The King Washington Irrevocable Pot Trust Agreement, often referred to as the King Washington Pot Trust, is a legally binding document that establishes a unique method for managing and distributing assets or property, typically in the form of estate planning. This trust agreement is designed to provide benefits for the beneficiaries while maintaining control and flexibility for the trust creator, also known as the granter. One of the remarkable features of the King Washington Irrevocable Pot Trust Agreement is its irrevocability. Once established, it cannot be modified, amended, or revoked by the granter. This ensures that the assets within the trust are protected, preventing any potential interference or outside claims. Additionally, this trust agreement can offer significant tax advantages, as the assets are no longer considered part of the granter's taxable estate. Within the realm of the King Washington Pot Trust, there exist several types, each serving specific purposes and meeting different needs: 1. Medicaid Asset Protection Trust: This type of pot trust can aid individuals in protecting their assets while still qualifying for Medicaid. By transferring assets into the trust and allowing a specified timeframe to pass, the granter becomes eligible for Medicaid, preserving their estate for future generations. 2. Special Needs Trust: Also known as a supplemental needs trust, this form of pot trust caters to individuals with disabilities. It allows the beneficiaries to receive necessary governmental assistance while simultaneously benefiting from the additional assets provided through the trust, enhancing their overall quality of life. 3. Charitable Remainder Trust: This trust structure is designed for those seeking to support charitable causes while receiving income during their lifetime. The granter can transfer assets into the trust, receive a regular income stream for a specific period, and ultimately, upon their passing, the remaining assets are donated to the designated charity. 4. Life Insurance Trust: By creating a King Washington Pot Trust for life insurance, the death benefit proceeds are excluded from the estate's value for tax purposes. This can help beneficiaries avoid substantial estate taxes while still benefiting from the life insurance policy. In conclusion, the King Washington Irrevocable Pot Trust Agreement is a legal document that establishes various types of trusts, allowing individuals to protect assets, provide for beneficiaries, and minimize tax burdens. Whether it be Medicaid asset protection, special needs, charitable remainder, or life insurance trusts, these unique structures serve different purposes, promoting financial security and efficient asset distribution.

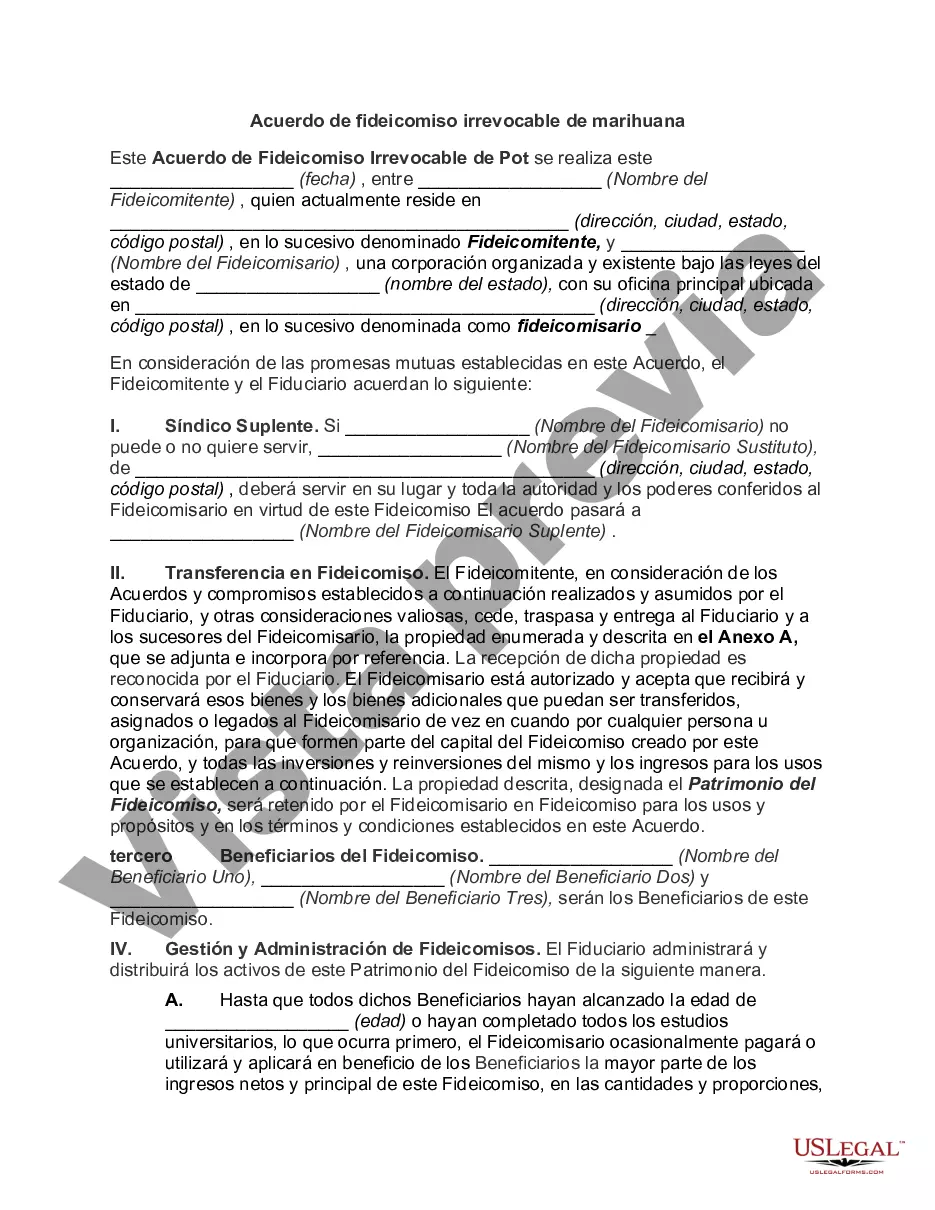

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.King Washington Acuerdo de fideicomiso irrevocable de marihuana - Irrevocable Pot Trust Agreement

Description

How to fill out King Washington Acuerdo De Fideicomiso Irrevocable De Marihuana?

How much time does it typically take you to draw up a legal document? Given that every state has its laws and regulations for every life scenario, locating a King Irrevocable Pot Trust Agreement meeting all regional requirements can be tiring, and ordering it from a professional lawyer is often costly. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. Apart from the King Irrevocable Pot Trust Agreement, here you can find any specific document to run your business or individual deeds, complying with your county requirements. Professionals check all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can pick the file in your profile at any moment later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your King Irrevocable Pot Trust Agreement:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the King Irrevocable Pot Trust Agreement.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!