually structured to provide financial security for the annuitant. 2. Deferred Private Annuity Agreement: In a deferred arrangement, the annuity payments are scheduled to commence at a future date, typically chosen by the annuitant. This type of agreement allows the annuitant to defer tax liability until the annuity payments begin. 3. Joint and Survivor Private Annuity Agreement: This agreement involves two annuitants, typically a married couple, who transfer assets to an obliged. The annuity payments continue throughout the lifetime of both annuitants, ensuring financial stability for a longer period. 4. Term Certain Private Annuity Agreement: This type of agreement specifies a fixed term for annuity payments, regardless of the annuitant's lifespan. For instance, the annuitant may choose a 10-year term, and the obliged is obliged to make annuity payments for the predetermined period, regardless of whether the annuitant lives through it or not. 5. Life Contingent Private Annuity Agreement: In this agreement, the annuity payments are contingent upon the annuitant's lifetime. If the annuitant passes away before the predetermined duration, the annuity payments cease. Travis Texas Private Annuity Agreements are commonly utilized as estate planning tools to facilitate the transfer of assets and provide financial stability for the annuitant. It is crucial for both parties involved to seek legal advice and carefully consider the tax implications and long-term financial implications of entering into such an agreement.

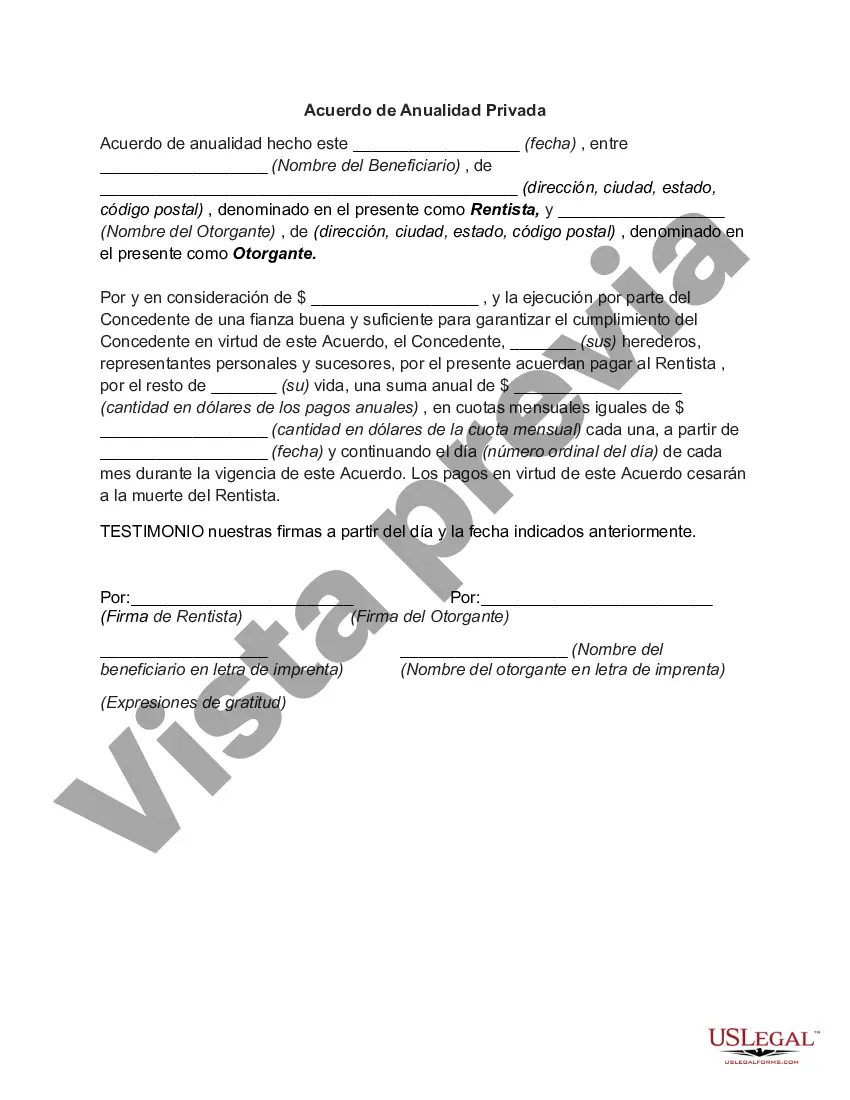

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Acuerdo de Anualidad Privada - Private Annuity Agreement

Description

How to fill out Travis Texas Acuerdo De Anualidad Privada?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask an attorney to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Travis Private Annuity Agreement, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario gathered all in one place. Therefore, if you need the latest version of the Travis Private Annuity Agreement, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Travis Private Annuity Agreement:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Travis Private Annuity Agreement and download it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!