Travis Texas Granter Retained Annuity Trust (GREAT) is a legal arrangement that allows the donor (granter) to transfer assets into an irrevocable trust while retaining an annuity interest for a specified period of time. This estate planning tool offers numerous benefits, including potential tax advantages and asset protection, making it an attractive option for individuals seeking to maximize their wealth transfer while minimizing their tax obligations. In a Travis Texas GREAT, the granter transfers assets to the trust and receives regular annuity payments for a predetermined term. At the end of this term, the remaining assets pass to the named beneficiaries, typically family members or loved ones, often with significant estate tax advantages. Grants are especially advantageous in periods of low-interest rates or when there is an expected increase in asset value. There are different types of Travis Texas Grants that individuals can consider, depending on their specific goals and needs. Some commonly used variations include: 1. Zeroed-Out GREAT: In this type of GREAT, the annuity payments are structured in such a way that they effectively reduce the taxable gift to zero, making it an efficient wealth transfer tool. 2. Granter Retained Unit rust (GUT): Unlike the traditional GREAT, a GUT provides annuity payments based on a fixed percentage of the trust's value, which allows for potential growth of the trust assets. 3. Granter Retained Income Trust (GRIT): This type of GREAT focuses on providing income to the granter rather than annuity payments, allowing for a regular income stream while still transferring assets to the beneficiaries at a reduced gift tax cost. 4. Charitable Lead Annuity Trust (FLAT): While not specifically a GREAT, a FLAT follows a similar principle by making annuity payments to a charitable organization for a set term, with the remaining assets passing to non-charitable beneficiaries. Class can provide substantial charitable income tax deductions. 5. Qualified Personnel Residence Trust (PRT): Although not a GREAT, a PRT allows the granter to transfer their primary residence or vacation home into the trust for a specified term while retaining the right to live in it. This can effectively reduce future estate taxes on the property. When considering a Travis Texas GREAT, it is crucial to consult with experienced professionals such as attorneys and financial advisors. They can help assess individual circumstances, navigate complex tax regulations, and develop a tailored strategy that aligns with the granter's goals of preserving wealth and minimizing tax implications.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Fideicomiso de anualidad retenida por el otorgante - Grantor Retained Annuity Trust

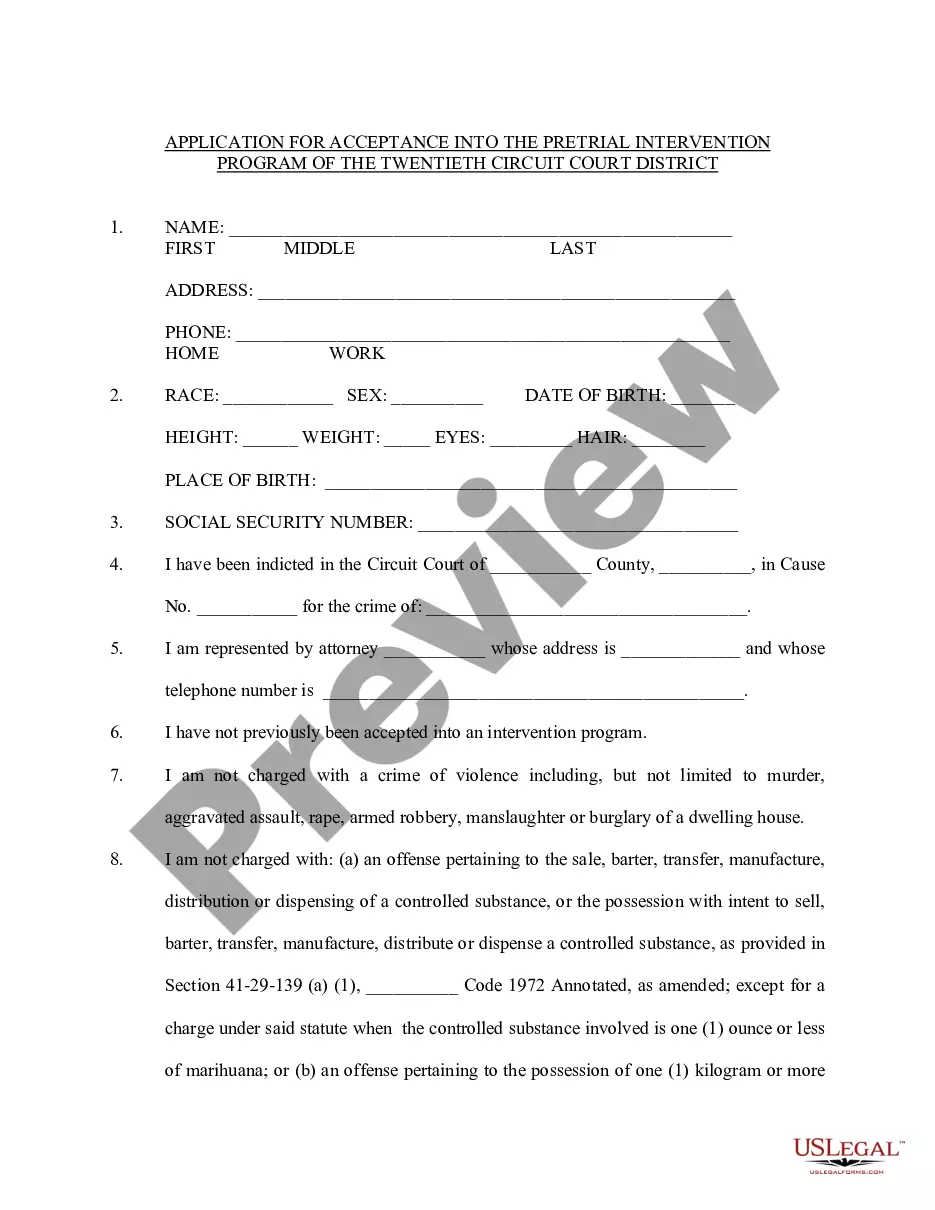

Description

How to fill out Travis Texas Fideicomiso De Anualidad Retenida Por El Otorgante?

How much time does it typically take you to draw up a legal document? Considering that every state has its laws and regulations for every life situation, finding a Travis Grantor Retained Annuity Trust meeting all local requirements can be stressful, and ordering it from a professional attorney is often costly. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, gathered by states and areas of use. In addition to the Travis Grantor Retained Annuity Trust, here you can find any specific form to run your business or personal deeds, complying with your regional requirements. Professionals verify all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can retain the document in your profile at any moment later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Travis Grantor Retained Annuity Trust:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Travis Grantor Retained Annuity Trust.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!