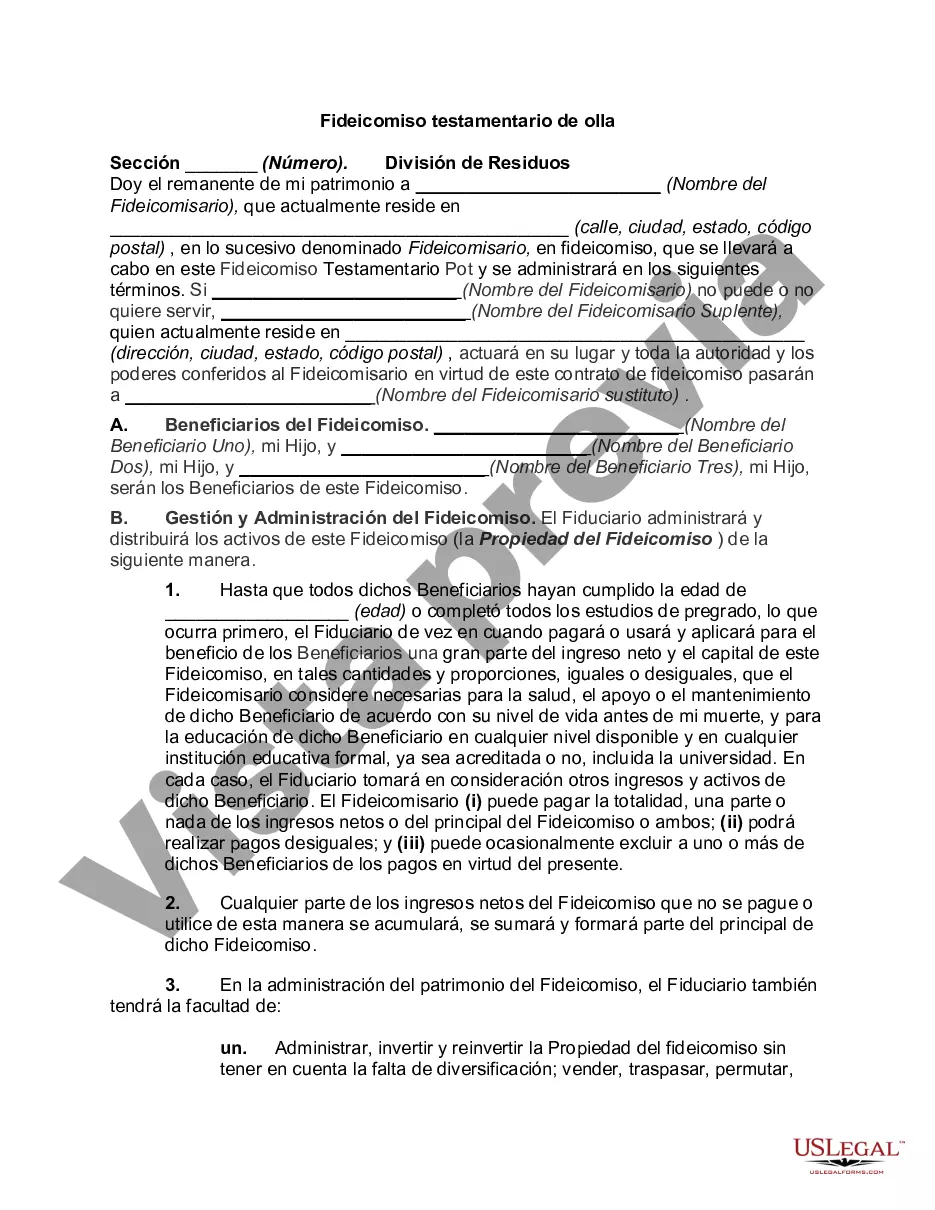

Franklin Ohio Pot Testamentary Trust is a specific type of trust established in the state of Ohio, United States. This trust incorporates the term "Pot" to indicate that it is funded by multiple sources or assets pooled together for the benefit of the beneficiaries. A testamentary trust, on the other hand, is a trust arrangement that is created through a will and takes effect after the testator's death. The Franklin Ohio Pot Testamentary Trust is designed to provide comprehensive asset protection, preservation, and distribution strategies for individuals residing in Franklin, Ohio. This trust serves as an effective tool for managing and distributing assets to designated beneficiaries in accordance with the wishes of the testator. There are different types of Franklin Ohio Pot Testamentary Trust, namely: 1. Franklin Ohio Pot Testamentary Charitable Trust: This type of trust allows individuals to designate a portion of their assets to charitable organizations or causes of their choice. This arrangement enables beneficiaries to continue supporting causes important to the testator even after their demise. 2. Franklin Ohio Pot Testamentary Special Needs Trust: This trust is created to provide lifelong financial care and support for individuals with disabilities or special needs. It ensures that the beneficiary's eligibility for government benefits, such as Medicaid, is not compromised while supplementing their quality of life with additional resources. 3. Franklin Ohio Pot Testamentary Revocable Living Trust: This trust option grants the testator the flexibility to modify or revoke the trust during their lifetime. It offers privacy, avoids probate, and helps in efficient asset management and distribution after the testator's death. 4. Franklin Ohio Pot Testamentary Irrevocable Trust: When established, this trust cannot be altered or revoked without the consent of all parties involved. It provides greater asset protection, minimizes estate taxes, and ensures efficient distribution to beneficiaries. 5. Franklin Ohio Pot Testamentary Spendthrift Trust: This trust safeguards the assets from creditors or potential financial mismanagement by the beneficiaries. It allows the trustee to control the distribution of funds, ensuring long-term financial stability for the beneficiaries. In conclusion, the Franklin Ohio Pot Testamentary Trust is a versatile estate planning tool that caters to various needs and objectives. Whether one wishes to provide for charitable organizations, individuals with special needs, or simply ensure efficient asset distribution, this trust provides flexibility, protection, and peace of mind.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Fideicomiso testamentario de olla - Pot Testamentary Trust

Description

How to fill out Franklin Ohio Fideicomiso Testamentario De Olla?

Preparing papers for the business or individual needs is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to draft Franklin Pot Testamentary Trust without professional assistance.

It's easy to avoid wasting money on lawyers drafting your paperwork and create a legally valid Franklin Pot Testamentary Trust on your own, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, adhere to the step-by-step guide below to obtain the Franklin Pot Testamentary Trust:

- Examine the page you've opened and verify if it has the document you need.

- To do so, use the form description and preview if these options are available.

- To find the one that suits your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any situation with just a few clicks!