The Hillsborough Florida Irrevocable Pot Trust Agreement is a legal document that establishes a trust in Hillsborough County, Florida, with specific terms and conditions. This agreement is irrevocable, meaning that once it is executed, it cannot be modified or revoked by the granter. The purpose of the Hillsborough Florida Irrevocable Pot Trust Agreement is to provide a mechanism for the management and distribution of assets held in trust for the beneficiaries. The agreement typically designates a trustee, who will be responsible for administering the trust in accordance with the terms outlined in the document. One type of Hillsborough Florida Irrevocable Pot Trust Agreement is a charitable trust. This agreement allows the granter to donate assets to a charitable organization while also providing for beneficiaries who may benefit from the trust's income or principal. Another type of Hillsborough Florida Irrevocable Pot Trust Agreement is a Medicaid trust. This agreement is specifically designed to protect assets from being counted towards the granter's Medicaid eligibility, allowing them to qualify for long-term care assistance while preserving their wealth for their intended beneficiaries. Furthermore, there can be variations in the terms and conditions specified within the Hillsborough Florida Irrevocable Pot Trust Agreement, depending on the specific needs and goals of the granter. These variations may include provisions regarding the distribution of assets, the appointment of successor trustees, the use of trust income, and the rights of the beneficiaries. In conclusion, the Hillsborough Florida Irrevocable Pot Trust Agreement is a legally binding document used in Hillsborough County, Florida, to establish and manage a trust. It serves various purposes, such as charitable giving or Medicaid planning, and can have different types and provisions based on the granter's objectives. Seeking professional legal advice is crucial while drafting or executing such an agreement to ensure compliance with Florida state law and to meet the unique needs of the granter.

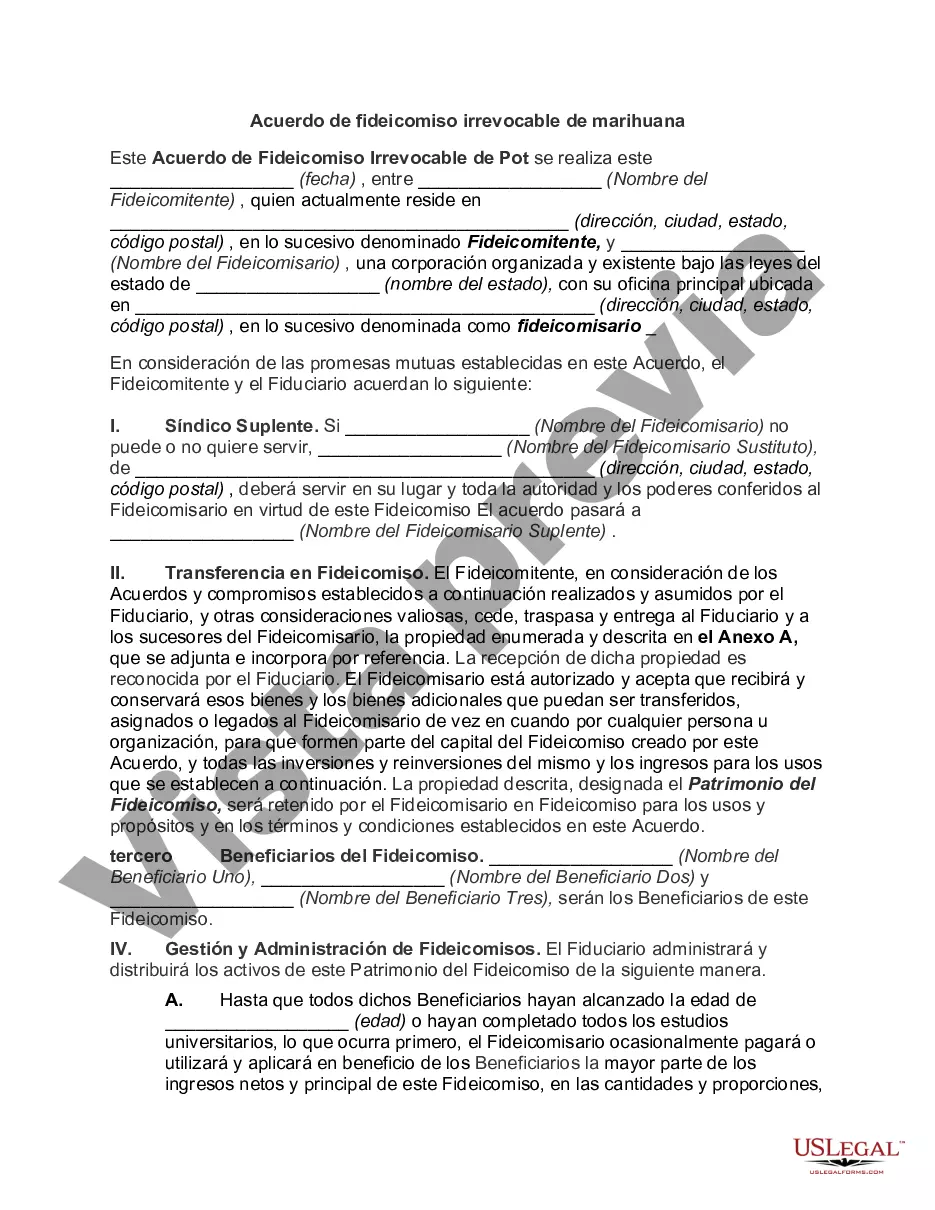

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hillsborough Florida Acuerdo de fideicomiso irrevocable de marihuana - Irrevocable Pot Trust Agreement

Description

How to fill out Hillsborough Florida Acuerdo De Fideicomiso Irrevocable De Marihuana?

Preparing legal documentation can be difficult. Besides, if you decide to ask a legal professional to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Hillsborough Irrevocable Pot Trust Agreement, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario accumulated all in one place. Therefore, if you need the recent version of the Hillsborough Irrevocable Pot Trust Agreement, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Hillsborough Irrevocable Pot Trust Agreement:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Hillsborough Irrevocable Pot Trust Agreement and download it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!