Orange California Pot Testamentary Trust is a legal arrangement designed to manage and distribute assets, particularly those related to cannabis, in Orange, California. Testamentary trusts are established in a person's will and only take effect after the individual's death, ensuring the protection and efficient distribution of their assets. Pot Testamentary Trusts in Orange, California specifically focus on the management of assets related to the cannabis industry. These trusts aim to provide a legal and structured framework for the management and distribution of marijuana-related assets, adhering to the unique regulations and complexities associated with the cannabis business in Orange County. With the legalization of recreational cannabis in California, the establishment of Pot Testamentary Trusts has become essential for individuals involved in the cannabis industry in Orange County. These trusts enable individuals to specify their wishes regarding the handling of their cannabis-related assets after their passing, ensuring their loved ones, business partners, or designated beneficiaries effectively manage and benefit from these assets. There are different types of Orange California Pot Testamentary Trusts that individuals can establish to suit their specific needs: 1. Pot Testamentary Trust for Business Succession: This trust ensures seamless business continuity by outlining a plan for the transfer of ownership and management of cannabis-related business entities located in Orange County. It addresses issues such as appointing successors, settling potential conflicts, and preserving the legacy of the business. 2. Pot Testamentary Trust for Asset Protection: Designed to safeguard cannabis-related assets against potential risks, this trust offers protection from creditors, lawsuits, divorces, or other claims that could potentially jeopardize the assets' value or integrity. It shields the assets, ensuring their preservation and controlled transfer to the intended beneficiaries. 3. Pot Testamentary Trust for Minors or Incapacitated Individuals: This type of trust provides a framework for managing and distributing cannabis-related assets owned by minors or individuals who lack the legal capacity to manage their assets independently. It allows for the appointment of a trustee to administer the assets until the beneficiaries reach a designated age or regain capacity. By establishing an Orange California Pot Testamentary Trust, individuals engaging in the cannabis industry can ensure that their assets are handled according to their wishes, while complying with the specific regulations and legal requirements in Orange County. Seeking professional legal advice is crucial when creating such trusts to ensure compliance with current legislation and maximize the benefits for all parties involved.

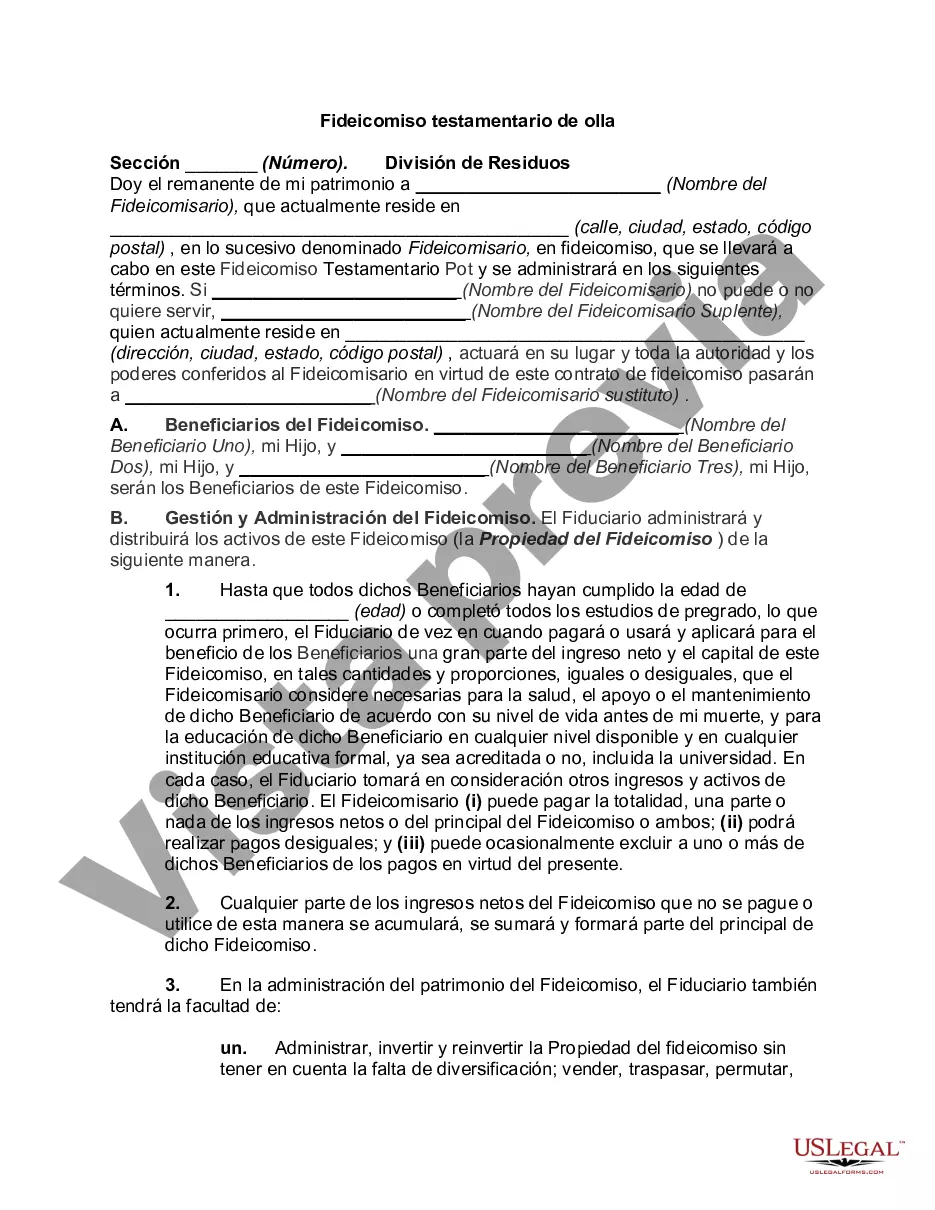

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Fideicomiso testamentario de olla - Pot Testamentary Trust

Description

How to fill out Orange California Fideicomiso Testamentario De Olla?

Are you looking to quickly create a legally-binding Orange Pot Testamentary Trust or maybe any other document to handle your own or business affairs? You can go with two options: contact a legal advisor to draft a valid paper for you or create it completely on your own. Thankfully, there's another option - US Legal Forms. It will help you get professionally written legal papers without paying sky-high fees for legal services.

US Legal Forms provides a rich collection of over 85,000 state-specific document templates, including Orange Pot Testamentary Trust and form packages. We provide documents for a myriad of life circumstances: from divorce paperwork to real estate document templates. We've been out there for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed template without extra troubles.

- To start with, double-check if the Orange Pot Testamentary Trust is tailored to your state's or county's laws.

- In case the document includes a desciption, make sure to check what it's suitable for.

- Start the searching process over if the document isn’t what you were hoping to find by utilizing the search bar in the header.

- Choose the subscription that best fits your needs and move forward to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Orange Pot Testamentary Trust template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to find and download legal forms if you use our services. In addition, the templates we provide are updated by industry experts, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!