The Hennepin Minnesota Irrevocable Pot Trust Agreement is a legal document designed to protect and manage assets for future generations. It provides a means of passing wealth to beneficiaries while allowing the granter to maintain control over the trust during their lifetime. This agreement is often utilized by individuals in Hennepin County, Minnesota, as a method of estate planning and asset protection. One of the main features of the Hennepin Minnesota Irrevocable Pot Trust Agreement is its irrevocability. Once the trust is established, the granter cannot make any changes or revoke it without the consent of all beneficiaries involved. This provides security and ensures that the assets held within the trust will be distributed according to the granter's wishes. The Hennepin Minnesota Irrevocable Pot Trust Agreement is versatile and can be customized to suit specific needs. There are different types of this trust agreement, including: 1. Medicaid Irrevocable Pot Trust Agreement: This type of agreement helps individuals protect assets from being spent down in order to qualify for Medicaid benefits. It allows the granter to remain eligible for government assistance while preserving their assets for future generations. 2. Charitable Irrevocable Pot Trust Agreement: This type of trust agreement is designed for individuals who wish to donate a portion of their assets to charitable organizations. It provides tax benefits to the granter while also supporting causes that align with their philanthropic intentions. 3. Special Needs Irrevocable Pot Trust Agreement: This agreement is specifically created to provide long-term financial support for individuals with special needs. It allows the granter to contribute assets to the trust, ensuring the beneficiary's financial security while maintaining eligibility for government benefits. 4. Generation-Skipping Irrevocable Pot Trust Agreement: This trust agreement is established with the intention of transferring wealth directly to grandchildren or future generations, bypassing the granter's children. It provides a way to pass on assets while minimizing estate taxes. These various types of the Hennepin Minnesota Irrevocable Pot Trust Agreement offer individuals in Hennepin County a wide range of options for estate planning and asset protection. With careful consideration and the guidance of an attorney, individuals can tailor the trust agreement to their specific needs and goals, ensuring the smooth transfer of wealth for the benefit of their loved ones and causes they care about.

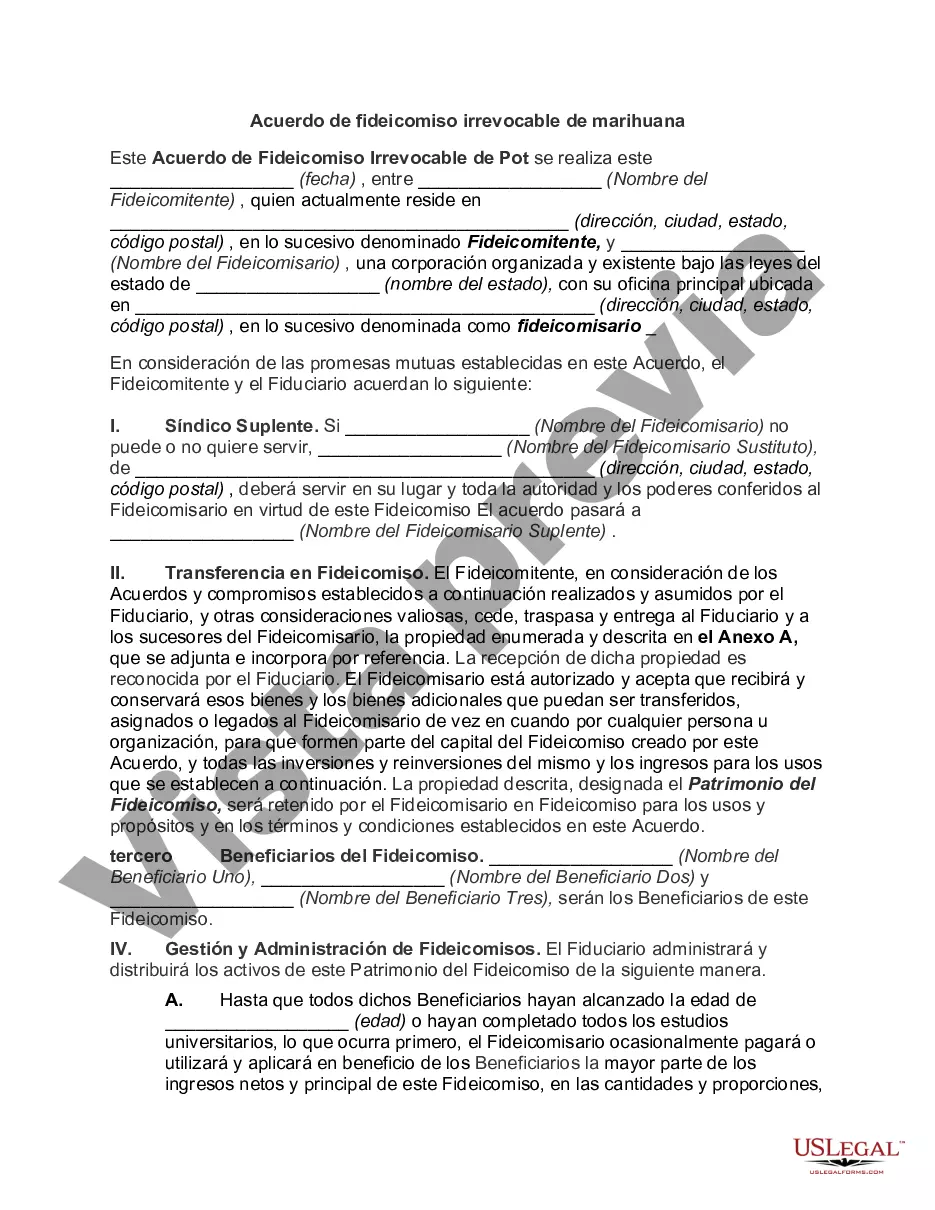

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Acuerdo de fideicomiso irrevocable de marihuana - Irrevocable Pot Trust Agreement

Description

How to fill out Hennepin Minnesota Acuerdo De Fideicomiso Irrevocable De Marihuana?

If you need to find a reliable legal paperwork provider to find the Hennepin Irrevocable Pot Trust Agreement, consider US Legal Forms. No matter if you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed template.

- You can browse from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, number of learning materials, and dedicated support team make it simple to locate and execute various documents.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

Simply select to look for or browse Hennepin Irrevocable Pot Trust Agreement, either by a keyword or by the state/county the document is created for. After locating necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Hennepin Irrevocable Pot Trust Agreement template and check the form's preview and description (if available). If you're comfortable with the template’s legalese, go ahead and click Buy now. Create an account and select a subscription option. The template will be immediately ready for download as soon as the payment is completed. Now you can execute the form.

Handling your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes this experience less costly and more affordable. Set up your first company, organize your advance care planning, create a real estate contract, or complete the Hennepin Irrevocable Pot Trust Agreement - all from the convenience of your home.

Join US Legal Forms now!