Chicago Illinois Pot Testamentary Trust is a legal entity established in the state of Illinois that allows individuals to set up a trust to distribute their assets, particularly those related to the cannabis industry, after their death. This type of trust is specifically designed for individuals involved in the cannabis business and aims to protect their financial interests, ensure proper estate planning, and provide for the beneficiaries as per the granter's instructions. The Chicago Illinois Pot Testamentary Trust is primarily used by individuals who want to secure their cannabis-related assets and ensure their proper distribution. By establishing this trust, individuals can have peace of mind knowing that their assets will be managed and divided in accordance with their wishes. There are various types of Chicago Illinois Pot Testamentary Trusts that individuals can choose from based on their specific requirements: 1. Cannabis Industry Trust: This type of trust is designed for individuals who own and operate cannabis-related businesses. It allows them to protect their business assets and ensure that these assets are passed down to their chosen beneficiaries after their death. 2. Cannabis Property Trust: This type of trust primarily focuses on safeguarding properties related to the cannabis industry. It permits granters to distribute properties, such as land, warehouses, or grow facilities, to their designated beneficiaries without undergoing a lengthy probate process. 3. Cannabis Investment Trust: This trust is ideal for individuals who have invested in various cannabis-related ventures. It enables them to manage and distribute their investments to their chosen beneficiaries, ensuring their financial interests are protected. 4. Cannabis Patent Trust: This trust is specifically designed for individuals or businesses holding cannabis-related patents. It ensures that the exclusive rights provided under these patents are transferred to the desired beneficiaries effectively. 5. Cannabis Intellectual Property Trust: This type of trust is created to protect and distribute intellectual property related to the cannabis industry. It covers trademarks, copyrights, and trade secrets, allowing granters to pass down their intellectual property rights to their chosen beneficiaries. Overall, Chicago Illinois Pot Testamentary Trusts are an essential tool for individuals involved in the cannabis industry to safeguard their assets and ensure that their beneficiaries are taken care of according to their specific instructions. Whether its business assets, properties, investments, patents, or intellectual property, these trusts provide a legal framework to protect and distribute assets related to the cannabis sector effectively.

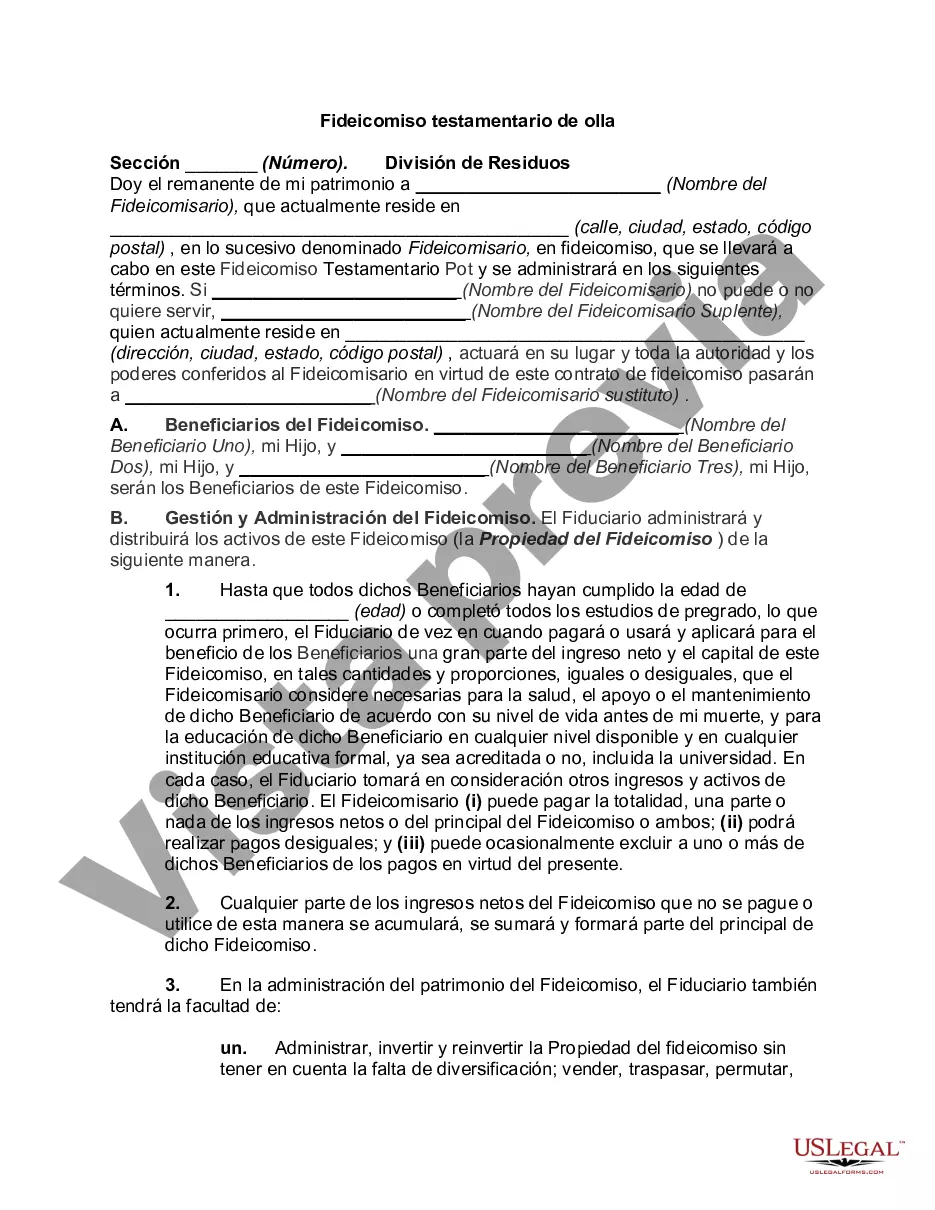

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Fideicomiso testamentario de olla - Pot Testamentary Trust

Description

How to fill out Chicago Illinois Fideicomiso Testamentario De Olla?

How much time does it usually take you to draft a legal document? Since every state has its laws and regulations for every life situation, finding a Chicago Pot Testamentary Trust suiting all regional requirements can be stressful, and ordering it from a professional attorney is often pricey. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. In addition to the Chicago Pot Testamentary Trust, here you can get any specific form to run your business or personal deeds, complying with your regional requirements. Experts check all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can retain the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Chicago Pot Testamentary Trust:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Chicago Pot Testamentary Trust.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!