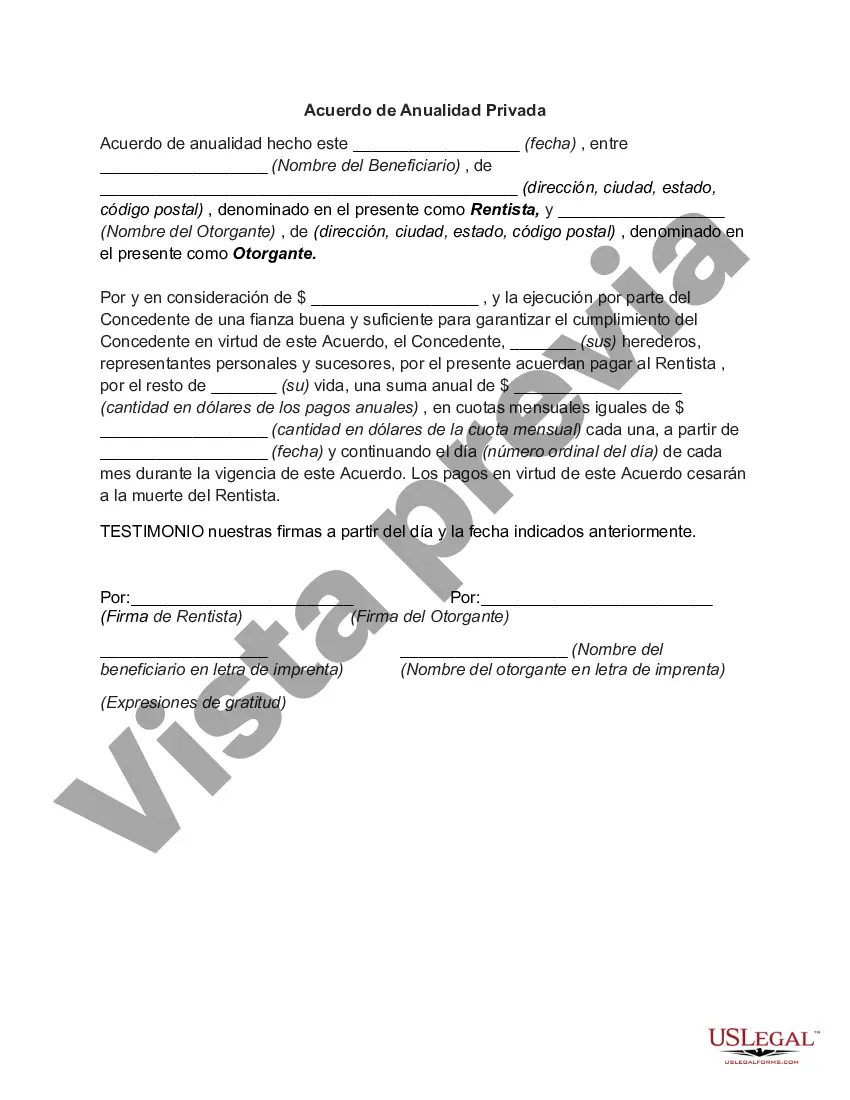

A Wayne Michigan Private Annuity Agreement refers to a legally binding contract entered into by two parties, where one party (the annuitant) transfers property or assets to the other party (the obliged) in exchange for a series of regular payments, usually for the remainder of the annuitant's life. This agreement allows the annuitant to convert their illiquid assets, such as real estate or businesses, into a stream of income. The Wayne Michigan Private Annuity Agreement follows specific guidelines and regulations set forth by the state of Michigan, ensuring the legality and validity of the contract. It offers a flexible financial planning tool for individuals looking to transfer their assets while also ensuring a stable income for their retirement years. This type of annuity agreement can be beneficial for individuals who wish to transfer their wealth to the next generation, reduce estate taxes, or protect their assets from future creditors. By establishing a private annuity agreement, individuals can effectively transfer the ownership of their assets to a trusted individual or entity, often a family member or a protective financial trust, while maintaining a regular income flow. Different types of Wayne Michigan Private Annuity Agreements may include: 1. Traditional Private Annuity: This is the most common type of private annuity agreement, where the annuitant transfers the ownership of assets to the obliged in exchange for periodic payments, usually structured as an income for life. 2. Installment Sale Annuity: In this type of agreement, the annuitant transfers ownership of assets in installments over a designated period. Instead of a lifetime income, the annuitant receives regular payments for a specified number of years. 3. Deferred Private Annuity: This type of agreement allows the annuitant to defer the income payments until a specified future date, chosen by the annuitant. It provides the opportunity to delay tax obligations and plan for retirement income later in life. 4. Joint and Survivor Annuity: This agreement includes two annuitants, typically a married couple. The annuity payments continue until the death of the last surviving annuitant, ensuring financial security for both spouses. It is crucial to consult with a qualified attorney or financial advisor experienced in annuities and estate planning to understand the specific requirements and implications of a Wayne Michigan Private Annuity Agreement. They can help determine if this financial tool aligns with your goals and guide you through the process to ensure compliance with relevant laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Acuerdo de Anualidad Privada - Private Annuity Agreement

Description

How to fill out Wayne Michigan Acuerdo De Anualidad Privada?

How much time does it typically take you to draw up a legal document? Because every state has its laws and regulations for every life situation, finding a Wayne Private Annuity Agreement meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often pricey. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. Apart from the Wayne Private Annuity Agreement, here you can find any specific form to run your business or individual deeds, complying with your regional requirements. Experts check all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can retain the file in your profile anytime later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you get your Wayne Private Annuity Agreement:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Wayne Private Annuity Agreement.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!